Somebody’s Raising Taxes on the Rich

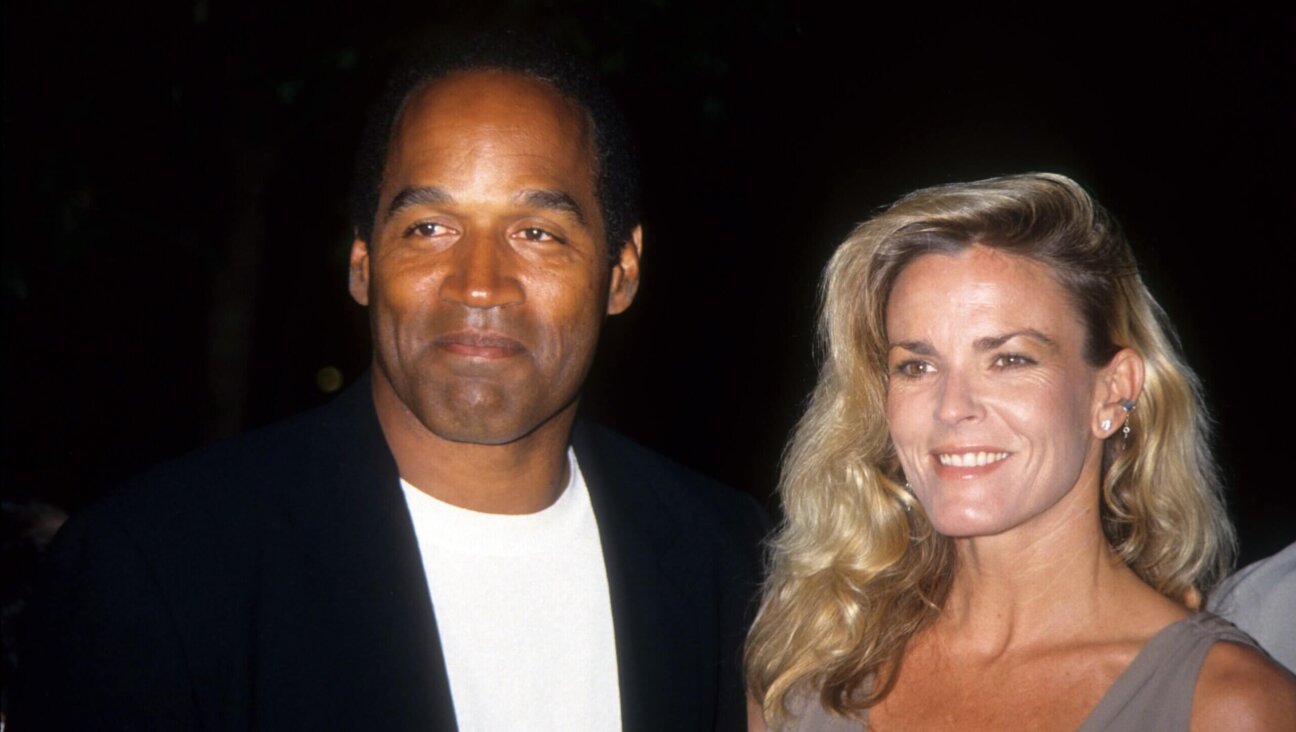

Manuel Trajtenberg and Bibi Image by Getty Images

The growing ideological connection between the Republican Party in the United States and the Netanyahu government in Israel doesn’t extend to tax policy, it seems. With little fanfare, the Knesset last week approved an increase in corporate taxes and personal taxes on the very rich, going where the GOP here threatens never to tread.

The legislation was prompted by recommendations in the Trajtenberg Committee report, a government-appointed group charged with responding to the social justice protests that roiled Israel through the summer and fall. While the percentage changes may not sound like much — corporate taxes will go up to 25% from 24%, while the highest tax bracket for the very rich will rise to 48% from 45% — it’s the trend line that’s significant. When Benjamin Netanyahu was campaigning for prime minister, he promised to lower taxes by 2017.

Now he’s raising them.

Discussing the move with a small group of journalists on Monday, Manuel Trajtenberg was gratified. The esteemed Israeli economist had marched in the social protests himself before he was asked to oversee the government’s response. He applauded Netanyahu’s willingness to consider the committee’s recommendations, though he reserved his biggest compliments for the protesters themselves.

“A whole generation of young people in Israel discovered they have a voice,” he said. “How this will play out, nobody knows.” But he is certain that the movement — broad-based, rooted in the middle class, concerned about social well-being — will transform Israeli society. “We’re in the presence of something big.”

I wonder if the politicians in this country who are so resistant to these sort of moves will take notice.

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning journalism this Passover.

In this age of misinformation, our work is needed like never before. We report on the news that matters most to American Jews, driven by truth, not ideology.

At a time when newsrooms are closing or cutting back, the Forward has removed its paywall. That means for the first time in our 126-year history, Forward journalism is free to everyone, everywhere. With an ongoing war, rising antisemitism, and a flood of disinformation that may affect the upcoming election, we believe that free and open access to Jewish journalism is imperative.

Readers like you make it all possible. Right now, we’re in the middle of our Passover Pledge Drive and we need 500 people to step up and make a gift to sustain our trustworthy, independent journalism.

Make a gift of any size and become a Forward member today. You’ll support our mission to tell the American Jewish story fully and fairly.

— Rachel Fishman Feddersen, Publisher and CEO

Join our mission to tell the Jewish story fully and fairly.

Our Goal: 500 gifts during our Passover Pledge Drive!