The Talmudic Argument For a More Ethical Financial System

Image by Getty Images

It takes some chutzpah to write a book that takes on the whole financial system, let alone a plan to fix it. But that’s the task my co-authors and I undertook in writing “What They Do With Your Money.”

Why? Consider that Talmudic tradition tells us that the first question you are asked in making the transformation from this world to whatever comes next is “were you honest in business?” And that there are more mitzvot regarding business and property and buying and selling than there are for almost anything else. From the earliest of times, our ancestors understood that a fair economy is central to an ethical world.

Yet today, we seem very far away from even considering the question of ethics and purpose when it comes to capitalism. That’s a shame because doing so could not only provide a framework for how the financial sector should function, but also point a direction to tikkun olam, to improving our world.

Like it or not, the financial system is vital. We can’t grow our economy, provide jobs, reduce poverty, build a climate-friendly infrastructure, and or solve a host of major societal problems world without it.

Finance facilitates essential functions businesses and citizens need — from safekeeping our money to facilitating payments to sharing risk. Perhaps the most important is what is known as “intermediation,” or, as the third Lord Rothschild put it, “taking money from point A where it is, to point B where it is needed”. This can mean pooling savings to fund a mortgage, helping build an efficient power plant, or facilitating retirement savings. Finance aggregates the capital needed for economic activity.

So, at its core, finance is a service industry. While it doesn’t create food or shelter or entertainment or medical care, none of those could exist at the scale we need without the financial system.

But, and this is a big but, how does well does the financial system work?

Unfortunately, not well. It costs about two percent to move money from point A to point B. That doesn’t sound like much, but it has cost the same two percent for 130 years. In that time, we have invented computers, cars, and telephones; landed people on the moon, eradicated diseases; increased life expectancy. In almost every human endeavor, we have become more productive. Except in finance.

Meanwhile, the amount of the real economy which is intermediated has quadrupled. Today, almost one out of every 12 dollars in the US economy finds its way into the pockets of the financial sector.

That is not to say there have been no efficiencies at all. We have credit cards, automatic teller machines, affordable mortgages, better risk-shifting ability, more efficient trading markets, and a host of other improvements. But, the benefits of these advancement and efficiencies have stayed within the financial sector.

Why? First, the number of financial intermediaries has grown exponentially. Each intermediary needs to be paid, so that while each transaction may be more efficient, the aggregate is not. One study identified 16 agents that shepherd your money from your wallet (point A) to the eventual investment (point B). And they all get paid. In fact, over the course of a lifetime, the aggregate costs can decrease your retirement savings by half. Literally half. 50%. By the way, that chain of agents also attenuates us from the ownership of the companies in which we invest, which is one reason that issues that most people care about, like long-term sustainability and growing economy so that we can have better jobs, take lesser priority than trading profits and short-term returns.

The second reason is that there are misalignments between the financial system and the needs of the real economy. For example, there are 79,669 mutual funds in the world. No one knows the optimal number, but everyone is pretty sure it’s less than 79,669. Why so many? As we show in the book, they serve an important marketing purpose, even as they make investing more expensive than it should be. Simply put, that many mutual funds benefit the industry, not society.

Fixing capitalism is a game worth playing and worth winning. The stakes are enormous. What if that 2% intermediation cost were 1%? Can you imagine what our society would look like if capital cost 1% less for 130 years? If those billions – hundreds of billions – trillions of dollars – compounding each year, had been put to work at companies that “do things”? Just this year alone, the economy would be growing about 20% faster than it is.

We reject the false dichotomy that seems to permeate any discussion of the financial industry in which your only choice is to accept the financial sector as it is, or be criticized as anti-business, or anti-capitalism. We are devout capitalists. And we are financial professionals. But what we have now is sub-optimal, and the trust between finance and the rest of society is frayed, if not torn. We can do better.

The dozens of specific fixes we suggest are pragmatic. Some are common knowledge, like suggesting you invest through low-fee investment products. Some are common sense, like creating the equivalent of a “nutrition label”, so that investors can see at a glance all the real costs financial intermediaries impose, and whether the agent is truly accountable to you. Others are more technical, like amending a section of the tax code which helped executive compensation skyrocket. Some are systematic, such as extending fiduciary obligation throughout that chain of intermediaries – a fancy way of saying that if you are dealing with my money you have to have my best interests at heart. Some are long-term, like teaching the purpose of finance in business schools. Finally, some are behavioral, to make sure that people are aware of the obligation to be honest in business. Because without that, any system, however well designed, will collapse.

Getting the financial system realigned to better serve the real economy is not only efficient, it’s ethical. That’s something that the ancient rabbis would understand intuitively.

Jon Lukomnik, a former member of the Forward board of directors, is the co-author of “What They Do With Your Money: How the Financial System Fails Us and How to Fix It.”

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Is Pope Leo Jewish? Ask his distant cousins — like me

- 4

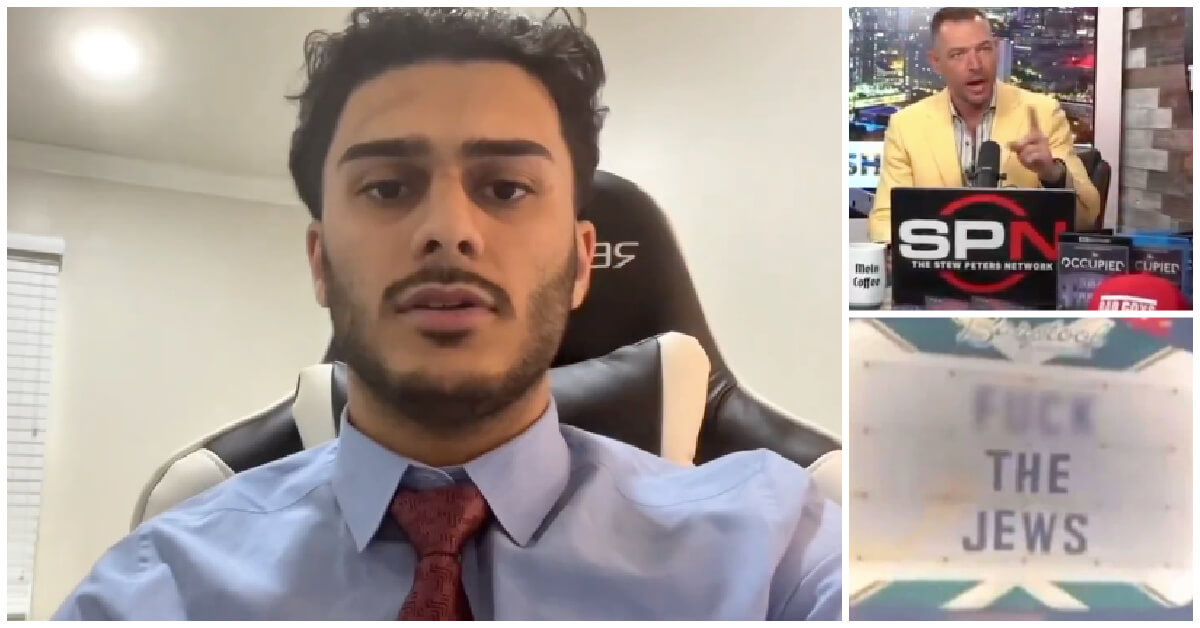

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

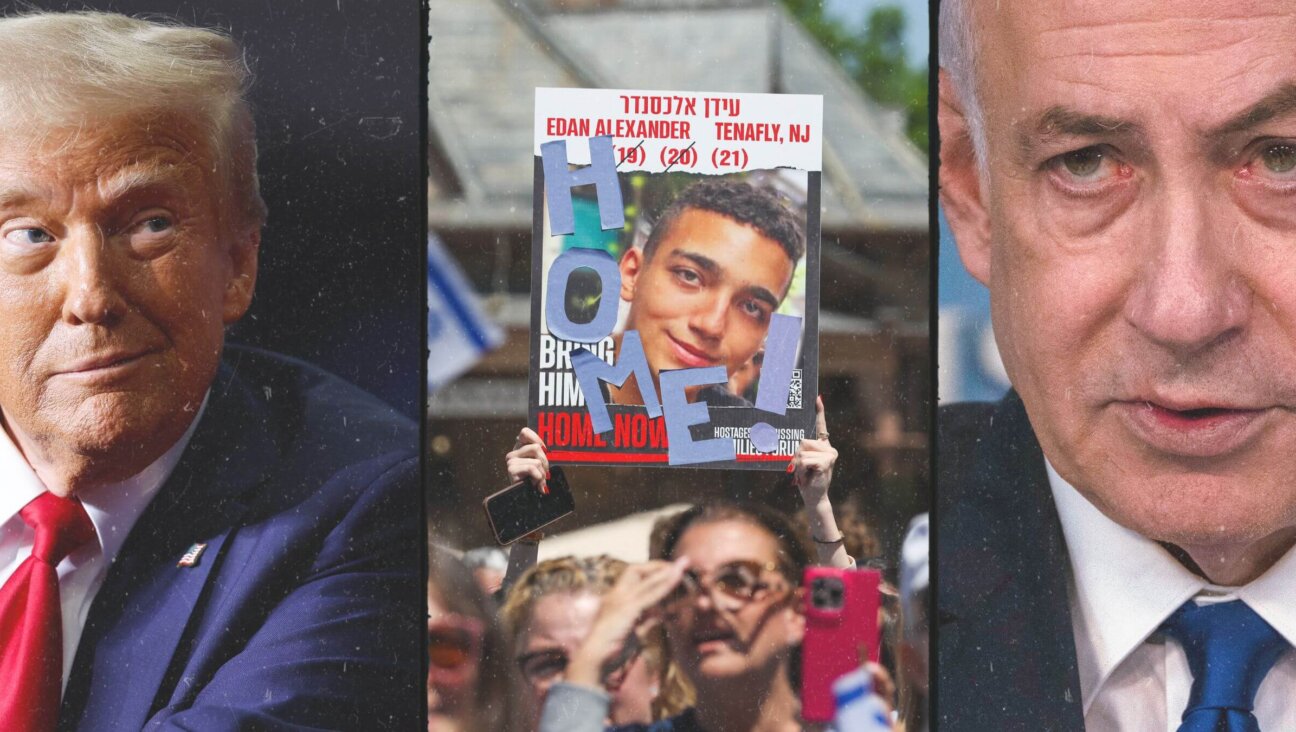

News In Edan Alexander’s hometown in New Jersey, months of fear and anguish give way to joy and relief

-

Fast Forward What’s next for suspended student who posted ‘F— the Jews’ video? An alt-right media tour

-

Opinion Despite Netanyahu, Edan Alexander is finally free

-

Opinion A judge just released another pro-Palestinian activist. Here’s why that’s good for the Jews

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.