Ivanka’s So Busy She Forgot To Pay Her New York State Taxes

Ivanka Trump Image by Getty Images

It must have been a busy year for Ivanka Trump. So busy that she neglected to pay her New York state taxes.

Now, President Trump’s Jewish daughter is facing a lien order after one of her companies, Ivanka Trump Fine Jewelry, failed to pay $5,000 in state taxes. The Daily Mail has the scoop with details of court documents indicating that the lien on Ivanka’s Trump Tower store was imposed on January 26.

Ivanka Trump announced shortly after Trump’s inauguration that she has resigned from her fashion and jewelry companies. She moved to Washington with her husband, Jared Kushner, who now serves as President Trump’s senior adviser.

But her business has taken some serious hits over the past year. In addition to the New York state tax lien, Ivanka Trump’s company was forced to pay $3 million to another jewelry company after losing a breach of contract lawsuit. And recently, Ivanka’s fashion line was removed from Nordstrom and several other retailers, in part due to a widespread customer boycott.

Ivanka Trump, according to the Daily Mail, has yet to settle her $5,000 bill, and so the lien is still active.

Contact Nathan Guttman at [email protected]

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Is Pope Leo Jewish? Ask his distant cousins — like me

- 4

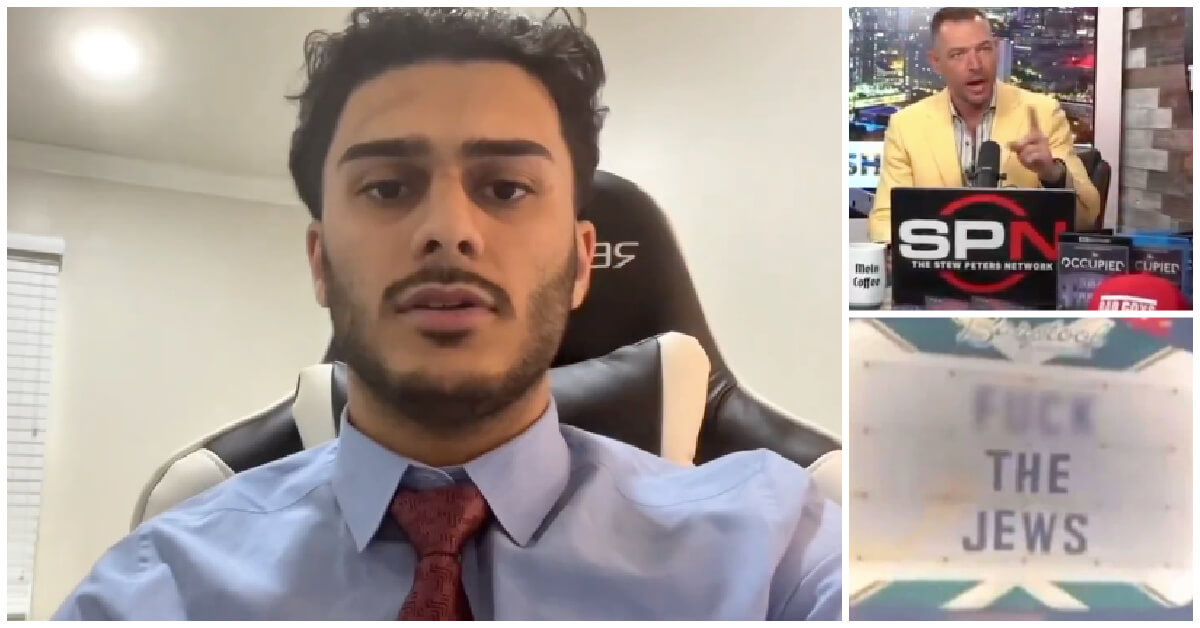

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Fast Forward For the first time since Henry VIII created the role, a Jew will helm Hebrew studies at Cambridge

-

Fast Forward Argentine Supreme Court discovers over 80 boxes of forgotten Nazi documents

-

News In Edan Alexander’s hometown in New Jersey, months of fear and anguish give way to joy and relief

-

Fast Forward What’s next for suspended student who posted ‘F— the Jews’ video? An alt-right media tour

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.