N.Y. Real Estate Developers Raise Billions From Israel

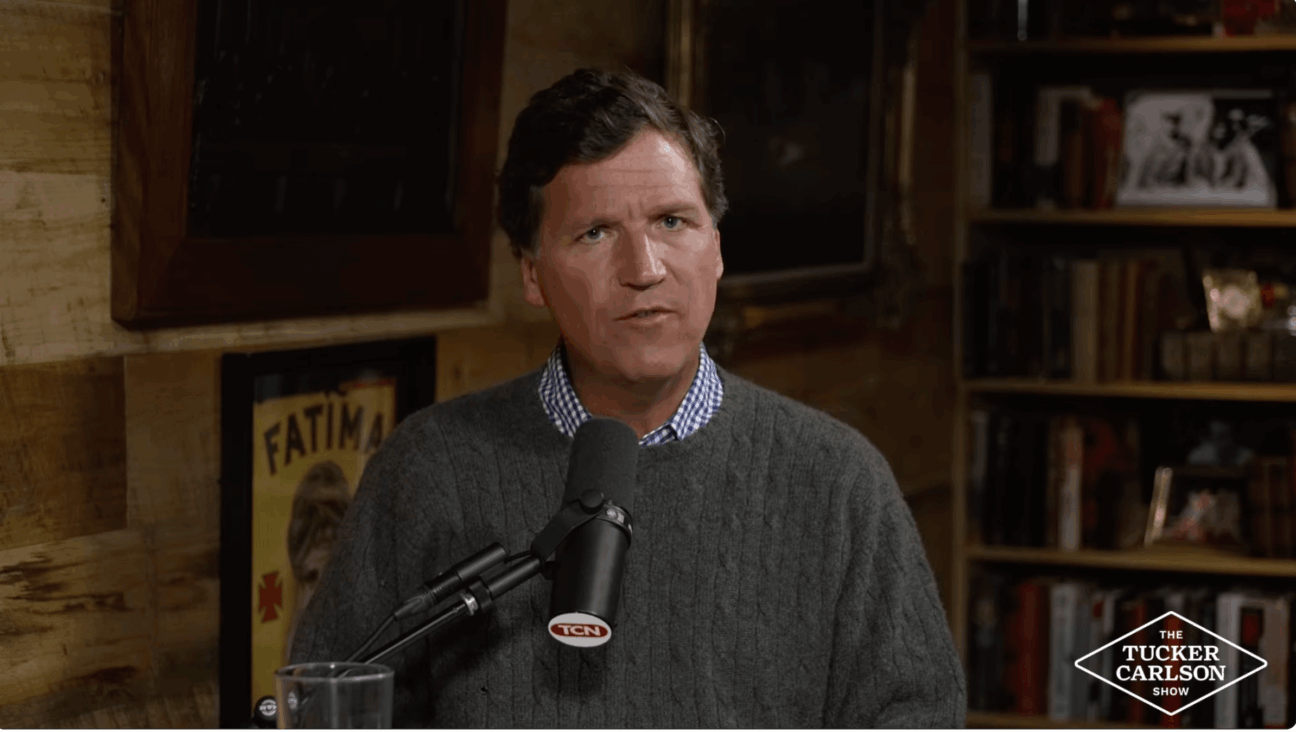

Graphic by Angelie Zaslavsky

New York real estate developers have found a new source of cash to finance their apartment complexes on the Tel Aviv stock market.

Only four months into the year, Israeli investors have bought $1 billion in debt bonds from big names in Manhattan’s development game – including Jeff Sutton of Wharton Properties and Joel Warner of the Pinnacle Group.

And those commercial bonds have been marketed successfully with record-low interest rates that make Israel an attractive place to garner capital.

Sutton raised $243 million in bonds for an interest rate of 3.9% while Sutton sold $120 million worth of them for 3.6% interest.

But the move into the Israeli market hasn’t been without risk for investors there. The sale of bonds took a momentary hit when the Canadian developer Urbancorp turned belly up after selling $48 billion in bonds.

The market has since rebounded, and is stronger than ever, with more capital volume and lower interest rates.

“We’re almost there,” Rafi Lipa, a real estate bond consultant based in Tel Aviv, told The Real Deal. “We are very close to the Israeli companies. “The smart investors started to see that not everyone is Urbancorp.”

Contact Daniel J. Solomon at [email protected] or on Twitter @DanielJSolomon