Group Paying IDF Soldiers To Refuse Duty May Be in Violation of U.S. Tax Law

An Israeli organization handing out cash to soldiers for disobeying orders has been collecting tax-exempt donations from American donors in apparent disregard of United States tax law.

The far right-wing group SOS-Israel and its leader, Shalom Dov Wolpe, a rabbi associated with the messianic wing of Chabad-Lubavitch, were in the news in November for rewarding each of the two Israeli recruits 1,000 shekels per day for the 20 days they spent in a military prison. The two had disrupted their induction ceremony at the Western Wall when they raised a banner that read, “Don’t Evacuate Homesh,” a reference to the West Bank settlement that was vacated by force as part of the 2005 disengagement from Gaza.

Wolpe presented the money to the two soldiers in an elaborate ceremony that took place at Jerusalem’s Finjan restaurant. At the time, Wolpe had told the press that the money was the gift of an anonymous American donor. Though the source of these particular funds is unclear, what is not in dispute — by even Wolpe himself — is that he has been misrepresenting the nature of his organization to the Internal Revenue Service, claiming that it is a religious institution when it is little more than a post office box, a ruse that allows him to maintain tax-exempt status.

The Web site of Wolpe’s organization, which was founded in 2003, claims SOS-Israel’s mission is to support the settlement movement and “deepen the awareness that any command to expel Jews from settlements is absolutely illegal.”

To that end, it solicits American donations, and Wolpe has consistently drawn attention to the fact that the group receives money from overseas sources. Last September, when he and a few other settler rabbis hosted a contest to build the biggest, most permanent-looking sukkah in the West Bank, Wolpe said that the awards — of 5,000 shekels each for the best sukkah — were provided by an American Jew. According to SOS-Israel’s Web site and literature, Americans may make contributions that are tax exempt by either donating directly online or sending the money to an organization called Machanaim, with an address on Kingston Avenue, the commercial thoroughfare of the Crown Heights section of Brooklyn, a few blocks from the Chabad-Lubavitch headquarters.

Machanaim is Wolpe’s American arm, established by him in 1972, and it was classified by the IRS back then as a “church” — a designation that is defined by the government agency’s official guidebook as a religious institution that has an “established place of worship,” A “regular congregation” and “regular religious services.”

Being characterized as a “church” provides special tax privileges beyond what is normally granted not-for-profits. Not only are donations tax exempt, but these institutions also do not have to file 990s, the form that most charities need to provide to the IRS yearly, publicly detailing their finances.

Machanaim, though, is no church. In fact, according to Wolpe himself, there is no office, no staff — nothing, in fact, besides a post office box in Crown Heights that Wolpe visits every few months when he comes to New York. A visit by the Forward to Machanaim’s address confirmed that the “Suite #155” referred to in the address is actually the number of a post office box.

Wolpe, reached by phone in Israel, did not deny that Machanaim no longer has any functioning parts, and he specifically requested that this fact not be publicized, in case, he said, “I ever want to use it again.”

It’s not clear that Machanaim was ever a “church.” Asked about the original organization, Wolpe said that its mission was “to do support for Israel.”

In the meantime, Machanaim still enjoys tax exemption. Wolpe insists that he has received no money recently through the organization, and that the large American donations he frequently mentions where given to him by other means. “I was recently in America after a few months of not being. I stopped by the post office box, and there was nothing,” Wolpe said.

Nevertheless, the organization’s status is, according to specialists in charities tax law, illegal.

“I do not understand how this organization could possibly qualify as a church,” said Bruce Hopkins, an expert in not-for-profit law who has written numerous books on the subject, including “The Law of Tax-Exempt Organizations.” “The law is very clear as to what a church is. There are certain requirements. You have to have a congregation and a place of worship, for one. I just don’t see how it could be a church and only have a post office box address.”

Hopkins said that it used to be much easier to file for tax-exempt status than it has been over the past 10 years.

He also described the only way that Machanaim could legally collect money for Wolpe: It would have to be registered with the IRS as an organization that supported a foreign entity. This would require it to file 990s. But even then, it would have to be more than just a “conduit,” Hopkins said. The organization would need to function independently and show that there was a decision to send the money abroad. “There’s a whole formal process,” Hopkins said. “You can’t just collect the money and just send it over to the foreign charity.”

An IRS spokesman declined to comment about Machanaim.

Controversy has often trailed Wolpe. He is the most prominent figure among the Lubavitch community, which believe that rebbe Menachem Mendel Schneerson, who died in 1994, was the messiah. He has led many of the clashes with the more established part of the Hasidic movement, which tries to distance itself from these beliefs.

More recently, Wolpe’s promotion of insurrection has forced Chabad leaders to distance themselves from the rabbi. In early 2008, Wolpe called for the entire Israeli government, then led by Ehud Olmert, to be hanged, and referred to the prime minister as a “terrible traitor” and to Ariel Sharon as someone who “collaborates with Nazis.”

A Chabad spokesman declined to comment about Wolpe, but pointed to the directory of Chabad rabbis, where Wolpe is not listed.

Contact Gal Beckerman at [email protected]

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 4

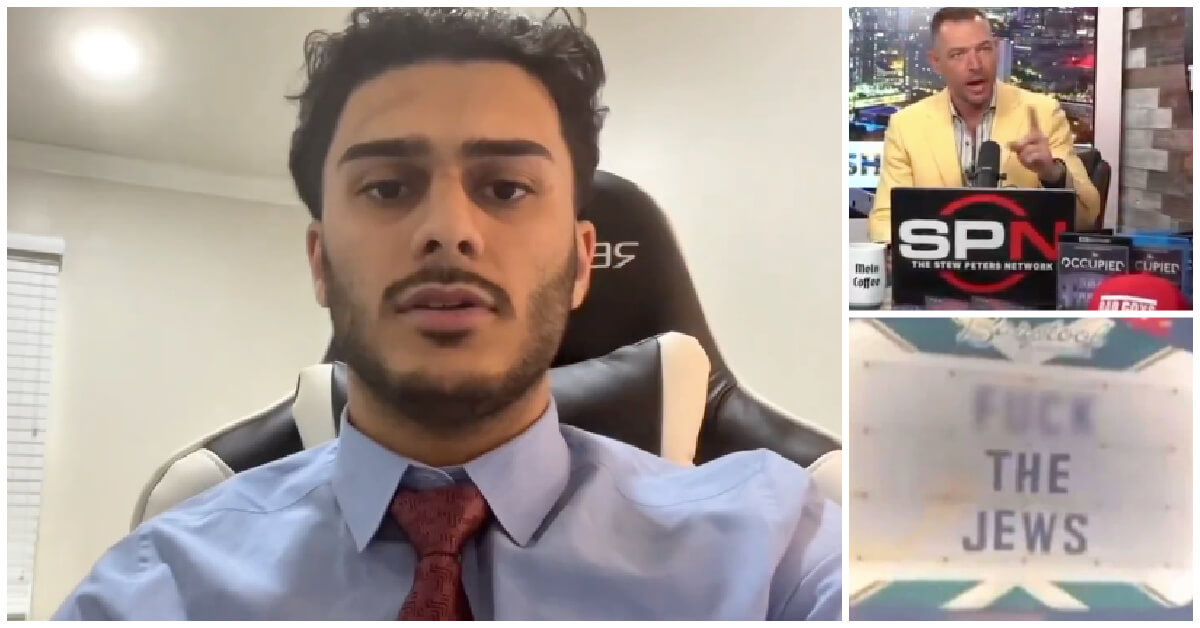

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Culture How one Jewish woman fought the Nazis — and helped found a new Italian republic

-

Opinion It looks like Israel totally underestimated Trump

-

Fast Forward Betar ‘almost exclusively triggered’ former student’s detention, judge says

-

Fast Forward ‘Honey, he’s had enough of you’: Trump’s Middle East moves increasingly appear to sideline Israel

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.