Can Tax-Free Donations Fund Settlements?

An early January announcement that Israeli authorities had approved a new Jewish settlement on the campus of an American-funded yeshiva in East Jerusalem came just weeks after President Obama issued a statement condemning new Israeli construction in the area.

The yeshiva, called Beit Orot, received nearly half a million tax-free dollars in donations from an American affiliate in 2007. And according to one expert, the group constructing the new housing is a subsidiary of Elad, a settlement organization that received $2.7 million in 2007 from its tax-exempt American affiliate.

This has raised the question: Can tax-exempt American donations be used to fund activities that are explicitly opposed to American foreign policy?

Not according to some critics, including one Arab-American advocacy organization that has undertaken a legal effort to strip the not-for-profit status of American groups that fund settlements. But legal experts question the validity of such claims, and even some American Jewish opponents of the settlement movement worry that the effort will be counterproductive.

“I don’t think this is a winning argument,” said Pamela Mann, a former chief of the New York State Attorney General’s Charities Bureau, of the claim by the American-Arab Anti-Discrimination Committee (also known as the ADC) that organizations opposing the public policy of the United States should not be eligible for tax exemptions.

The notion that tax-exempt groups cannot oppose American policy is based on a 1983 decision by the U.S. Supreme Court in a case involving Bob Jones University, an evangelical Christian school in Greenville, S.C. The university’s not-for-profit status had been revoked by the Internal Revenue Service over a school ban of interracial relationships, and the university had sued. In its decision, the Supreme Court upheld the IRS’s finding, stating that “an institution seeking tax-exempt status must… not be contrary to established public policy.”

Critics of the settlements, including the ADC, point out that the State Department and the Obama administration are opposed to settlement construction, a position that has been shared by previous administrations. “The United States is opposed to settlements, period,” said Darby Holladay, a spokesman for the State Department.

Although most settlement expansion is temporarily on hold in the West Bank, religious nationalist organizations and the Israeli government continue to build in East Jerusalem, which Palestinians hope to make the capital of a future Palestinian state. The major East Jerusalem settlement organizations, including Elad and Ateret Cohanim, each have American auxiliaries that accept tax-deductible donations. While American Friends of Ateret Cohanim, which sent $1.6 million to the Israeli group in 2007, claims in American tax documents to fund education, a Haaretz report last August quoted an Israeli Ateret Cohanim official saying that all money raised through the American group is used for “land redemption.”

In an October press release, the ADC described administrative complaints it was filing with the Treasury Department and the IRS against American groups that support the settlements. The complaints are not public, but according to the ADC release, they focus on misrepresentation of charitable purposes, such as was alleged in the Haaretz report, and on the groups’ opposition to public policy.

The first argument has remained relatively uncontroversial. Legal experts agree that organizations cannot misrepresent the charitable goal of their organization, or how donations are being used. But the claim that groups that support settlement construction should not be tax exempt has proven controversial.

ADC lawyers could not be reached for comment.

Legal experts are divided on whether, in working in opposition to State Department positions on the settlements, these groups are opposing public policy as described in the Bob Jones decision.

“I could see the IRS saying, ‘That’s contrary to American foreign policy and therefore contrary to American public policy,’ said Bruce Hopkins a not-for-profit law expert. “It’s never happened, but I don’t know of any reason why it couldn’t.”

Johnny Buckles, a professor at the University of Houston Law Center, disagreed. He argued that when the Bob Jones decision found racial discrimination to be against American public policy, it based that finding on statements by all three branches of the federal government, not just the executive branch. “One can argue that Bob Jones requires a very broad — across the various branches — violation of policy. I’m not sure you would have that here,” Buckles said.

“We don’t have a really well-defined concept of what established public policy is,” added Nicholas A. Mirkay, a law professor at Widener University. Mirkay and other legal experts said that the Bob Jones ruling didn’t go far in defining what it meant by “public policy,” and that neither the courts nor Congress had elaborated significantly since the 1983 decision.

Even if the argument could be made that the Bob Jones decision allows for the revocation of the tax exemption of groups that fund settlement construction, some argue that the IRS would never make such a claim. “Revocation of exemption is an enormous and extreme sanction, one that the IRS is loath to impose,” wrote Loyola Law School Los Angeles professor Ellen Aprill in an e-mail. “Put yourself in the place of the commissioner of the IRS. Whatever settled or firm national public policy may mean, the IRS is not going to interpret it to mean the current position of a particular administration.”

That’s a position shared by some American Jewish groups otherwise critical of American support of the settlements.

“You’re going down a very slippery slope, and it’s something we prefer not to do,” said Ori Nir, spokesman for Americans for Peace Now. Nir said that his group supports drawing attention to American not-for-profits that fund settlements, but that the notion that organizations opposing the policy of a given administration could lose their tax exemption is troubling.

“Take the issue of abortion, for instance,” Nir said. “Is it right when there is a conservative administration that opposes abortion to apply that kind of litmus test to organizations that deal with issues of reproductive rights? It’s messy.”

Contact Josh Nathan-Kazis at [email protected]

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Is Pope Leo Jewish? Ask his distant cousins — like me

- 4

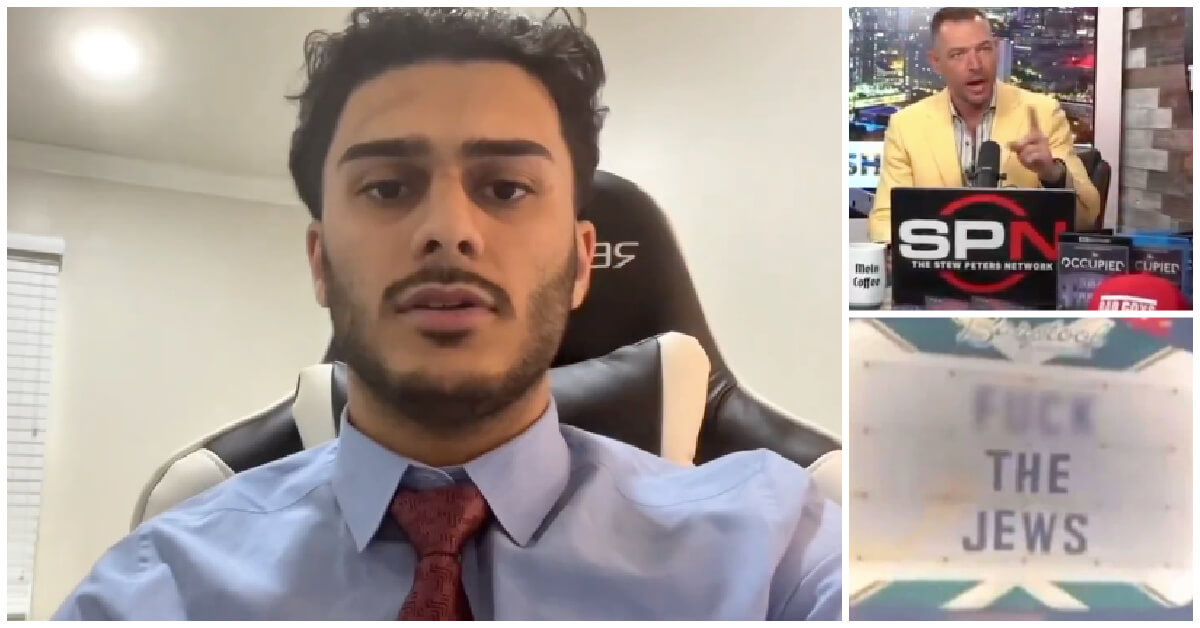

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

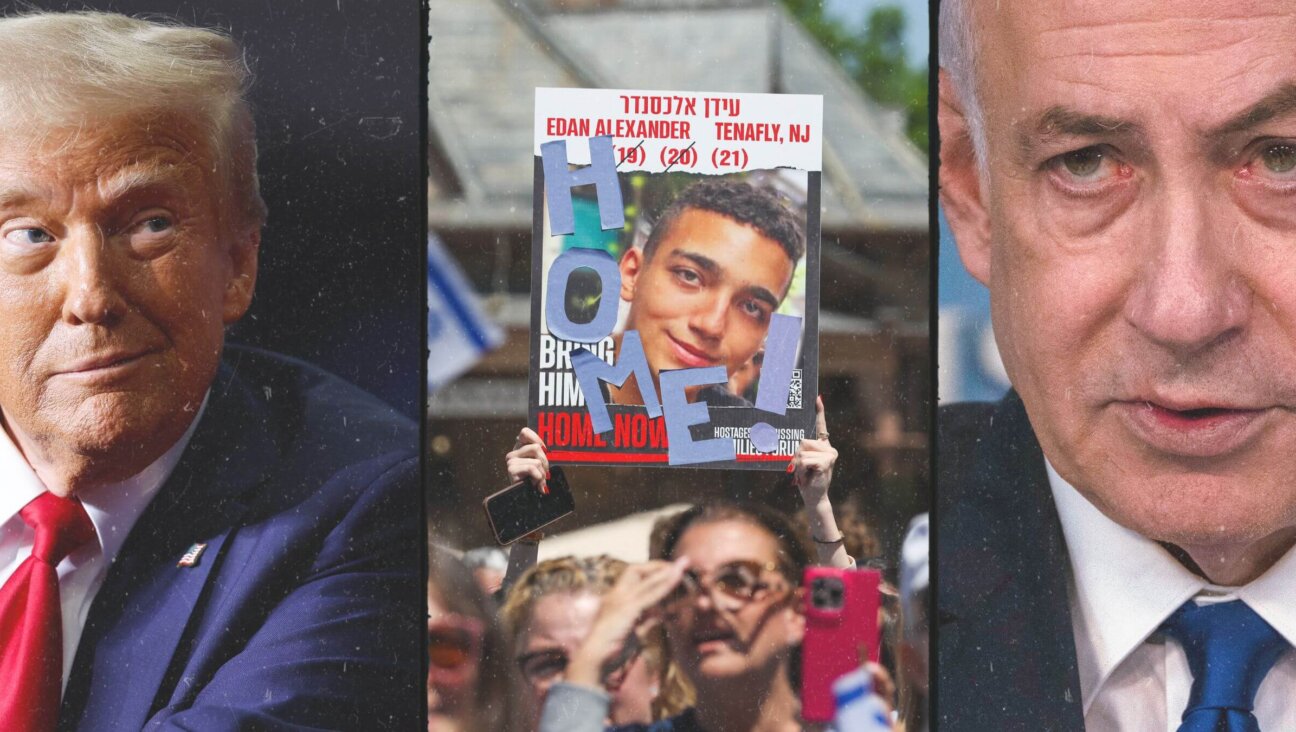

News In Edan Alexander’s hometown in New Jersey, months of fear and anguish give way to joy and relief

-

Fast Forward What’s next for suspended student who posted ‘F— the Jews’ video? An alt-right media tour

-

Opinion Despite Netanyahu, Edan Alexander is finally free

-

Opinion A judge just released another pro-Palestinian activist. Here’s why that’s good for the Jews

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.