Jewish Charity Scandals Tied to Long Tenures and Weak Oversight

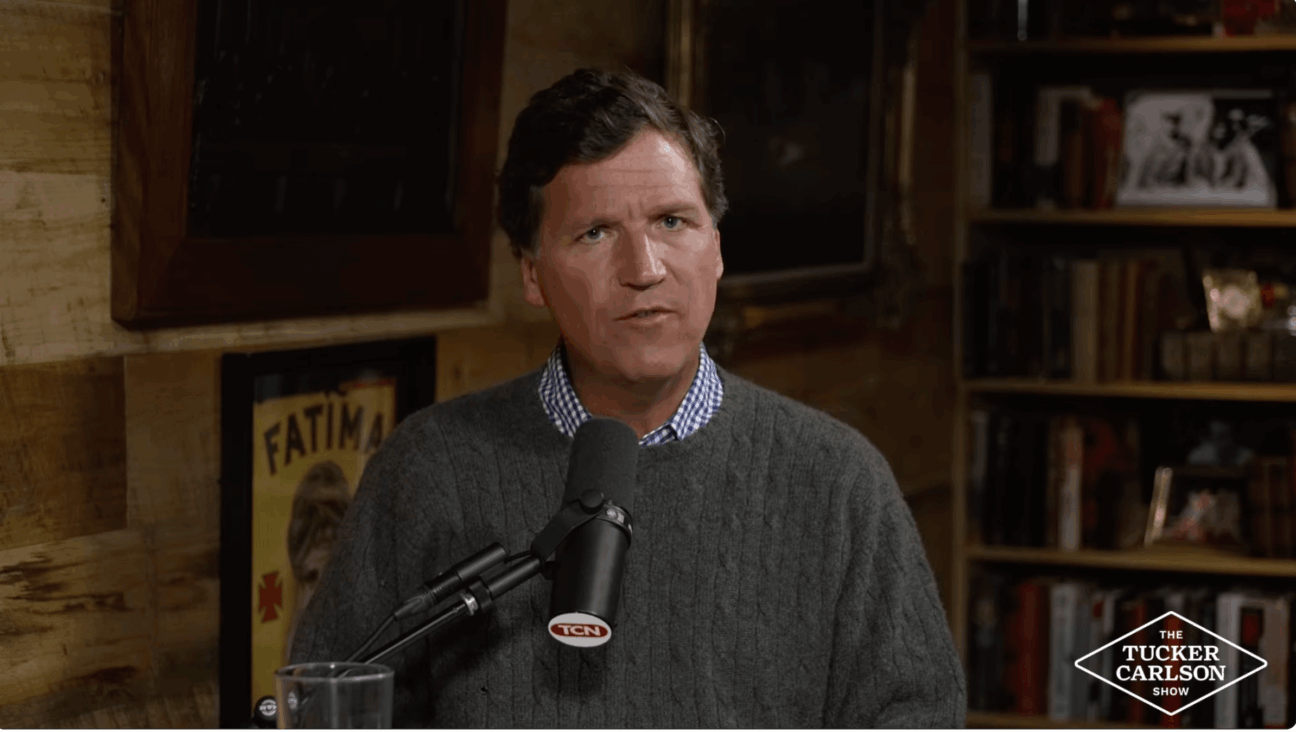

$5 Million Man: William Rapfogel was charged with stealing from Met Council. His predecessor Dovid Cohen (right), resigned his current job running Jewish ambulance service Hatzolah. Image by Courtesy of the Met Council

One Jewish charity CEO hid allegedly stolen cash in his apartment closet. Another had an affair with his assistant while the assistant’s son-in-law stole from the CEO’s organization. A third covered up sex abuse charges for decades.

Scandal after scandal has hit New York’s top Jewish charities this year. Experts blame lax oversight, saying that the multi-decade leadership tenures common among Jewish charity CEOs have corroded governance at some of the Jewish community’s largest not-for-profits.

The four major Jewish charity scandals over the past 10 months come just five years after some of the same organizations lost a fortune in Bernard Madoff’s Ponzi scheme.

“It has definitely shaken a lot of people’s confidence,” said Rabbi David Teutsch, who heads the Center for Jewish Ethics at the Reconstructionist Rabbinical College, referring to the repeated blasts of bad news. “The response clearly needs to be greater controls and better training.”

Two-decade terms are common for the men who run the nation’s largest Jewish organizations. Wealthy families hold seats on multiple boards of trustees. Several professionals who specialize in Jewish charity management told the Forward that fixes exist for the governance problems facing the Jewish not-for-profit sector, but they require structural changes. Executive suites need to turn over faster, the experts said. Trustees need to be better trained, and to be selected with an eye toward oversight skills, not just deep pockets.

Those interviewed were careful to state that most Jewish charities are well managed. But they said that governance improvements are important even without an apparent problem.

The worst year for Jewish charities since the Madoff debacle in 2008 started in late December 2012, when the Forward reported that Yeshiva University’s longtime former president Rabbi Norman Lamm had admitted to covering up allegations of sex abuse of high school students from the 1970s through the ’90s. Alleged victims soon filed a $380 million lawsuit against the school.

Then, in May, the Forward reported that top officials at the Conference of Jewish Material Claims Against Germany, which distributes aid to Holocaust victims, had been warned of fraud being perpetrated by employees eight years before a full investigation uncovered a multi-million dollar scam.

Things got even darker over the summer. In July, the 92nd Street Y fired its executive director, Sol Adler, after learning of Adler’s affair with his assistant, Catherine Marto. His affair, though embarrassing, wasn’t the worst of it. Marto’s son-in-law was the Y’s head of facilities, and was accused of taking kickbacks from vendors on construction projects. The Y shouldn’t have been surprised: He had pleaded guilty in 1999 in a Mafia-backed Wall Street fraud.

All those scandals were just a warm-up for the firing in August of William Rapfogel, CEO of the Metropolitan Council on Jewish Poverty and one of the largest figures on the New York Jewish not-for-profit scene. Rapfogel was charged in September with stealing $5 million from Met Council in a two-decade kickback scheme. His predecessor at Met Council, Rabbi Dovid Cohen, resigned in September from his current job running the Jewish ambulance service Hatzolah.

These weren’t the first embarrassing scandals in recent memory for Y.U. or for Met Council, both of which lost donor money in the 2008 Madoff fraud. Madoff was chairman of the board of Y.U.’s business school and a former treasurer of the university; J. Ezra Merkin, who managed funds that secretly fed millions into Madoff’s Ponzi scheme, was on Y.U.’s investment committee. That Merkin was on the board committee charged with overseeing the university’s investments didn’t keep Y.U. from investing in his fund, a conflict that received heavy criticism after the Madoff fraud was revealed. Y.U. lost $105 million invested with Madoff through Merkin.

Met Council lost an account invested with Madoff through Merkin with a purported value of $1.4 million.

A number of Jewish charities turned down offers to invest with Madoff before 2008, citing questions about his returns and their own conflict-of-interest policies.

The four scandals in 2013 are different in their circumstances. But according to Andrés Spokoiny, president and CEO of the Jewish Funders Network, all four come down to poor oversight on the part of their boards.

“Nobody in those boards had bad will,” Spokoiny said. “They simply didn’t have the mechanisms in place to have a more effective governance.”

One way in which governance controls fail at not-for-profits, Spokoiny and others said, is when top executives serve excessively long terms. Three of the four groups that faced scandals in 2013 had top officers in office for more than two decades. Rapfogel led Met Council for 20 years, Adler led the 92nd Street Y for 25 years, and Lamm was president of Y.U. for 27 years and then chancellor for another ten.

“It’s certainly put us in a position of vulnerability when the board does not feel like they need to, or can be, that power check against the executive,” said Mark Charendoff, former president and CEO of the JFN. Executives who stay too long build boards that are simply unable to challenge them, explained Charendoff, a longtime critic of extended tenures for executive directors.

Such CEOs “are basically working with a board who they have put in place,” he said. The board members “can’t imagine any world other than the world of that executive being synonymous with the organization…. There’s an erosion of those checks and balances.”

Teutsch, who works as a consultant to some Jewish not-for-profit boards and serves on others, echoed Charendoff’s warning. “The longer a CEO is in office and the more successful he is at his work, the less careful people are to do any double checking of his activities,” Teutsch said.

Two-decade terms are common among Jewish charity executives nationwide. Malcolm Hoenlein has led the Conference of Presidents of Major American Jewish Organizations for 27 years; Abraham Foxman has led the Anti-Defamation League for 26 years; David Harris has led the American Jewish Committee for 23 years; Barry Shrage has led Boston’s Jewish federation for 27 years; Steve Nasatir has led Chicago’s Jewish federation for 35 years; Dan Mariaschin has headed B’nai B’rith International for 25 years, and Michael Miller has led the Jewish Community Relations Council of New York for 26 years.

(Sam Norich, publisher of the Forward, has been the executive director of the Forward Association for 16 years.)

According to Spokoiny, charismatic CEOs can escape scrutiny. “There is something to be said [for] distributing leadership,” Spokoiny said. “It’s great to have a good, powerful, visionary CEO, and somebody that knows the business inside-out, but the concentration of power is never good.”

Boards, too, need to change their practices, experts said. Large and complex not-for-profits like Y.U., the Claims Conference, and the Met Council, can be hard for boards to track and oversee.

According to Teutsch, organizations need to train their boards in proper governance procedures. They also need to select board members who are prepared and qualified to scrutinize their organizations.

“Institutions depend upon board members for a significant portion of the funding [of] the institution,” Teutsch said. “When that becomes too large a portion of the total consideration for [selecting] board members, then the pool of skills and the commitment of time and energy that’s needed from the board sometimes suffer.”

Four people serve or have served on more than one of the boards of the groups that faced scandal this year. Among them, Claims Conference Chair Julius Berman is also a Y.U. trustee; Met Council Vice President Israel Englander is a former Y.U. trustee.

Wealthy and prominent families have seats on more than one of the four troubled boards. Ronald Stanton is an emeritus chairman of Y.U; his son Oliver Stanton is on the board of the 92nd Street Y. Former Met Council chair and current Met Council board member Meryl Tisch is married to the nephew of Joan Tisch, a director of the 92nd Street Y. Ronald Lauder is on the board of the Claims Conference; his nephew William Lauder is on the board of the 92nd Street Y.

The four 2013 scandals and the Madoff scandal are only the most high-profile recent governance flubs in Jewish not-for-profits. There have been plenty of others since 2008, like the IRS’s revocation of the Zionist Organization of America’s tax exemption for failing to file tax returns. In 2011, a clerk at UJA-Federation of New York attempted to steal donor credit card information in an identity theft scheme.

“For many years, the Jewish community looked at the failings of other faith groups and proclaimed with pride that that’s not happening in our house,” Charendoff said. “I think it led us [to] a certain complacency that recent events have proven we can’t afford.”

Contact Josh Nathan-Kazis at [email protected] or on Twitter, @joshnathankazis