How Norman Sugarman Became $50B Godfather of Charitable Funds

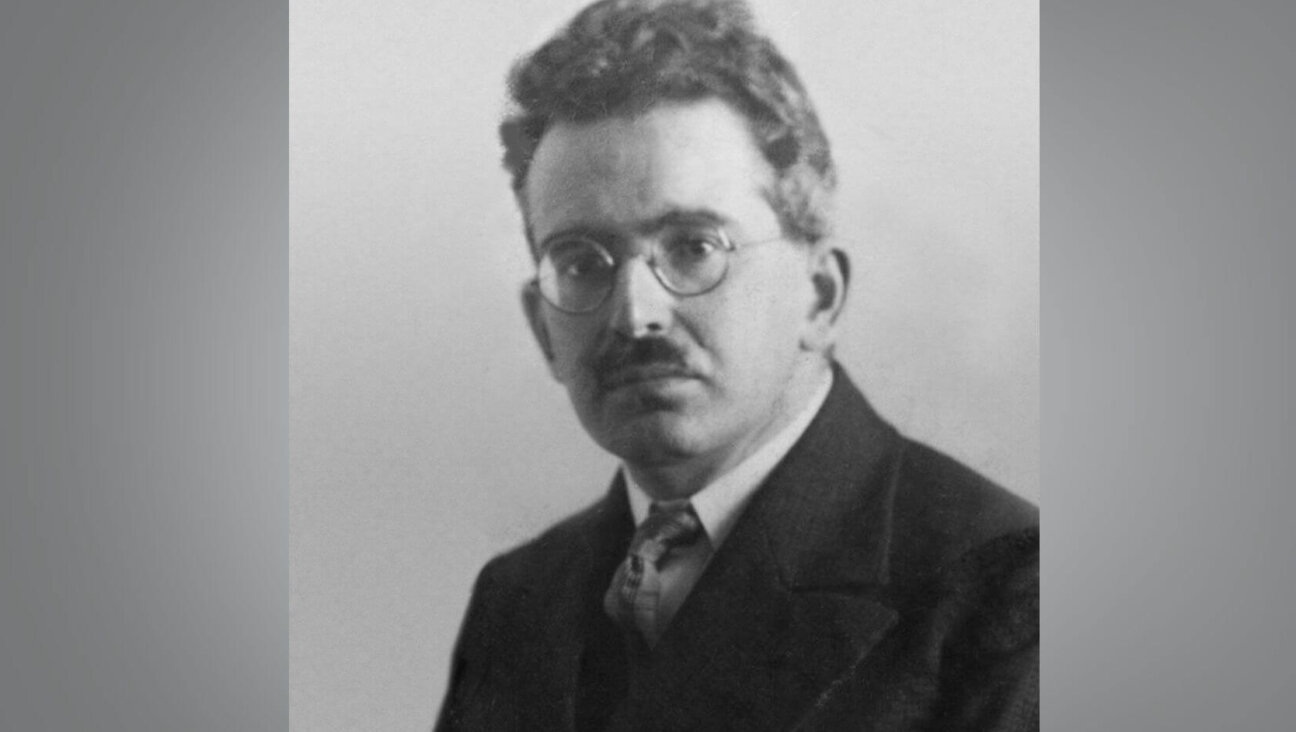

Image by Anya Ulinich

If you asked most people why the year 1969 was important in American life, few would mention that year’s federal Tax Reform Act. But Norman Sugarman’s fingerprints on that document may have had as much of a lasting effect on this country’s history as Neil Armstrong’s feet on the moon.

More than $50 billion in charitable assets now course through our country’s economy via Donor Advised Funds (DAFs) as a result of changes wrought by the act, its interpretation and its application. In no small part due to the acumen and persistence of a mid-century Jewish tax lawyer, those dollars function quite differently from other charitable resources.

Most fundamentally, although DAFs look to the IRS and other regulatory bodies like public charitable funds, they behave as if they’re individual or private charitable assets. In this gap between appearance and behavior lies a legal gray zone that has allowed private individuals to increase their control over ostensibly public resources.

For charitable organizations, the most significant piece of the 1969 Tax Reform Act was its differentiation between public and private charities. Charities that met the public classification standards won tax advantages, as did their donors, compared to those charities classified as private. As the act passed into law, foundations and other charitable institutions scrambled to determine their status and, in some cases, reorganize themselves in order to obtain public designation and the privileges that came with it.

Cleveland-born Sugarman, a lawyer, realized that for his clients, including several community foundations and the Jewish Community Federation of Cleveland, the new law was a serious matter. It could cripple the work they did, or, as he told an audience at the 1970 national General Assembly of the Jewish Federations, “with some imagination and use of initiative,” the act could be a great boon to them. He committed himself to helping his clients and their donors find every possible upside to the legislation.

Few were better positioned to interpret tax code than Sugarman. Throughout the 1940s and early 1950s, he’d served on the staff of the Bureau of Internal Revenue (renamed the Internal Revenue Service in 1953) and helped draft a major overhaul of the tax code. When he returned to his hometown to enter private practice, he had an almost unrivaled command of tax regulations and how the IRS tended to interpret them.

Sugarman knew, even before the Tax Reform Act of 1969 passed into law, that it would contain a crucial lacuna: It did not detail a clear path between a donor’s gift to a public charity and the allocation of those funds. In this absence, Sugarman saw possibility for ingenuity. On behalf of the Cleveland Federation, he requested a private-letter ruling from the IRS.

Private-letter rulings enable the requester to set forth an interpretation of tax code and then require the IRS to judge whether that interpretation is fair or not. Sugarman detailed for the IRS why Philanthropic Funds (only in the 1980s were they more commonly called Donor Advised Funds) deserved the agency’s imprimatur. He defined Philanthropic Funds as consisting of irrevocably charitable dollars placed in individually named accounts managed by a public charity. The assets channeled into these accounts would be immediately tax-deductible since they were donations to a public charity. However — and here Sugarman sought a permissive interpretation of the lacuna he had identified— the account holders would retain the right to recommend in an advisory capacity how and when to distribute the funds. The IRS accepted his interpretation, and the DAF was born.

DAFs were just one piece of Sugarman’s larger strategy to remake charitable giving. His grander vision was to build charitable endowments that would both ensure the stability of an organization’s charitable mission and also give individuals significant tax incentives to commit themselves to charitable donations. But DAFs were by far the most radical part of his vision because they challenged the practice of collective giving. For example, an individual could set up a fund at his or her local Federation. Upon transfer of the assets, the individual received an immediate tax deduction for donating charitable dollars to a public charity — and in the case of a donation of appreciated property, such as stock or securities, the donor would also receive relief from capital-gains taxes.

Unlike other donations to a Federation that were allocated directly by that Federation, however, the money in this account, by and large, circulated at the discretion of the fund holder. A Federation might urge the individual to give the money to a particular cause, and it would ensure that the money went to legal charitable organizations, but it exercised substantially less power over DAF dollars than it did over its other charitable assets.

It’s ironic that Sugarman first sought IRS approval on behalf of a Jewish Federation. In its ideal form, Federation embodied the concept of Jewish peoplehood by committing itself to collective action and support. In the late 19th and early 20th centuries, the Federation system set the trend for collective giving in the United States through its annual campaign, which brought in dollars from a broad pool of donors and distributed them across a range of agencies. Donor trust in the central institution was necessary for the success of the annual campaign and the agencies that relied upon it.

By the second half of the 20th century, Sugarman and a small cohort of Federation staff and lay leaders (almost all lawyers) insisted that Federations step away from being a revolving door charity — where funds that came in went straight out — and instead hold greater assets in reserve. For Sugarman, aggregation meant fiscal stability; for Federation leaders, fiscal stability came to signify a stable Jewish future.

Initially, most donors were unaccustomed to seeing their money flow into a Federation and simply stay there. In selling the idea of Philanthropic Funds or DAFs, Sugarman trained donors to understand charitable giving as more than a direct link to charitable distribution. Instead, he instructed donors to invest their charitable assets in a public charity and hold them there until they could make a “wise” — today we would say “strategic” — decision about where to direct them.

In exchange for its pivotal position and financial service, the public charity might take a modest management fee and it would also gain convening power to help donors make philanthropic decisions. Sugarman understood that assets held in endowment would only hold their value if they grew. Individual charitable dollars in DAFs would not disappoint. First, the federal tax deduction would boost their value, and, second, by investing in securities, the market would grow and add value to the invested charitable dollars.

Sugarman helped transform charitable giving into a financial institution. Whether operating as a Jewish Federation, a community foundation or, starting in 1990, as a charitable arm of a commercial investment house, philanthropy became an instrument of finance. By 2013, the Jewish Federation system valued its endowment at $16 billion, with a full third of those dollars in DAFs. Given the high level of individual power over DAF distributions, the valuation of a Federation’s endowment may be an inflated portrait of the assets that a Federation truly controls. Still, the fact that so many individuals have decided to maintain DAFs at a Federation indicates, at the very least, that they trust the Federations as a financial manager. After all, these same individuals could just as well choose to open funds through commercial investment houses, which as of 2014 held $25 billion dollars in DAFs.

Attentive to what tax law said as what it did not, Sugarman helped create a new way for private entities and individuals to assume public fiscal power and responsibilities. But his work with Federation was more personal than his work for other clients. He wanted Federation, a proxy for the Jewish people itself, to endure long after his passing. So he endowed Federation, through his legal prowess, with a new means to build charitable assets. He may have imagined a future, like our own, in which fewer Jews each year gave to Federations, yet a Federation’s net worth continued to grow. Some may dispute the Federations’ claim that they remain the central address for the Jewish people, but thanks to Sugarman, we cannot contest that it is the central address for Jewish dollars.

Lila Corwin Berman is Associate Professor of History at Temple University. She holds the Murray Friedman Chair of American Jewish History and directs the Feinstein Center for American Jewish History.