Adelson Shills For Republican Tax Plan That Will Save Him Hundreds Of Millions

Sheldon Adelson Image by Getty Images

“What’s in it for you?” the 30-second video advertisement asks as the screen fills with images of everyday Americans: a farmer, factory workers, a young African-American woman. “The Republican tax cut saves middle-class families more than $1,200 a year,” the ad states, as faces continue to flash on the screen: a woman clocking in as she arrives at work, another working the assembly line. “More money in your pocket. A stronger economy. That’s what’s in it for you,” the ad concludes.

The fine print at the end says 45Committee sponsored the ad.

The group, a not-for-profit affiliated with the super PAC Future45, is funded by billionaires Sheldon Adelson, 84, and Joe Ricketts, 76. Adelson, a casino mogul, grew up poor, but now he stands to rake in hundreds of millions if the tax reform, with its corporate tax relief and estate tax rollback, is approved by Congress. Forbes estimates his wealth at $37.2 billion.

“Adelson and other billionaires have disproportionate power and influence on the public discourse about the tax cut,” said Leonard Burman, of the Urban Institute and of Syracuse University. He noted that even before final details of the plan are clear, it is obvious that it will provide billionaires like Adelson nine-figure tax relief.

Adelson is deeply involved in both American and Israeli politics. He’s one of President Trump’s top donors and has provided years of support to Israel’s prime minister through a daily newspaper he owns that is in favor of Benjamin Netanyahu.

Ricketts and Adelson have put up $10 million for the pro-tax reform campaign they are funding. And they are not alone; fellow billionaires the Koch brothers are funding another $10 million ad campaign through Americans for Prosperity. The American Action Network, a pro-Republican group that is not required to disclose its donors, plans to spend up to $22 million on pro-tax reform ads.

45Committee’s ads posted online focus on the benefits offered by the plan to middle-class families, stressing the number “1,182,” a reference to Republican estimates that, if approved, the tax reform could add $1,182 to workers’ annual wages.

But while Adelson, Ricketts and other billionaires are going out of their way to sell the proposed tax reform as a middle-class program that has nothing to do with their own finances, senior members of the Republican Party are undercutting this message, making clear that the plan would benefits donors.

“My donors are basically saying, ‘Get it done or don’t ever call me again,’” is how New York Republican Rep. Chris Collins put it, and Sen. Lindsey Graham, according to The Huffington Post, also made no secret of the role major donors are playing in this public debate. When asked what would happen should the plan not pass, Graham responded candidly: “The financial contributions will stop.”

Adelson has long supported lowering corporate tax rates, though it does not top his interest list. Most of his lobbying and advocacy efforts are directed at ensuring support for Israel and the Israeli government; curbing online gambling, the biggest threat to his casino empire, and countering the wave of marijuana legalization across America.

In 2012 he backed Mitt Romney’s presidential run to the tune of over $100 million. An analysis prepared by a liberal group at the time found that if Romney got elected, Adelson would see a $2 billion tax cut. Romney’s plan was similar in its basic elements to the tax cut now proposed by Trump and congressional Republicans.

The main impact that tax reform would have on Adelson’s personal finance comes from the graduate repeal of the estate tax, now imposed on wealthy Americans with an estate of more than $5.5 million. Burman estimates that the new plan, if passed, would save heirs nearly $400 million for each billion dollar of inheritance. The current net worth of Adelson, who is 84 years old, is estimated at $32 billion.

The other key element is the corporate tax cut, which would lower significantly the rate paid by Adelson.

Trump has touted his tax plan as a way to bring back U.S. businesses that have moved overseas in search of lower tax rates. In Adelson’s case, this will make little difference. His headquarters are already located in America, and most of his overseas business is based on Chinese casinos that cannot be relocated.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 4

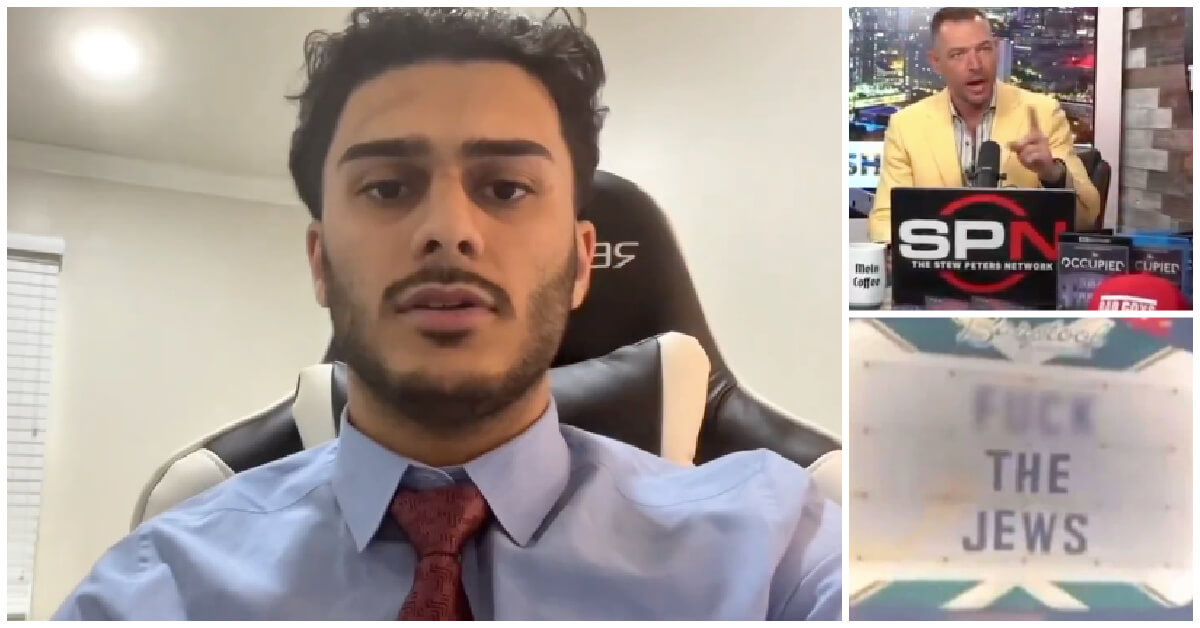

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Culture How one Jewish woman fought the Nazis — and helped found a new Italian republic

-

Opinion It looks like Israel totally underestimated Trump

-

Fast Forward Betar ‘almost exclusively triggered’ former student’s detention, judge says

-

Fast Forward ‘Honey, he’s had enough of you’: Trump’s Middle East moves increasingly appear to sideline Israel

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.