White House Cool to $1T Platinum Coin Plan

The White House on Wednesday sees little profit in the notion of minting $1 trillion platinum coin as an escape hatch to avoid a debt default if Congress balks at raising the U.S. debt limit.

With another standoff with Congress over raising the debt ceiling looming as early as mid-February, a petition on the White House website asks the administration to create a single platinum coin worth $1 trillion to avoid a stalemate over lifting the borrowing cap. The petition has garnered more than 7,100 signatures.

An asset of that value would place the United States well within its $16.4 trillion borrowing limits, the argument goes.

Pressed to rule out the idea, White House Press Secretary Jay Carney on Wednesday passed the buck.

“I would refer you to Treasury for the specifics of this question,” Carney told reporters. “I can tell you that the president does not believe that there is a backup plan or a Plan B or an off-ramp.”

Carney would only say the president doesn’t believe there are alternatives to raising the debt limit.

Congress’ refusal in 2011 to raise the debt ceiling unless the White House agreed to large spending cuts brought the United States close to the brink of a debt default and dealt the weak recovery a setback.

With the need to raise the debt limit again on the horizon, Obama has this time taken the position that doing so is Congress’s responsibility and that because a debt default would cause widespread economic damage, he does not need to offer lawmakers incentives to do so.

However, given the past willingness of some congressional Republicans to entertain a default rather than raise the borrowing cap – which they say puts the nation on a fiscally unsustainable path – observers have proposed emergency measures.

Some have urged the administration to cite the 14th amendment to the U.S. Constitution, which says the validity of the public debt should not be questioned, and ignore the limit if Congress fails to raise it. The White House says it does not believe that approach would stand up legally.

Enter the trillion-dollar coin idea. Liberal columnist and Nobel-winning economist Paul Krugman wrote that the while the notion may be “undignified,” it would avoid catastrophic economic developments by taking the debate over the debt ceiling off the table. Representative Jerrold Nadler, a New York Democrat, has said he supports the idea.

Carney, meanwhile, wasn’t buying.

Pressed repeatedly on whether the administration has reviewed the idea, he would only say that it is Congress’s responsibility to raise the debt ceiling, and that the White House is not mulling any contingency plans.

“I have no coins in my pockets,” he said.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 4

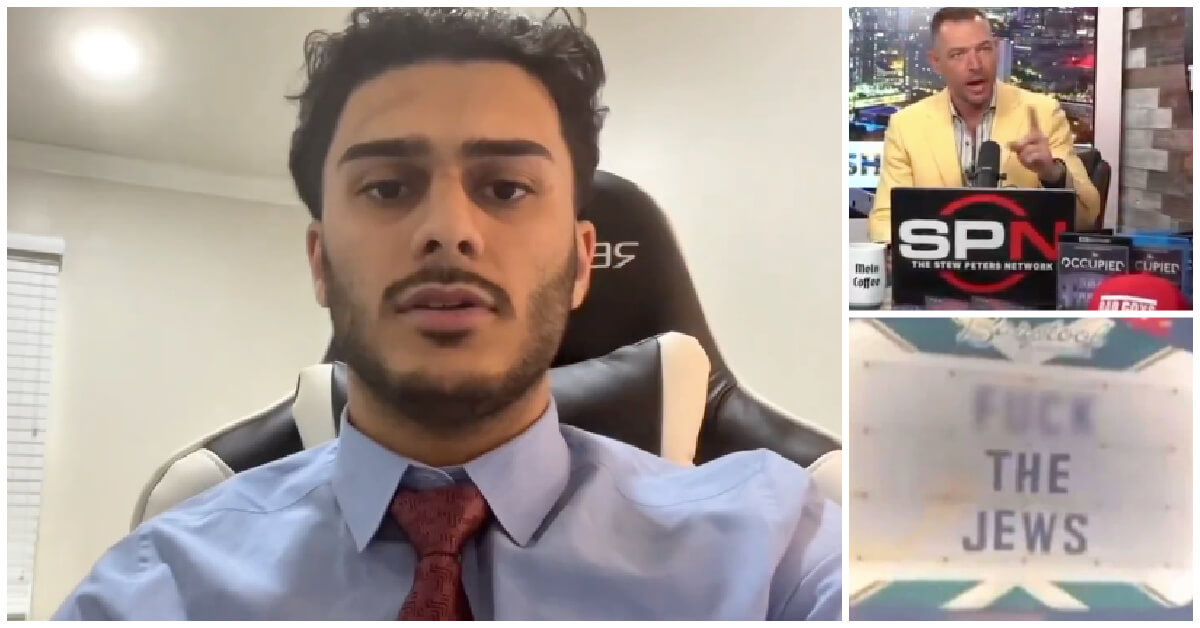

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Culture How one Jewish woman fought the Nazis — and helped found a new Italian republic

-

Opinion It looks like Israel totally underestimated Trump

-

Fast Forward Betar ‘almost exclusively triggered’ former student’s detention, judge says

-

Fast Forward ‘Honey, he’s had enough of you’: Trump’s Middle East moves increasingly appear to sideline Israel

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.