Sheldon Adelson Spotlights Dark Side of China’s Tourist Paradise Macau

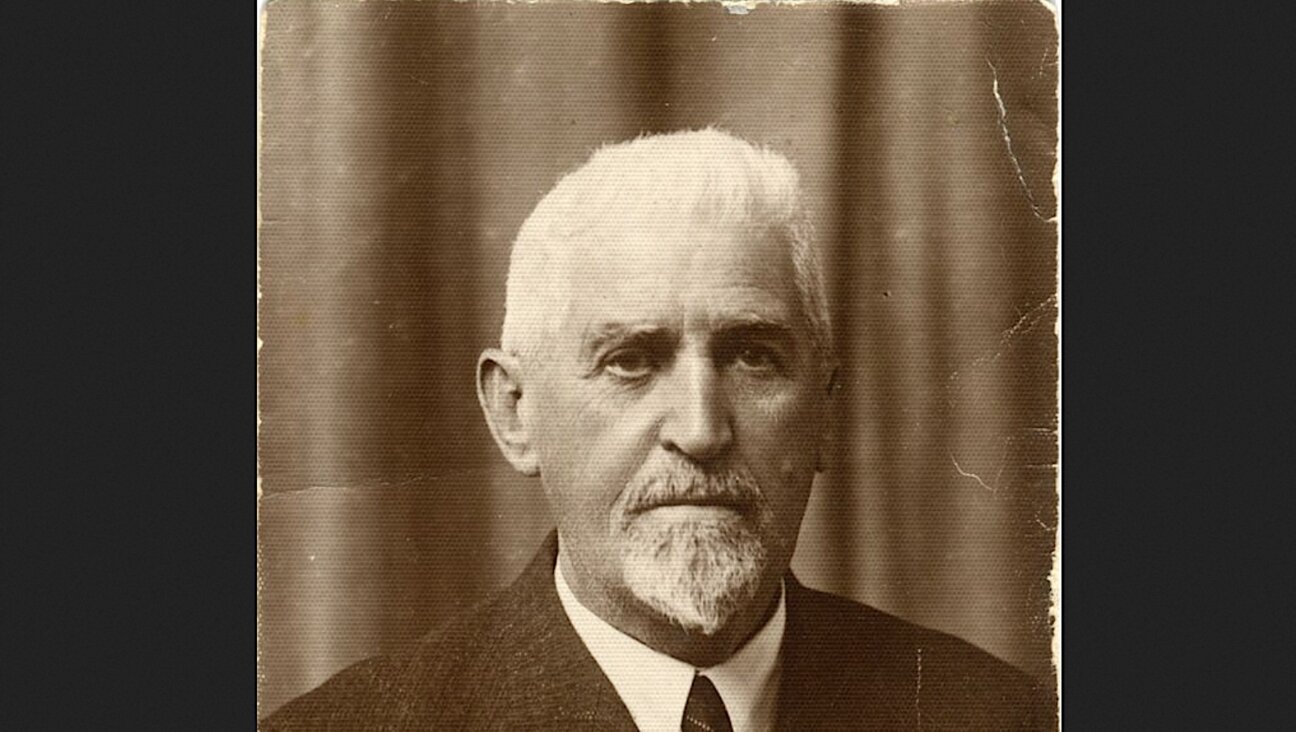

Touchy Subject: Sheldon Adelson raised hackles in China with his testimony about the power of organized crime on the gambling paradise island of Macau. Image by getty images

Casino magnate Sheldon Adelson’s reference to triad organised crime gangs in testimony in a lawsuit has hit a raw nerve in Macau, the Chinese boomtown that his Las Vegas Sands Corp helped transform from a gangland haven into a $38 billion gambling capital.

The lawsuit against Sands was brought by Hong Kong businessman Richard Suen, who is seeking $328 million he says he is owed for helping the U.S. firm obtain one of three coveted casino licenses in Macau, now the world’s biggest gambling market with annual revenues more than six times Las Vegas’s.

Adelson’s comments about triads reverberated across Macau this week and prompted a former Sands partner, casino operator Galaxy Entertainment Group Ltd, to post a regulatory filing with the Hong Kong stock exchange objecting to “certain inaccurate statements”.

Sands and Galaxy jointly won a Macau casino license in 2002, but they failed to reach an operational agreement and split up. Adelson, 79, when asked in a Las Vegas court why the two firms could not work together, responded that Galaxy “had expressed their judgement they were going to do business with either reputed or triad people and we couldn’t do that.”

That comment, which drew little attention in Las Vegas, was front-page news in Macau because it suggested China had failed to clean up the violent gangs that dominated the gambling scene a decade ago. Triads involved in Macau’s VIP gaming rooms were notorious for their heavy-handed methods of collecting on gambling debt. Macau’s VIP segment, where wealthy Chinese wager millions, accounts for around 70 percent of total revenues.

A Galaxy spokesman said the company was seeking legal advice and could not comment further.

Interviews with seven Macau gaming executives, including four former Sands employees, revealed a sense of dismay that the trial, watched locally online and tracked closely in the daily papers, was drawing attention to a seedier side of Macau that China has sought to scrub. The city wants to position itself as a transparent and reputable tourist destination.

China cracked down on triads after it took formal control of the former Portuguese colony in 1999. Back then, mobsters like the infamous Wan “Broken Tooth” Kuok-koi gave Macau a name for violence as much as gambling.

Macau’s casino revenue hit $38 billion last year, dwarfing Las Vegas’s $6 billion. Unlike Vegas, where fun-seekers can dine, see showbiz legends and go nightclubbing without laying a dollar on the tables, Macau’s visitors tend to focus intently on betting in its massive, packed gambling halls.

‘EVERYONE IS WATCHING’

Macau, home to 500,000 people, is the only place in China where casino gambling is legal. Gaming accounts for 70 percent of its government revenues, which explains why the trial has received so much interest.

In China, court proceedings are normally closed, so the open access to the Sands hearing – and its allegations of Macau gang activity and backroom deals – makes for prime viewing.

“Everyone is watching this,” said a casino executive in Macau who declined to be named because of the sensitivity of the matter. “Adelson’s comments have so many underlying meanings that are embarrassing. Talking about triads, whether it is true or not, implies the government didn’t do a good job at cleaning up Macau.”

Some casino sources expressed surprise that Adelson would draw negative attention to a city that helped turn Sands into a $46 billion company. Sands owns four of Macau’s 35 casinos – more than any other U.S. firm – and its Macau operations generated about 60 percent of the company’s total 2012 casino revenues of $9 billion.

“Why is he killing the goose that gave him the gold?” a casino executive asked.

Several executives questioned why Sands did not settle the lawsuit to prevent unflattering details from reaching the public domain. Former Sands executive William Widner said he had lost confidence in Adelson because of the Suen trial.

“This trial was injurious to relations in China; it should have never been in a courtroom like this,” Widner said in court on Wednesday.

REPUTATION RISK

This is the first of three legal battles that are casting an uncomfortable spotlight on how Macau awarded lucrative gambling licenses in 2002, a source of controversy because little was publically revealed about how the winners were selected.

The lawsuits show behind-the-scenes jockeying and close connections between business and government as 21 bidders were whittled down to three – the Sands-Galaxy partnership, Macau kingpin Stanley Ho, and Las Vegas mogul Steve Wynn’s Wynn Resorts Ltd.

After Galaxy and Sands split, Macau awarded a sub-concession license to Sands for no charge, which was controversial because Wynn and Ho’s SJM were able to sell their sub-concessions to Melco Crown and MGM Resorts for $900 million and $200 million respectively.

A Sands spokesman declined to discuss any specifics regarding the concession license process.

Some Macau residents welcomed the closer scrutiny that came with the lawsuits.

“The Macau people want to hear more about these cases, find out how the license process worked,” said Jose Coutinho, a directly elected member of Macau’s legislative assembly who is known for promoting democratic reforms. “The government should set up an independent panel to find out what happened when the licenses were awarded.”

The Macau government did not respond to email and telephone requests for comment.

But the Macau Business Daily, the city’s main English-language daily, said the city’s reputation was at risk.

“Things can be said in U.S. courts – and then reported by the media using the rule of court privilege there – that if repeated outside the tribunal or in other jurisdictions might be considered inflammatory or even defamatory,” it wrote in an editorial published on Thursday.