Jon Corzine Sued by Louis Freeh Over $1B MF Global Collapse

Image by getty images

Jon Corzine was sued by the bankruptcy trustee liquidating MF Global Holdings Ltd, who accused the former chief executive of negligently pursuing a high-risk business strategy that culminated in the commodities brokerage’s destruction.

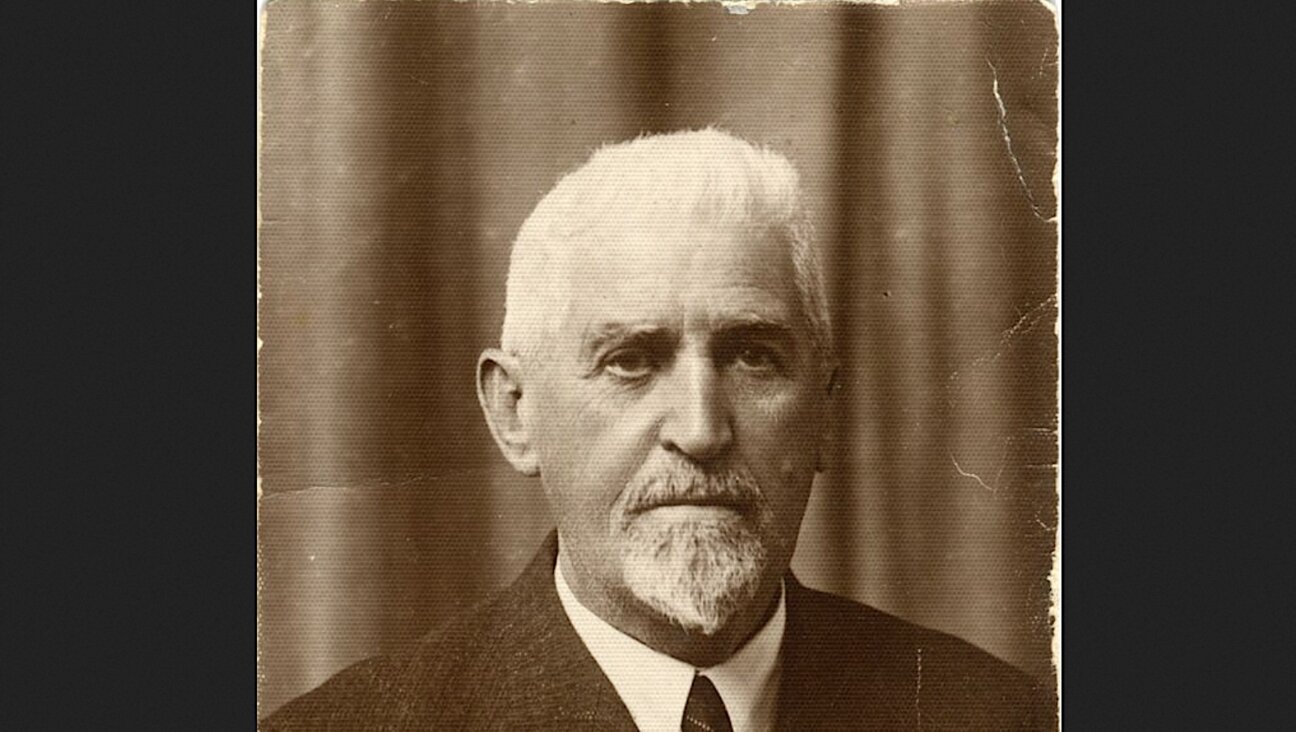

The trustee, Louis Freeh, said in the lawsuit that Corzine and two top deputies overhauled MF Global’s business without addressing “systemic weaknesses” in oversight and monitoring.

Freeh said the officials breached their fiduciary duties to shareholders and failed to act in good faith, wiping out more than $1 billion in value by the time of MF Global’s Oct. 31, 2011, bankruptcy.

“The company’s procedures and controls for monitoring risk were lacking and in disrepair,” Freeh said in the lawsuit, filed Monday night in U.S. Bankruptcy Court in Manhattan. “Corzine engaged in risky trading strategies that strained the company’s liquidity and could not be properly monitored.”

The lawsuit seeks unspecified damages that could be used to pay creditors of MF Global, whose bankruptcy remains one of the 10 largest in U.S. history according to BankruptcyData.com.

Corzine is a former Goldman Sachs chairman and former Democratic governor and senator from New Jersey.

The other defendants are Bradley Abelow, who was MF Global’s chief operating officer, and Henri Steenkamp, its former chief financial officer.

FREEH REPORT

Corzine spokesman Steven Goldberg called the lawsuit a case of “Monday morning quarterbacking” filled with “seriously flawed allegations,” and said there was no basis to claim that Corzine breached his fiduciary duties or was negligent.

Abelow’s lawyer, Gary Naftalis, said the allegations lack any factual or legal basis, and that his client “did not cause any losses or contribute in any way to the collapse of the company.”

Lee Richards, a lawyer for Steenkamp, was not immediately available for comment.

The extent to which insurance might cover any payouts was not immediately clear. Last April, U.S. Bankruptcy Judge Martin Glenn in Manhattan said Corzine and other officials may tap insurance money to defend against lawsuits.

Freeh’s lawsuit echoes criticisms he raised in an April 4 report on MF Global’s collapse. He said at the time that he planned to file the lawsuit, but agreed to wait pending mediation with Corzine, including over a separate securities class-action lawsuit.

Corzine’s spokesman said mediation is continuing. A lawyer for Freeh did not immediately respond to a request for comment.

FAILED TRANSFORMATION

Corzine had sought to transform MF Global into a global investment bank, with a strategy that included a $6.3 billion bet on sovereign debt of countries such as Belgium, Ireland, Italy, Portugal and Spain.

But as Europe’s economy weakened, MF Global was forced to meet margin calls, and regulators learned that money in customer trading accounts had been used to cover liquidity shortfalls.

The end came after the European sovereign debt wager and high leverage ratio spooked markets and credit rating agencies. But Freeh said MF Global even then missed opportunities to curb its losses.

MF Global came under more intense scrutiny, including in Washington, after about $1.6 billion went missing from commodities customers’ accounts.

But much of the money has been recovered, and James Giddens, the trustee recovering money for those customers, has said he expects to recover 93 percent of their funds.

In a statement on Tuesday, Giddens said his office also saw potential legal claims against Corzine and others, but chose to join the existing class-action litigation “because it was the most efficient way to get money to customers and creditors.”

On April 5, the Manhattan bankruptcy court approved MF Global’s liquidation plan, with unsecured creditors recovering as much as 34 cents on the dollar.

Federal regulators including the Commodity Futures Trading Commission are still examining MF Global’s collapse, but have not accused Corzine of wrongdoing.

“Anyone who violates the law, and particularly anyone at MF Global who used a billion bucks of customer cash that should have been protected, should be punished appropriately,” CFTC Commissioner Bart Chilton said in a statement discussing Freeh’s lawsuit.

In the wake of MF Global’s collapse, the CFTC proposed new rules to better protect client funds and improve oversight by the commodities industry’s self-regulatory bodies, CME Group Inc and the National Futures Association.