Does Eliot Spitzer Comeback Herald Return of ‘Sheriff of Wall Street’?

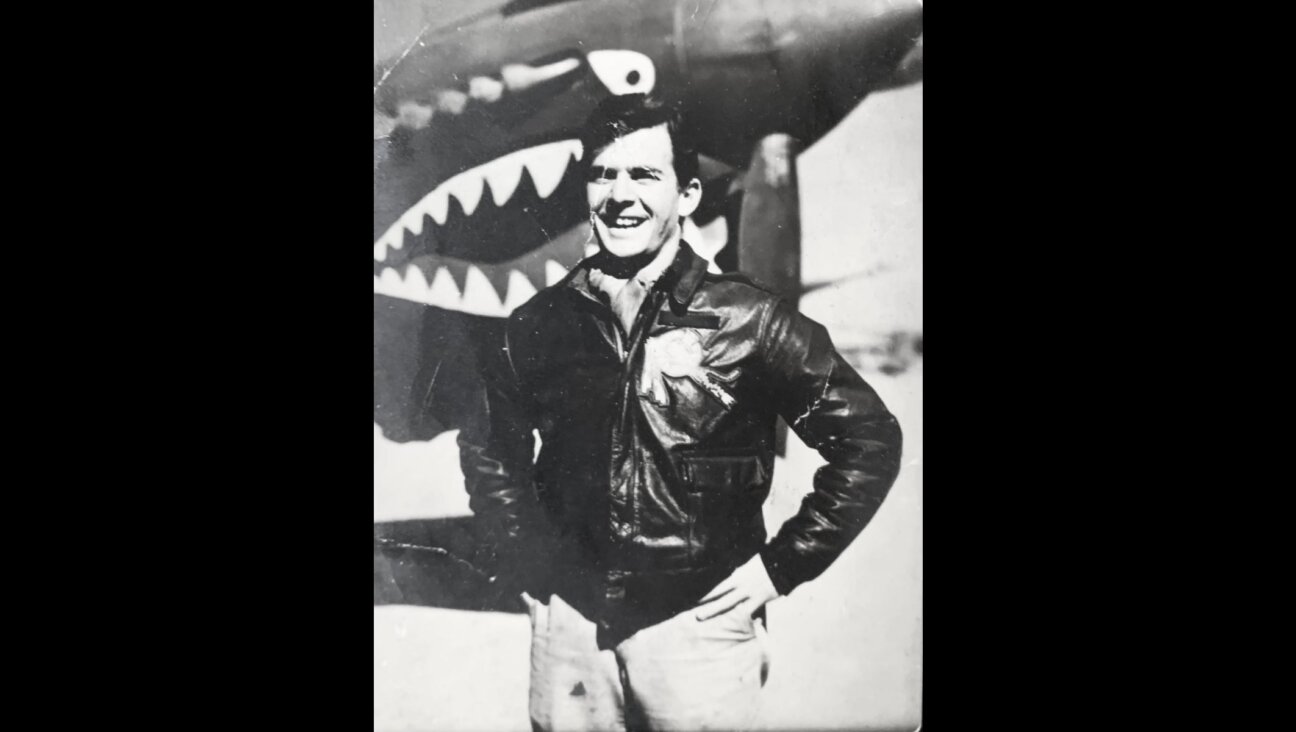

He?s Back: Some in the financial world are trembling at the return of Eliot Spitzer. Before his infamous sex scandal, Spitzer was known for his crackdown on Wall Street excesses. Image by getty images

If elected New York City comptroller, Eliot Spitzer has vowed to wield power as aggressively as he did as state attorney general, leading some in the financial community to worry that the “Sheriff of Wall Street” might be back.

Both Spitzer and his critics, though, may be over-estimating the impact that the comptroller of New York can have beyond matters of budgeting and contracting.

No one questions Spitzer’s ambition or his ability to use his powers to the max. He has already leaped to the top of the polls less than a week after announcing his candidacy, and the comptroller’s office would give him a pulpit from which to decry perceived wrongs.

It would also offer him rehabilitation from the prostitution scandal that forced his resignation as governor of New York in 2008 and a possible springboard to higher office.

But an examination of the actual tools and powers available to the comptroller and interviews with a former holder of that office and others suggest that Spitzer would be hard pressed to have much influence on the behavior of Wall Street or corporations.

As the city’s chief financial officer, the comptroller is the watchdog of a $70 billion budget, with the power to audit city agencies and spending. The comptroller also signs off on New York’s bonds and oversees the city’s five employee pension funds, which have a total value of about $139 billion.

In interviews this week, Spitzer has pointed to the role of pension fund administrator as one he could use to pressure corporations to change their practices.

Top priorities would be pushing to separate the positions of chairman and chief executive, remove anti-takeover “poison pills” and scrap staggered boards, another arrangement that hinders takeovers, he said on a New York Public Radio program.

INCREMENTAL CHANGE?

Spitzer might be able to use his stature to persuade other states and institutions to join him in shareholder activism, but any change could be only incremental to the ongoing efforts of the New York comptroller’s office.

The current comptroller, John Liu, filed 61 shareholder proposals at 58 companies in 2012. Twenty three were adopted or settled. Of 31 proposals that went to a shareholder vote, only eight passed.

One of Liu’s highest-profile pushes was to try to split Jamie Dimon’s role as chairman and chief executive of JPMorgan Chase & Co into two. About a third of shareholders backed Liu’s latest effort, down from 40 percent the year before.

The city’s pension funds track broad stock market indexes and have small stakes in thousands of companies.

Its biggest single holding is Exxon Mobil in which it holds $1.02 billion, or about 0.25 percent of the company. In May, Exxon’s shareholders defeated a proposal backed by the New York comptroller’s office to release information on the extraction of shale gas, a process known as fracking.

The comptroller might also be able to exert influence over the financial firms that manage its pension funds, but because it deals with a large number of fund managers, it may not be able to influence any one in particular.

The idea that New York’s comptroller could pressure financial institutions – beyond negotiating fees – is “ridiculous,” said a hedge fund manager who advises city pension funds.

“If a pension is all combative and hostile, then you just don’t want their business,” said the manager, who spoke on the condition of anonymity because of a relationship with the city’s pension funds.

“REVITALIZE AND RE-ENERGIZE”

Another factor limiting the comptroller is that decisions are taken by the boards of the five city pension funds, which include trustees from labor unions and other public officials.

Harrison Goldin, who was New York City comptroller from 1974 through 1989, described the job as “a monitoring role, an oversight role.”

Goldin is supporting Scott Stringer for the position. Stringer was leading in the race for the Democratic nomination until Spitzer burst onto the scene last Sunday night.

Still, Spitzer says he has big plans.

“I hope to do with it what I did to the attorney general’s office, which is to revitalize and re-energize it,” Spitzer said in an interview with Reuters this week.

After becoming state attorney general in 1999, Spitzer revived the 1921 Martin Act, which gave him extraordinary powers to go after financial fraud and earned him the moniker “Sheriff of Wall Street.”

He pursued Maurice “Hank” Greenberg, the former head of American International Group Inc, for misleading shareholders about the insurer’s financial health. A small part of that case is still ongoing. And he sued Richard Grasso, a former head of the New York Stock Exchange, over compensation Spitzer said was excessive. That case was later dismissed.

But legal experts say there is no easy equivalent to the Martin Act waiting for an aggressive city comptroller to revive.

More frequently, comptrollers use their power to clash with other city politicians and build their resumes.

Liu, for example, criticized the New York Police Department’s stop-and-frisk practices and attacked Mayor Michael Bloomberg over city contracts. Liu, who did not comment on Spitzer’s ambitions, is now running for mayor.