Israel’s 40-Year Old Yom Kippur War Tweet Jolts Oil Markets

Graphic by Angelie Zaslavsky

Oil traders razor-focused on signs of escalating violence in the Middle East were jolted on Thursday by a Twitter posting from the Israeli military that, at first glance, suggested they had just bombed Syrian airports.

Oil prices jumped $1 as the talk raced through oil markets, which frequently react quickly to rumors of geopolitical events and where traders have increasingly turned to the Internet and social media for advance warning of escalating risks, from the Arab Spring to the Iranian nuclear standoff.

The Tweet was true, but it wasn’t news. The posting referred to an attack 40 years ago in the Yom Kippur war, the latest in a series of Tweets from the Israel Defense Forces Twitter handle (@IDFSpokesperson) commemorating the war.

The Tweet just before 10:30 a.m. EDT stated: “Oct. 10 #YomKippur73: Israel Air Force bombards airports in Syria to prevent Soviet weapons reaching the Syrian Army”. It then links to a website that gives a day-by-day account of the war.

“Obviously this was part of our Yom Kippur Twitter series. The facts are there and simple to read. It was apparent within the Tweet itself,” said IDF spokesman Peter Lerner.

Although traders quickly realized the historical nature of the Tweet, oil prices maintained their gains, supported in large part by hopes of a breakthrough in U.S. debt discussions and earlier anxiety over political stability in Libya.

Front-month Brent crude prices rallied from $110.40 a barrel at 10:20 a.m. EDT – just before the Tweet – to as high as $111.50 just after 11 a.m., as trading volumes rose. By 1 p.m. oil was up $2.68 a barrel to $111.74, its highest in a month.

The incident is the latest example of how social media outlets are playing an increasingly important role in financial markets, often causing sudden moves – not always corrected.

In April, hackers took control of the Associated Press Twitter account and falsely posted that two explosions at the White House injured President Barack Obama. Reuters data showed the Tweet briefly wiped out $136.5 billion (89.5 billion pounds) of the S&P 500 index’s value before markets recovered.

“The IDF tweet caused a bit of a stir in the oil market, with rumours circulating of a possible Israeli strike in Syria before people realised they were referring to events 40 years ago,” said Richard Mallinson, chief policy analyst at consultancy Energy Aspects.

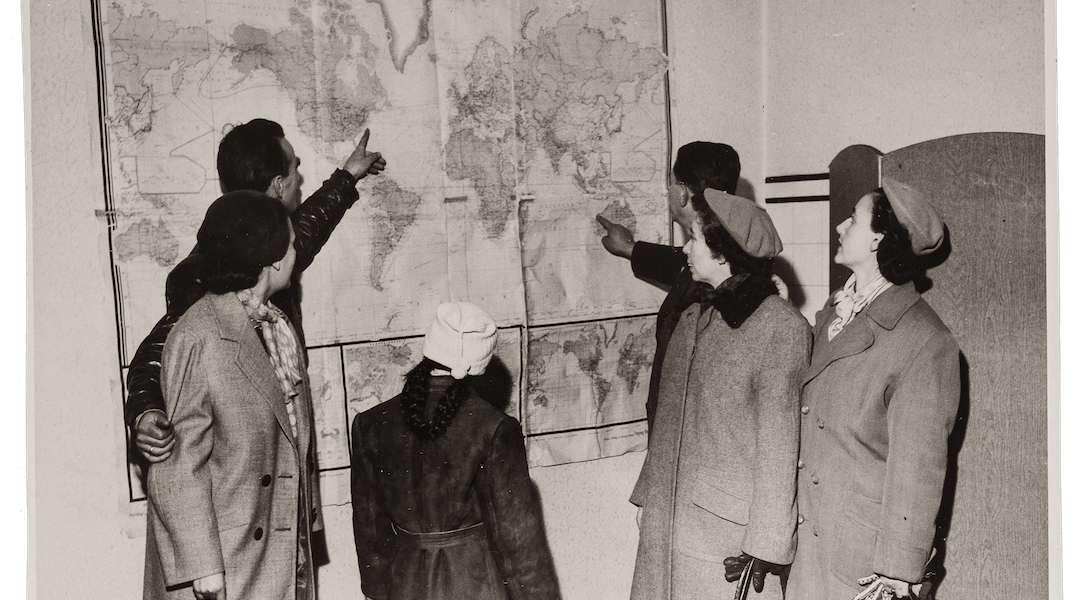

Oil prices surged in October 1973 after a coalition of Arab states launched a surprise attack on Israel during the Jewish holy day of Yom Kippur, threatening to overwhelm the country. Israel launched a massive counter-offensive before a ceasefire took hold.

The war prompted Arab nations and members of OPEC to use what they called “the oil weapon,” proclaiming an oil embargo that lasted several months and set off global oil price shocks.

More recently, the conflict in Syria, and its potential to spill over into large oil-producing nations in the region, have kept crude traders on closely watching for fresh news.