Jewish institutions should divest billions in fossil fuels, new report says

The Jewish nonprofit Dayenu encourages Jewish groups to divest $3 billion in non-renewables and invest it in clean energy

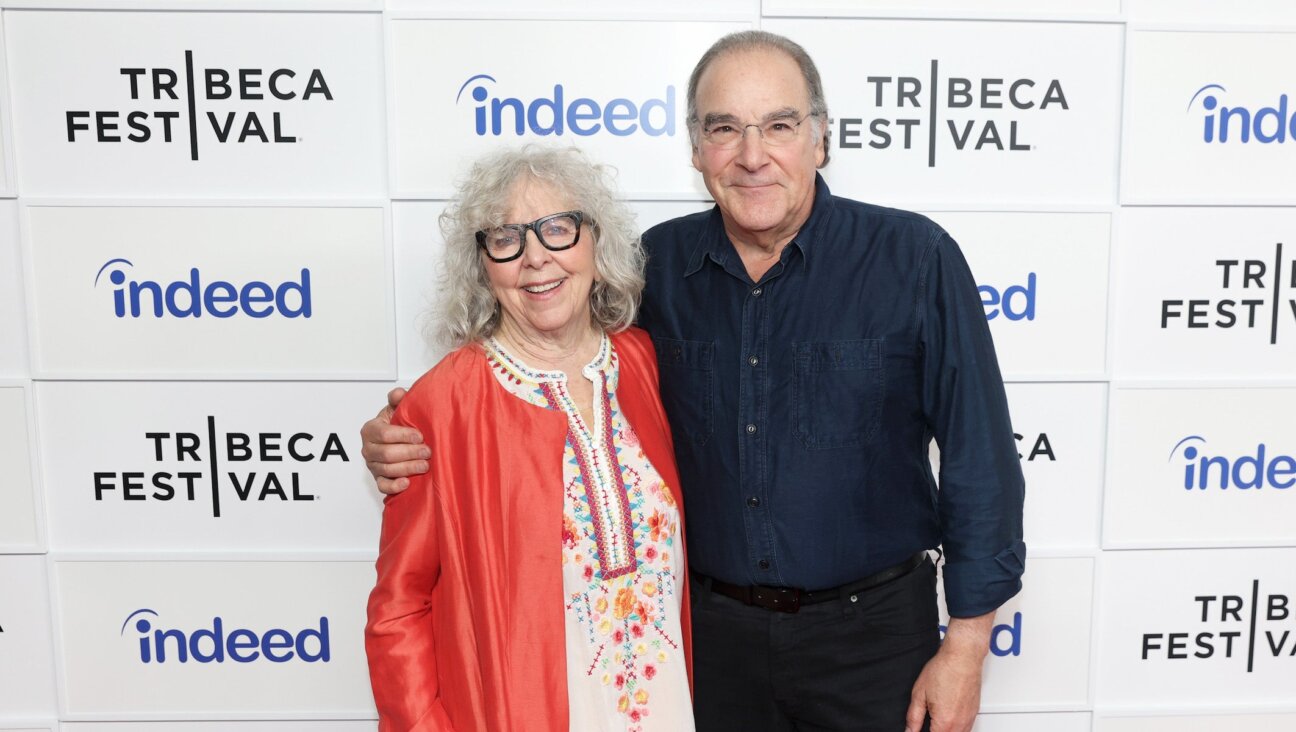

Jewish institutions have billions invested in the fossil fuel industry according to a new report. While environmental group Dayenu is urging divestment, some of those involved in these organizations’ finances say that may not be the most responsible option. Photo by iStock/Schroptschop

A new report from a prominent Jewish environmental group urges American Jewish institutions to pull billions of dollars worth of investments out of the fossil fuel industry. The organization Dayenu argues that it’s a moral obligation considering the industry’s role in climate change, but also that clean energy presents a financially smart alternative.

The report, issued Thursday, analyzed tax filings and financial statements from the top bodies of the four major denominations of Judaism in the U.S. — the Union for Reform Judaism, United Synagogue of Conservative Judaism, Orthodox Union and Reconstructing Judaism. It also included data from the 20 largest private Jewish foundations and 20 largest Jewish federations, as well as the national federation.

Advising that its calculations were rough, and acknowledging that Jewish institutional investment alone would do little to help the environment, Dayenu estimated these organizations’ investments made up one-third of the $100 billion in total U.S. Jewish institutional investment. Based on that, the group estimated total Jewish institutional investment in the fossil fuel industry at $3.3 billion.

When minimal investment information was available for a Jewish institution, Dayenu assumed that fossil fuels make up about 6% of its investments, a proportion comparable to a diversified index and on par for institutional investments across the market.

The report is part of a larger push in recent years from environmental groups, which have called on governments, companies and nonprofits to divest from fossil fuels. Their campaigns have met with some success, particularly with colleges.

Dayenu did not identify the federations and foundations used in its calculations. Washington director Dahlia Rockowitz said the omission was intentional as the goal was not to shame any individual organizations.

“This is not intended to be a calling out moment, but a calling in,” she said. “These numbers are to help people sort of metabolize what the impact is of the climate crisis and how their financials are tied up in that and how this represents an opportunity for action.”

A powerful gesture

In January, Dayenu called on Jewish institutions to divest from the fossil fuels industry. At the time, chief strategy officer Phil Aroneanu acknowledged that even if all money invested by Jewish institutions were withdrawn from fossil fuels and reinvested in green energy, it would not “make or break” the industry. Between 2016 and 2020, 60 of the world’s largest banks invested over $3 trillion into fossil fuel companies.

Still, Aroneanu said, Jewish divestment is a powerful symbolic gesture.

Pulling money out of fossil fuels wouldn’t only be a moral act, said Rockowitz on the eve of the report’s release, but also a financial opportunity, with green energy presenting a sound long-term investment.

Is pulling money out of fossil fuels risky? Oil and gas companies would like you to think so, Rockowitz said. But “when you actually run the numbers, and looking into the longer term, it’s undeniable that the future is renewable.”

A caution

But some financial experts have cast doubt on the efficacy of calls for divestment in fossil fuels.

Jewish communal leader Greg Neichin, who is also managing director of impact investing firm Ceniarth, said divestment campaigns often oversimplify, and are often not the best way to make both a financial and environmental impact.

Neichin, who chairs the Jewish Community Federation of San Francisco, the Peninsula, Marin and Sonoma Counties impact investing task force, used the example of a charity selling their shares of an oil company.

“If somebody sells those shares in Exxon Mobil, those shares are going to be bought on the open market in 30 seconds,” he said. In his view, divestment gives foundations a superficial green win.

“They sort of get their gold star for having done something which is really not much and then they feel like they’re off the hook in terms of devoting more actual dollars into the problem,” he said.

Rather, Neichin said, the smart move would be to focus on where an institution’s investment money can have the greatest positive impact, such as energy efficiency projects in low-income communities.

Jewish groups respond

Jewish institutions were not able to review the document before Thursday but when contacted by the Forward, several said the issue is one that they are aware of and are working to address.

Barbara Weinstein, an associate director at the Union for Reform Judaism, said the report’s recommendations are in line with the URJ’s goals. She noted the organization’s pension board already offers a Jewish Values fund, which does not include any holdings in coal companies. A task force is also examining the divestment issue, although there is no timeline for when the findings will be made available.

“What this task force is looking at is how we can use the impact of the funds that we have to make a difference on climate issues that could include divestment, but it is not the ultimate conclusion that we are necessarily driving towards,” she said. “This is very much a process of learning, of understanding and seeing how we can best use the leverage that we have as a movement to make a difference on this issue and I think Dayenu’s report is a really important part of that whole process.”

A spokesperson for Reconstructing Judaism declined to comment. No one from the United Synagogue of Conservative Judaism was available to comment before press time, while a spokesperson for the Orthodox Union did not respond to efforts to contact them.

Other organizations were more tentative on the report’s findings. In a statement, Eric Fingerhut, president and CEO of Jewish Federations of North America, said the connection between investment and climate is “extraordinarily complex and cannot be captured by rough estimates based on broad assumptions.”

“As a founding member of the Jewish Climate Leadership Coalition, we look forward to continuing to work with a wide range of partners to advance this cause,” he added.

A spokesperson for the Jewish Federation of Metropolitan Chicago said the organization “does not invest in any stock of any company directly,” but did not mention funds that could include fossil fuel-based assets.

However, she added the Chicago Federation is “exploring various Jewish-values based investment models that will include environmental aspects among its considerations.”