Somebody’s Raising Taxes on the Rich

Manuel Trajtenberg and Bibi Image by Getty Images

The growing ideological connection between the Republican Party in the United States and the Netanyahu government in Israel doesn’t extend to tax policy, it seems. With little fanfare, the Knesset last week approved an increase in corporate taxes and personal taxes on the very rich, going where the GOP here threatens never to tread.

The legislation was prompted by recommendations in the Trajtenberg Committee report, a government-appointed group charged with responding to the social justice protests that roiled Israel through the summer and fall. While the percentage changes may not sound like much — corporate taxes will go up to 25% from 24%, while the highest tax bracket for the very rich will rise to 48% from 45% — it’s the trend line that’s significant. When Benjamin Netanyahu was campaigning for prime minister, he promised to lower taxes by 2017.

Now he’s raising them.

Discussing the move with a small group of journalists on Monday, Manuel Trajtenberg was gratified. The esteemed Israeli economist had marched in the social protests himself before he was asked to oversee the government’s response. He applauded Netanyahu’s willingness to consider the committee’s recommendations, though he reserved his biggest compliments for the protesters themselves.

“A whole generation of young people in Israel discovered they have a voice,” he said. “How this will play out, nobody knows.” But he is certain that the movement — broad-based, rooted in the middle class, concerned about social well-being — will transform Israeli society. “We’re in the presence of something big.”

I wonder if the politicians in this country who are so resistant to these sort of moves will take notice.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Is Pope Leo Jewish? Ask his distant cousins — like me

- 4

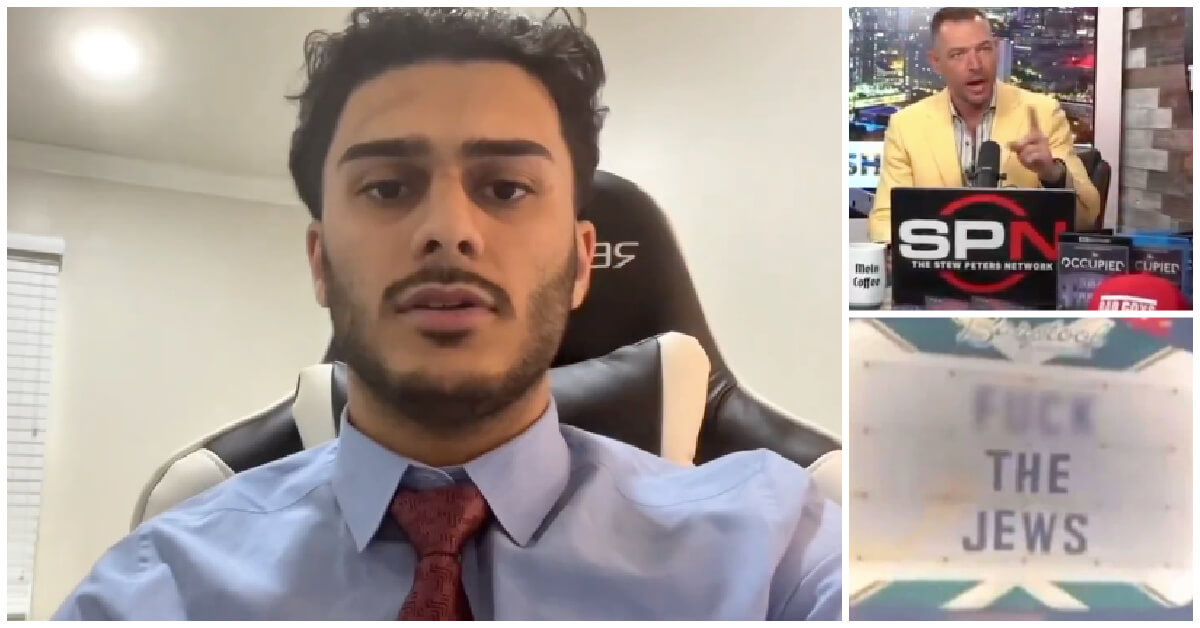

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

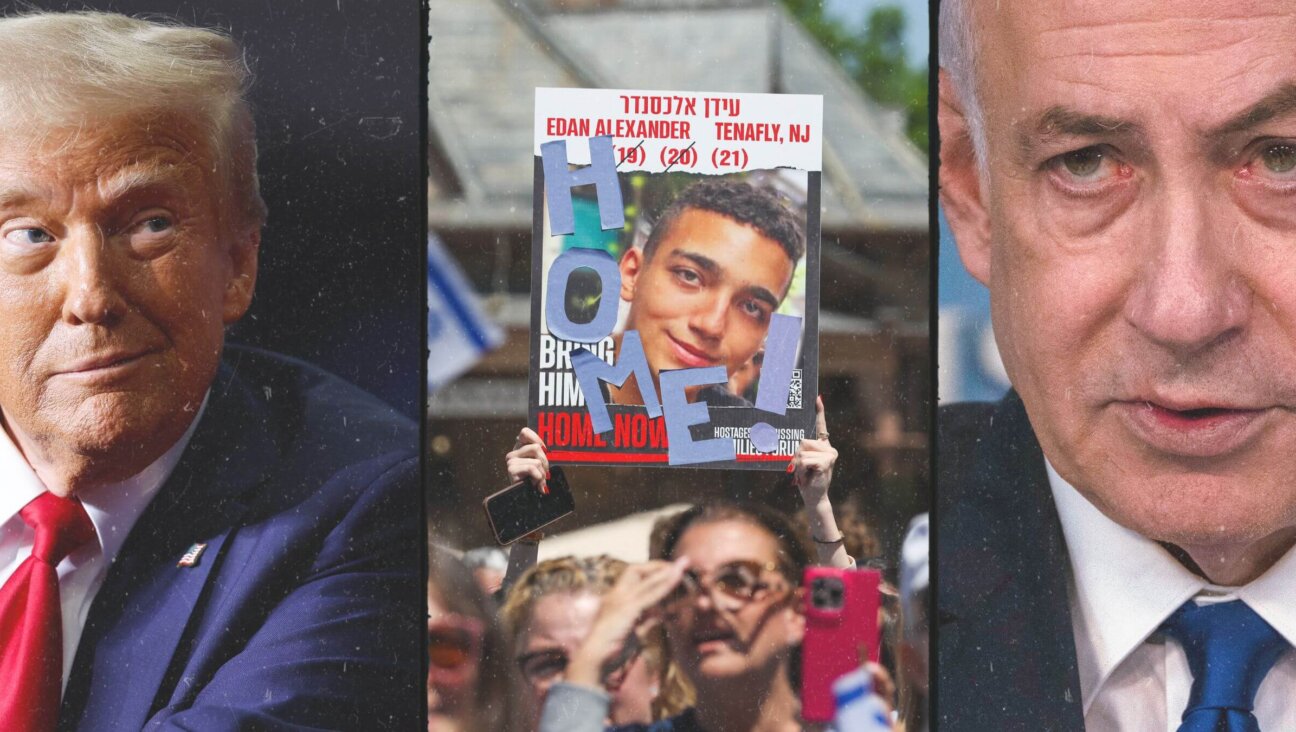

News In Edan Alexander’s hometown in New Jersey, months of fear and anguish give way to joy and relief

-

Fast Forward What’s next for suspended student who posted ‘F— the Jews’ video? An alt-right media tour

-

Opinion Despite Netanyahu, Edan Alexander is finally free

-

Opinion A judge just released another pro-Palestinian activist. Here’s why that’s good for the Jews

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.