Everyone can be a war profiteer in Gaza or Iran, thanks to online betting markets

Polymarket and Kalshi let people bet on exactly when and where bombs might fall

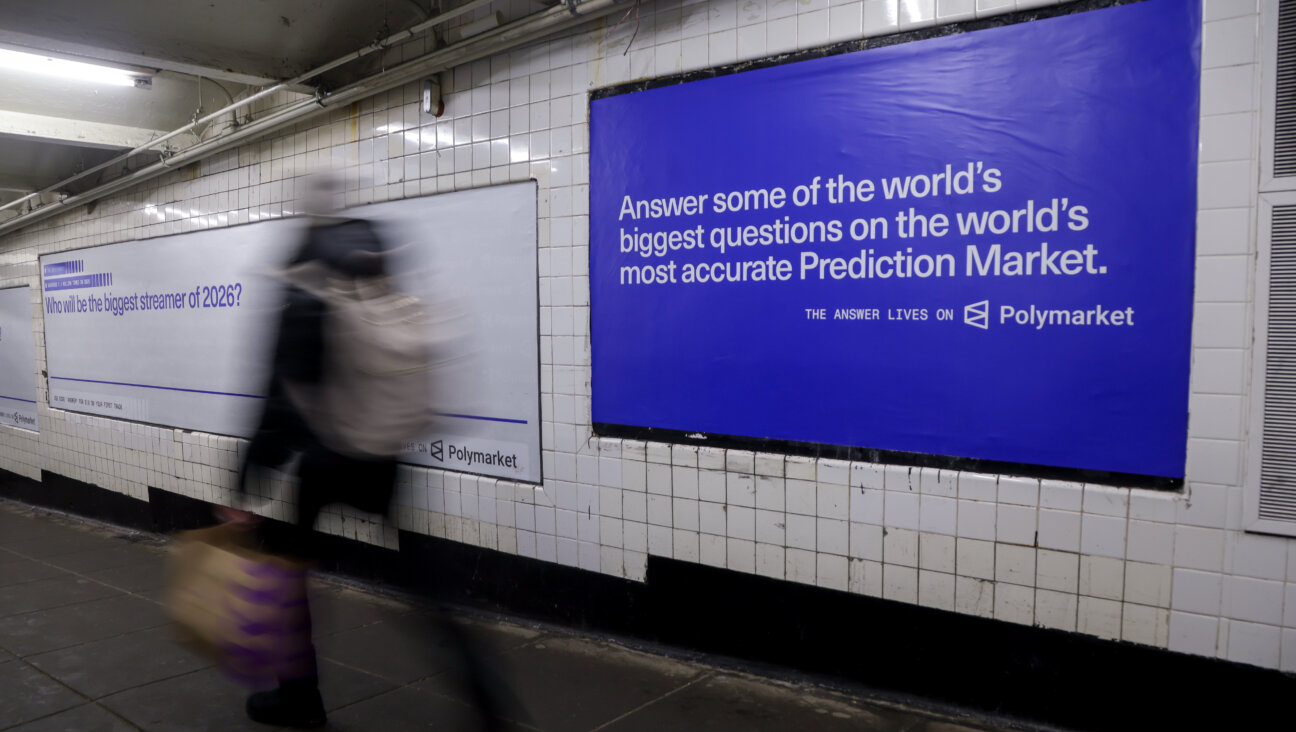

A Polymarket advertisement in a subway station. Courtesy of Getty Images

At any moment, an alert might pop up about a catastrophic world event. Maybe Israel has bombed Iran, or Iran has bombed Israel. Maybe the U.S. has bombed Iran’s nuclear programs, or its capital of Tehran. That’s the world we live in.

And, as long as things are so bad, you might as well profit on the start of World War III.

You may have noticed a sky-high number of ads for gambling sites. DraftKings, an online sports betting site, advertises during pretty much every game for every kind of sport. But the real game is on unregulated betting sites like Polymarket and Kalshi, where users can, from the comfort of their couches on their phones, bet on pretty much anything — what phrases Trump will use in his next social media post, or when the next snow will hit New York City.

Many of the bets are frivolous, but there’s a darker world. Betting on Middle Eastern geopolitics has become hot on the platform; the likelihood of the U.S. striking Iran is currently the top trending market on Polymarket, with $313 million wagered. Bets on Israel’s geopolitical moves are also hot.

Polymarket says its intent, “in gut-wrenching times like today,” is “to harness the wisdom of the crowd to create accurate, unbiased forecasts for the most important events to society.” (Kalshi has fewer Middle Eastern betting markets — though not none.)

But it all seems rather ghoulish. Sure, war always leads to some profiteering, but the prediction markets have made profiting on death pretty literal. Over $3 million has been placed on dates Israel might strike Gaza in the month of February, with Polymarket users hotly debating what, exactly, counts as a strike and celebrating drone hits with the hope of a payout. One commenter posted that they’d heard a Palestinian man was killed on Feb. 16; “Let’s hope,” another excitedly replied.

People who wagered on Israel striking Gaza have already won on nine different days in February. Rates depend on the bet’s odds when placed; shares are priced between 1 cent and $1 based on the going odds, with a payout of $1 a share for a win. Based on February’s odds, most people doubled or tripled their money.

There’s a lot of fine print, however. Artillery fire does not qualify as a “strike,” according to the rules of the market. Neither does a ground or naval invasion. The rules are extensive and include the types of sources that can count as confirmation — government confirmation or “a consensus of credible reporting” is required. Reporting exclusively from Palestinian outlets seems not to count, making the resolution to each wager a fraught issue.

And the markets are easy to manipulate or game with insider information. Two Israelis — a civilian and a reservist — were charged by the IDF for betting on a geopolitical market based on classified information. And Israel is investigating this as a wider problem after one user on Polymarket cashed out on numerous correct bets related to Israel’s June 2025 strike on Iran.

Shayne Coplan, the founder of Polymarket, has called the site a “truth machine,” framing it as a source of knowledge on world events. And, in some ways, the markets do have access to a certain type of truth: public opinion. One market on Kalshi, worryingly, is betting on whether Nick Fuentes will become president in the next 20 years. His chances are currently sitting at 16%.

Yet the wisdom of public opinion is fallible. People can only make their best guesses based on public information, which can lead to big losses; users lost hundreds of thousands of dollars on the Romanian presidential election. Some traders, who make a living on Polymarket and Kalshi, rely on short delays in confirmation, managing to sneak in on a bet after news has happened but before it is officially confirmed. The best way to win, however, is insider information — without regulation, there’s nothing to prevent, say, Trump’s speechwriter from wagering on what topics the president will cover in his State of the Union.

Still, there are some zealots who will always bet on their favorite, though, no matter how bad the odds. The devout have put Jesus at a 4% chance of returning before the end of the year.

Everyone else is happy to bet against it. Sure, it’s a safe bet, but the “no” bettors still made a tidy 5.5% return last year.