Warren Buffett Pitches $200M Investment In Israel Bonds

Image by Getty Images

Billionaire investor Warren Buffett will travel to New York this week to help Israel sell government bonds.

Development Corporation for Israel, which underwrites the bonds in the United States and is commonly known as Israel Bonds, said Buffett will meet privately on Thursday with U.S., Canadian, Mexican and Brazilian investors who have each signaled plans to buy between $1 million and $5 million of the bonds.

It said a similar event held in November in Omaha, Nebraska, where Buffett runs Berkshire Hathaway Inc, raised more than $60 million, and the New York event could raise an additional $140 million.

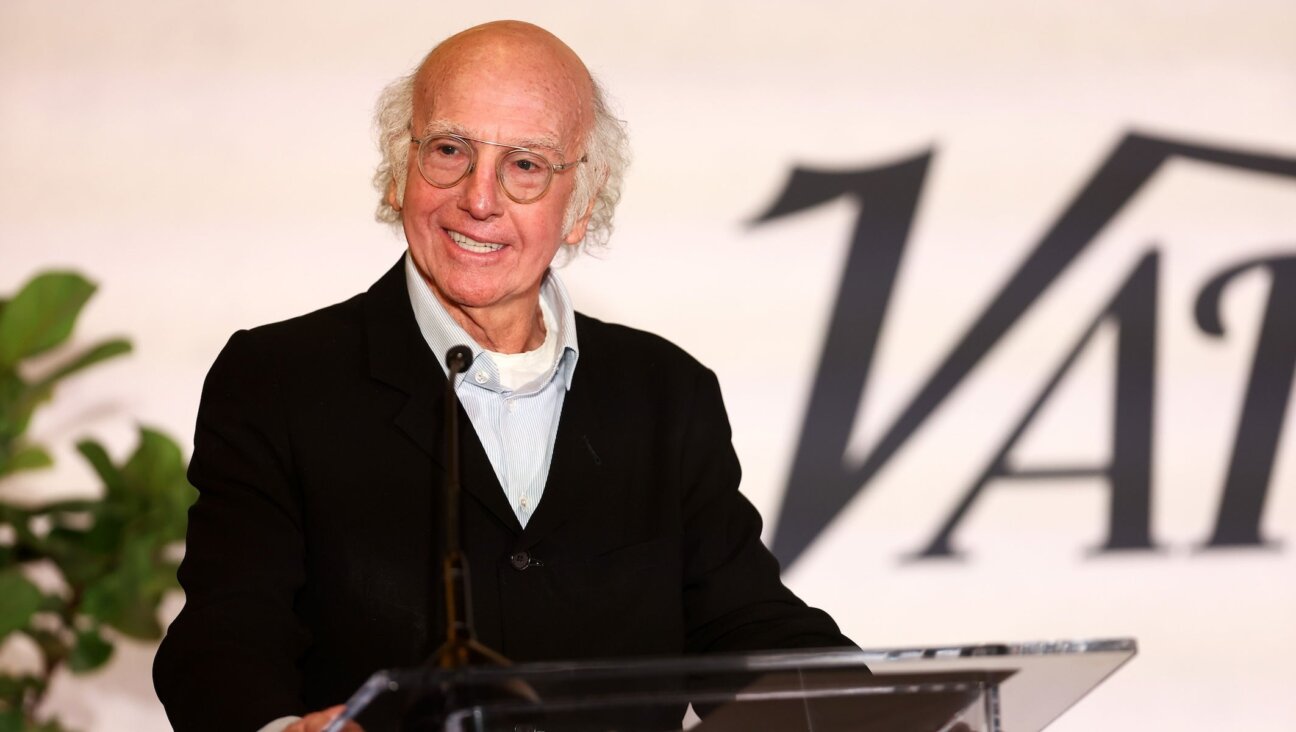

The event will include a luncheon with Larry Silverstein, who helped found Silverstein Properties and is the developer of the One World Trade Center site in Manhattan.

Buffett owns $5 million of Israeli bonds in his personal portfolio, Israel Bonds said.

“The purchase of Israel bonds is a sound investment and a deserved endorsement of a remarkable country,” Buffett said in a statement provided by Israel Bonds.