Bill To Aid Survivors Could Undermine Settlements

In a move that could put Congress on a collision course with the federal bench and the White House, a Florida lawmaker is fighting to allow Holocaust survivors with unpaid insurance claims to have their day in court.

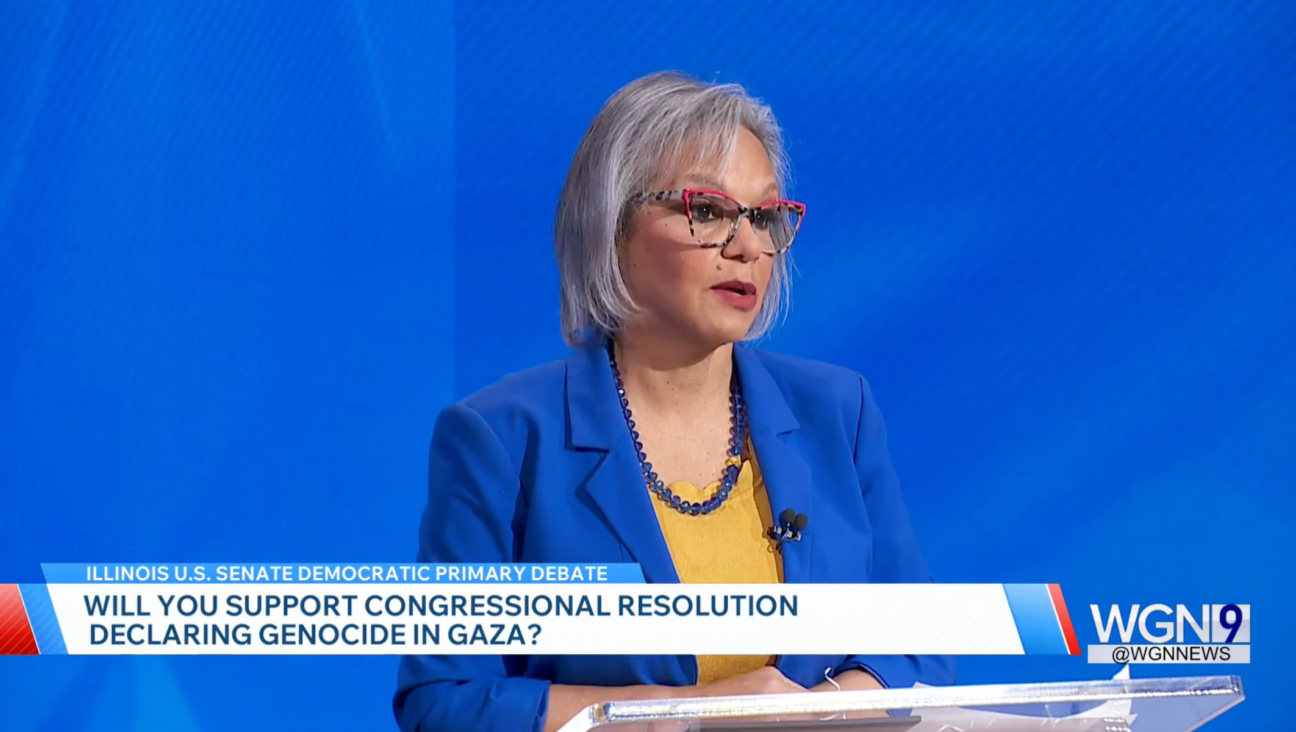

Rep. Ileana Ros-Lehtinen, a Republican from Miami with close ties to the Jewish community, is sponsoring a bill that would force insurers to publish lists of all policyholders from the Nazi era. The measure, the Holocaust Insurance Accountability Act of 2007, also would allow survivors and their heirs to sue European insurers in American courts.

For many American Holocaust survivors, the bill holds out the promise of a modicum of justice, many decades in the making. But some former government officials and Jewish communal leaders who were intimately involved in a previous settlement with European insurers worry that the measure would upend a decade-old international agreement — approved by the insurance companies, survivors’ groups and American insurance regulators — that resulted in the disbursement of more than $306 million to some 48,000 survivors.

“You just can’t go back now and unscramble this omelet,” said Stuart Eizenstat, an official in the Carter and Clinton administrations who helped negotiate agreements that netted $8 billion in Holocaust restitution funds as President Clinton’s special representative on Holocaust-era issues. “We reached agreements in Germany and Austria and France which precluded any further lawsuits in return for a substantial amount of money.”

Ros-Lehtinen’s bill, which is co-sponsored by a colleague from South Florida, Democratic Rep. Robert Wexler, comes during a transitional time for Holocaust restitution efforts. On the one hand, one of the most important Holocaust archives in the world, a vast repository of Nazi documents stored in Bad Arolsen, Germany, could soon open after years of foot-dragging by European governments. The archives, with some 30 million to 50 million pages that record the fates of more than 17 million victims of the Nazis, potentially hold valuable information to bolster survivors’ claims, in insurance and other areas.

But even if new information becomes available, most of the restitution efforts established in the late 1990s — including programs that compensated survivors for confiscated bank accounts, forced labor and abandoned real estate — have already wound down. The international panel established in 1998 to oversee European insurance payouts, which is named the International Commission on Holocaust Era Insurance Claims, or Icheic, officially concluded its work last month.

For the Holocaust survivors who believe the Icheic settlement yielded far too little, the Ros-Lehtinen bill is itself a victory.

“I can tell you that in a survivor’s opinion, this is high time, it was long overdue,” said Leo Rechter, 79, who chairs the National Association of Jewish Children Holocaust Survivors from his home in Jamaica, Queens. Rechter lost his father, as well aunts, uncles and cousins during World War II, which he survived, along with his mother and two younger siblings, by fleeing their home in Vienna and hiding out in Belgium.

Critics of Icheic, Rechter among them, have long argued that the panel suffered from mismanagement and too often sided with the insurance companies. Most Eastern European Jews held accounts with three giant insurers, which spent years after the war demanding documentary proof that most survivors could not provide. The insurers also claimed that policies signed in Eastern Europe — where most of Hitler’s victims lived — had been expropriated after the war by the communist regimes and were not longer the companies’ responsibility. The detractors believe Icheic did not put enough pressure on the insurers to find solutions.

Earlier this year, American Holocaust survivors unsuccessfully petitioned a federal judge in New York to reject a settlement with Italian insurance giant Generali because Icheic had failed to publish the names of all Jews whom the company insured before World War II.

The result of incomplete records, according to Sidney Zabludoff, an economist who served as an adviser to Icheic, is that the commission wound up disbursing perhaps only 3% of the total value of policies held by Jews during the Holocaust. Zabludoff estimates that the total unpaid value of about 870,000 policies is $17 billion.

The Ros-Lehtinen bill aims to give ammunition to survivors who want to go to court by forcing European insurance companies operating in the United States to hand over the names of all policy holders. The companies published 400,000 to 500,000 names as part of the Icheic process — an amount the congresswoman’s office accounts for only about 20% of policyholders from Eastern and Central Europe.

While in many circles the logic of helping Holocaust survivors recover lost property may seem unassailable, some government officials and Jewish leaders intimately involved in past Holocaust restitution efforts say the Ros-Lehtinen bill could undermine the basis upon which all past agreements were reached: voluntary monetary payouts in return for future immunity from further lawsuits.

“I’m in favor of every Holocaust victim having every right to go forward with what they feel is the truth, but I do not want to go back to the same insurance companies who made an award and say, ‘You should now make a different award because there’s new legislation,’” said veteran negotiator Bobby Brown, who served as the Israeli government representative on Icheic.

Although Icheic officially closed its doors last month, participating insurance companies have agreed to entertain any new claims that emerge according to the guidelines set by the commission, Brown said.

Further complicating Ros-Lehtinen’s effort is the fact that any new lawsuits against German or Austrian insurance companies would contradict prior agreements made between the U.S. government and the Austrian and German governments. The Icheic money distributed on behalf of Austrian and German insurance companies came from government funds established as part of broad settlement agreements made in the late 1990s, which netted $8 billion in total and were supposed to preclude future lawsuits against individual German and Austrian companies.

Given such realities, the reaction to Ros-Lehtinen’s bill has not been universally positive in Congress. Senator Bill Nelson, a Florida Democrat, backs the bill’s disclosure requirement, but not the provision giving Holocaust survivors the ability to sue. While serving as the insurance commissioner of Florida during the late 1990s, Nelson was one of several state regulators who initially pressed European insurers over Holocaust-era claims, a process that ultimately brought the companies to the bargaining table with Icheic.

Senator Joseph Biden, the Delaware Democrat who chairs the Senate Foreign Relations Committee, has not yet decided whether he would introduce a companion bill in the Senate.

Biden, a 2008 presidential contender, is the sponsor of a resolution, unanimously approved in the Senate last week, that urges the European countries that help oversee the Bad Arolsen archives to ratify opening them to the public.

In order to allow for open access to the archives, the members of a consortium of nations that oversees them must ratify an agreement to that effect. The United States, Israel, Poland, the Netherlands and the United Kingdom have ratified, but Belgium, France, Germany, Greece, Italy and Luxembourg have yet to do so. The commission will meet next month in Amsterdam.