Bush Picks Nix Bailout For Famed Fleece Mill

Even as the White House promises to make the creation of manufacturing jobs a top priority, an independent government bank run by presidential appointees is refusing to guarantee a $35 million loan that could save a famed company with 1,200 employees in New England.

Legendary Malden Mills owner Aaron Feuerstein’s chances of regaining control of his company from creditors slipped after the federal agency, the Export-Import Bank of the United States, decided against guaranteeing a $35 million loan. The bank did offer a $20 million loan guarantee, but Feuerstein said it was insufficient to save the company, which manufactures Polartec synthetic fleece.

Feuerstein, the septuagenarian, third-generation owner of Malden Mills, rose to national prominence when the company’s main plant in Lawrence, Mass., burned down in December 1995. Citing his Orthodox Jewish values, he continued to pay employees until the factory was rebuilt.

Riding a wave of positive publicity highlighted by Feuerstein’s appearance during then-President Clinton’s 1996 State of the Union Address, Malden Mills thrived before economic difficulties forced it into bankruptcy in November 2001. Since then Feuerstein has sworn to regain control of the company in order to prevent its creditors from closing down its American operations.

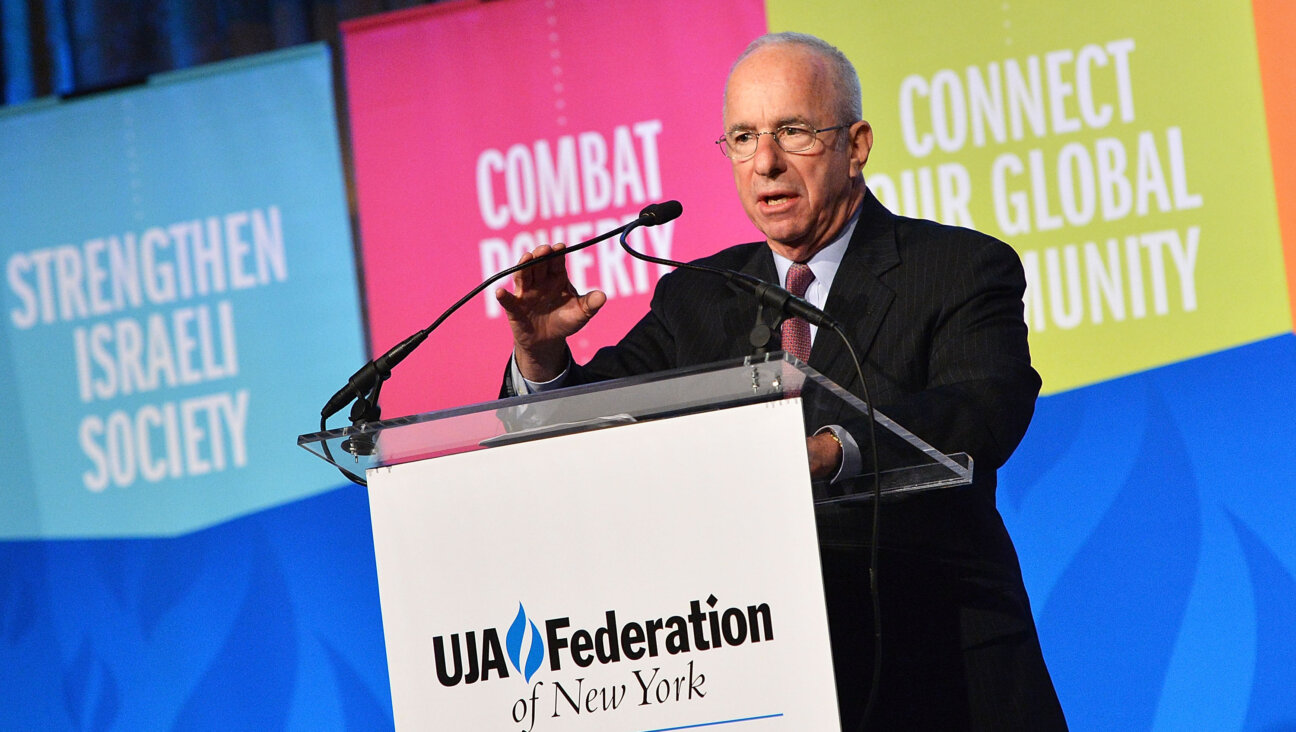

Bipartisan political pressure on the bank has mounted in the wake of the decision against the $35 million loan guarantee. “Everyone’s looking at manufacturing jobs and this is a clear-cut case,” said Massachusetts Rep. Barney Frank, the ranking Democrat on the House Committee on Financial Services, which oversees the agency. “The bank actually can do something about it, and I think they need to. If it doesn’t, it could easily turn into a campaign issue.”

Frank and the Financial Services Committee’s Republican chairman, Ohio Rep. Michael Oxley, signed on to a letter excoriating the lender. The letter, co-signed by members of a subcommittee on international trade that also oversees the bank, insisted that the bank’s budget had been re-authorized for the purpose of helping smaller companies stay competitive against foreign manufacturing concerns and “preserving and promoting U.S. jobs.”

The letter stated: “It concerns us that the Bank would refuse financing for a medium-size exporter, the direct consequence of which would be a loss of manufacturing jobs in the United States.”

“People have been criticizing that bank for only helping big companies, while manufacturing jobs are slipping away here,” Frank said. “Frankly, it was just stupid of them to walk away from a local company that’s trying to save those kinds of jobs.”

The bipartisan support that the company received from the House committee echoes the efforts from the company’s home state, where Democratic Senators John Kerry and Edward Kennedy have been joined by Republican Governor Mitt Romney in lobbying the bank for a larger loan guarantee.

The bank is an independent federal government agency that helps finance the sale of American exports by providing loans, guarantees and export credit insurance. Its three voting board members were all appointed by President Bush. Only one of them, Democrat Joseph Grandmaison, supported the $35 million loan guarantee for Malden Mills, while the other two voted for the smaller financing package.

As Malden Mills prepared this week to emerge from two years of Chapter 11 bankruptcy protection, Feuerstein said that $35 million is the minimum amount required to finalize a $92 million financing package that would allow him to buy back the company from his creditors.

The Bank has agreed to re-hear Feuerstein’s case, but it is not clear if it will do so before the expiration on September 26 of a 30-day extension of an option to buy back control; if the extension expires, the price goes up from $92 million to more than $120 million, which could be out of Feuerstein’s reach. G.E. Commercial Finance, the majority lender, is on board with the extension, but not all of the unsecured creditors have agreed to the extension of the lower-cost buyback option, making the situation even more uncertain.

According to company spokesman David Costello, Malden Mills’s political support is due in part to its recent work for the military — work that was awarded to the company largely due to Feuerstein’s political capital.

“We’re delighted to receive such bipartisan support,” Costello said. “It shows the concern members of Congress have for manufacturing in general in the U.S., and Malden Mills is an example of a company that has continually exerted care for employees and community. But we’re also a critical supplier for the Department of Defense. Members of Congress want to ensure the U.S. maintains the ability to re-supply the armed forces domestically, and we’re the only company left in the U.S. who can make the kinds of technically advanced fabric products the U.S. has been buying for its soldiers.”

If Feuerstein fails to regain control of the company, he will still have access to a seat on the company’s board of directors, but he would own less than 5% of the company and have a largely ceremonial position.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 2

News School Israel trip turns ‘terrifying’ for LA students attacked by Israeli teens

- 3

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 4

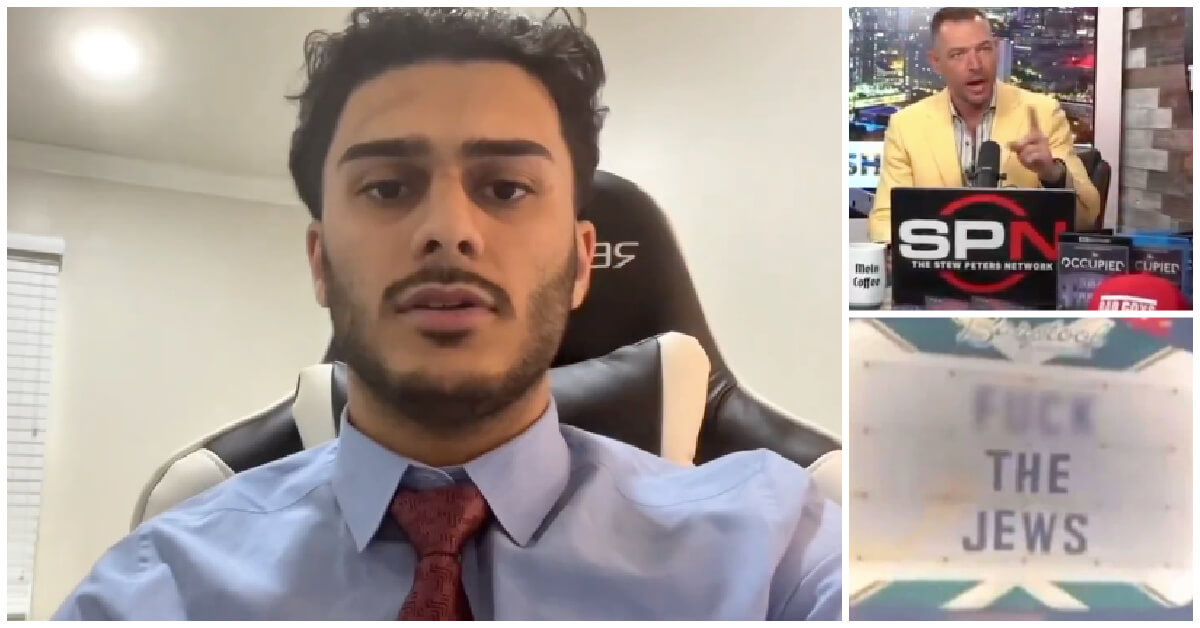

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Yiddish קאָנצערט לכּבֿוד דעם ייִדישן שרײַבער און רעדאַקטאָר באָריס סאַנדלערConcert honoring Yiddish writer and editor Boris Sandler

דער בעל־שׂימחה האָט יאָרן לאַנג געדינט ווי דער רעדאַקטאָר פֿונעם ייִדישן פֿאָרווערטס.

-

Fast Forward Trump’s new pick for surgeon general blames the Nazis for pesticides on our food

-

Fast Forward Jewish feud over Trump escalates with open letter in The New York Times

-

Fast Forward First American pope, Leo XIV, studied under a leader in Jewish-Catholic relations

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.