Fortunes Rise on Israeli Stock Exchange

Propelled by a quick American victory in Iraq and a dramatic government budget-cutting proposal, the Tel Aviv Stock Exchange is outperforming Wall Street this year.

Since the beginning of the year, the benchmark index of the Israeli stock exchange’s 25 largest companies, the TA 25, has jumped 13% — a better showing than the Dow Jones Industrial Average, the Nasdaq Composite and the S&P 500, all of which have posted only modest gains.

Observers say the Israeli rally is being fueled by several developments, including Finance Minister Benjamin Netanyahu’s campaign to cut $2.3 billion from the government’s $56 billion budget.

“A degree of certainty has been restored in Israel,” said Yaron Neudorfer, deputy chief fiscal officer of the Israeli Finance Ministry, in an interview.

“No missiles were fired at Israel during the [Iraq] war, and this gave our markets a positive boost,” said Neudorfer, who works out of the Manhattan offices of Israel’s economic mission. “Uncertainty never helps capital markets.”

Uncertainty about the war had a much greater impact on the Israeli economy than on the American economy, said Daniel Laufer, a professor at the University of Cincinnati’s College of Business Administration.

“Tourists and investors are not deterred from visiting the U.S.A. or investing in U.S. companies because of the Iraq situation,” said Laufer, who counts the Israeli business sector among his many interests. Israeli stocks, he added, had more to gain from an end to hostilities than did American shares.

Neudorfer also credited the recent decision by Congress to approve $9 billion in loan guarantees, which will enable Israel to borrow money on the international money markets at a reduced rate. The message to investors, Neudorfer said, is that “the U.S. is confident in the Israeli economy and its ability to pay its debts.”

The stock exchange’s recent success is particularly welcome given the dismal performance of the Israeli market in recent years. In 2002 the TA 25 plummeted 32.2%, following a 17% drop in 2001. Moreover, the index’s recent flirtation with the 400-point benchmark was the closest it has come to reaching that level since February 2002.

The Tel Aviv exchange lists 637 companies with a market capitalization of about $53 billion — by way of comparison, the New York Stock Exchange has a market capitalization of some $9 trillion.

As of early this week, the exchange’s benchmark index, the TA 25, had a combined value of $34 billion.

In addition to international developments, investor enthusiasm over Netanyahu’s budget plan also appears to be a major factor in the stock market’s recent rise.

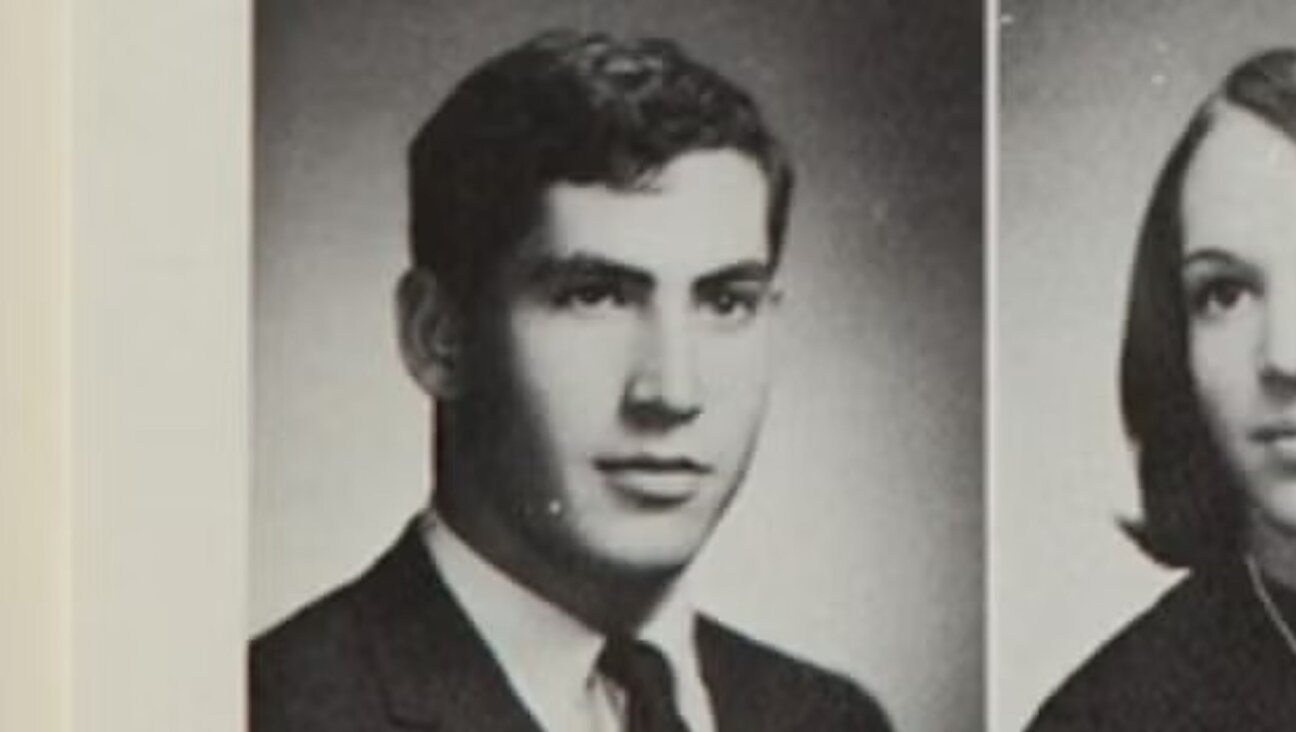

“There is no question that people are happy that Netanyahu is heading the Finance Ministry,” said Cliff Goldstein, president of Amidex Funds, a mutual fund featuring companies whose primary operations are in Israel. “Although people may not agree with him politically, they are generally confident in his abilities.”

While the financial community is backing Netanyahu’s plan, the proposed budget has met stiff resistance from Israel’s labor federation, the Histadrut, which fears that the cuts would cost thousands of public-sector workers their jobs, at a time when the unemployment rate is already 12%.

Last week the Histadrut called a general strike, paralyzing the country for two days. The strike was partially suspended May 2, as Treasury and Histadrut officials renewed negotiations.

“The strike was no surprise,” said Goldstein, speaking from his suburban Philadelphia offices. “Conventional wisdom is that after the strike, everyone will see the need for some austerity in Israel. The strike will be short and its impact will be negligible.”

So far, the Tel Aviv Stock Exchange has borne out Goldstein’s prediction, as the TA 25 gained 4% in its first full day of trading after the general strike.

Goldstein added that the Tel Aviv exchange has also been boosted by newfound optimism over the chances for diplomatic progress with the Palestinians, particularly due to the election of Mahmoud Abbas as the Palestinian Authority’s prime minister and the Bush administration’s unveiling of the internationally backed “road map” to peace.

In recent months, Prime Minister Sharon and Israeli business leaders have said that the long-term recovery of the nation’s economy depends on diplomatic progress and a political deal with the Palestinians.

“There’s a new glimmer of hope in the Middle East with [Abbas] as the prime minister,” Goldstein said. “He has thus far made the right types of comments and provided some hope.”

Few in the financial community have benefited more from the renewed optimism and the stock market’s surge than Goldstein, whose Amidex 35 fund currently boasts the top three year-to-date returns of any international fund, according to the Chicago-based investment research firm Morningstar.

The only Israel-focused fund in the United States, Amidex holds shares in banks that operate primarily in Israel, as well internationally oriented juggernauts like Teva Pharmaceuticals, the largest producer of antibiotics in the world.

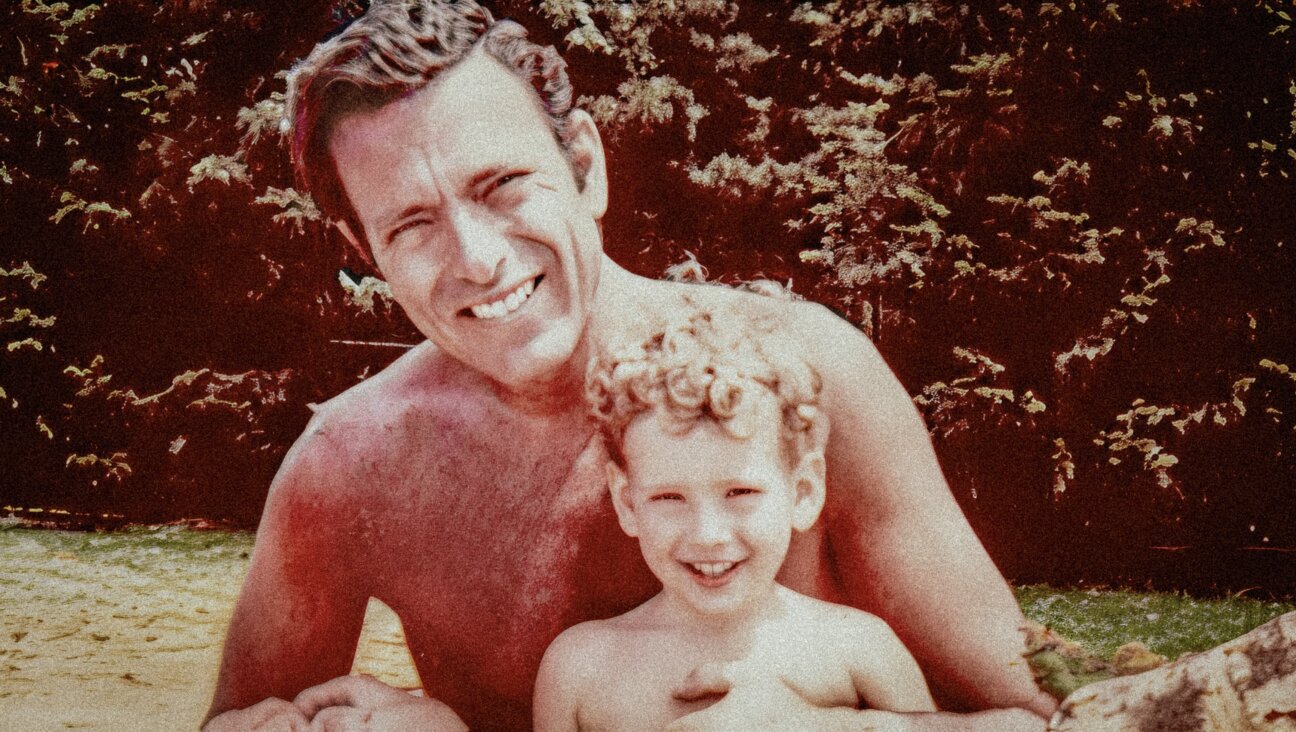

Goldstein, who acquired his first Israeli stock — a $7 share in the Tel Aviv-based development company Ampal-American Israel Corp. — at the age of 6, praised what he described as Israel’s unique ability to conduct business during war.

“It’s stunning how well Israeli stocks have done, especially with all the problems,” Goldstein said. “If you look back at the last year, you have the election, the formation of the government, and turmoil with the Palestinians. Yet, despite all that, the Tel Aviv Stock Exchange has flourished where others would have failed.”