Supreme Court Refuses to Hear Appeal From Madoff Victims

Image by Getty Images

Victims of the Ponzi schemes of Bernard Madoff and Allen Stanford, two of the largest in U.S. history, suffered setbacks on Monday as the U.S. Supreme Court refused to hear appeals in two cases seeking to recoup more money for them.

In the Madoff case, the court rejected a request by Irving Picard, the trustee liquidating Bernard L. Madoff Investment Securities LLC, to review the dismissal of his claims against banks he accused of enabling Madoff’s fraud.

Separately, the court rejected a request by Ralph Janvey, a receiver unwinding Stanford’s businesses, to review a ruling that blocked him from pursuing claims against Stanford employees on behalf of the receivership’s creditors, not the businesses themselves.

In both cases, lower courts concluded that Picard and Janvey lacked standing to bring their respective claims.

The Supreme Court did not give reasons for its decisions, which leave intact a June 2013 ruling in the Madoff case by the federal appeals court in New York, and an August 2013 ruling in the Stanford case by the federal appeals court in New Orleans.

Amanda Remus, a spokeswoman for Picard, said the trustee respected the decision in the Madoff case, and will still pursue $3.5 billion of bankruptcy claims against international banks such as Switzerland’s UBS AG and Britain’s HSBC Holdings Plc.

Kevin Sadler, a lawyer for Janvey, said the receiver is disappointed with the decision in the Stanford case, and will continue to press claims on behalf of more than 18,000 victims against those who profited from or aided Stanford’s fraud.

A Ponzi scheme is where early investors are usually paid with money from later investors.

Picard has recovered about $9.82 billion for former Madoff customers, who he has estimated lost $17.5 billion of principal in a decades-long fraud uncovered in December 2008.

The trustee has also sued banks including JPMorgan Chase & Co, which was Madoff’s main bank, and Italy’s UniCredit SpA over their dealings with the swindler.

JPMorgan was dropped from the case after reaching a $325 million settlement with Picard in January, part of a $2.6 billion global resolution of federal and private claims.

Stanford’s estimated $7.2 billion fraud was based on the sale of bogus certificates of deposit issued by Antigua-based Stanford International Bank to customers who thought the CDs were safe. The Ponzi scheme was uncovered in February 2009.

Janvey won court approval for an initial $55 million distribution to CD investors in April 2013.

Madoff, 76, is serving a 150-year prison term after pleading guilty in March 2009. Stanford, 64, is serving a 110-year term following his jury conviction in March 2012.

The cases are Picard v. JPMorgan Chase & Co et al, U.S. Supreme Court, No. 13-448; and Janvey v. Alguire et al, U.S. Supreme Court, No. 13-913.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 4

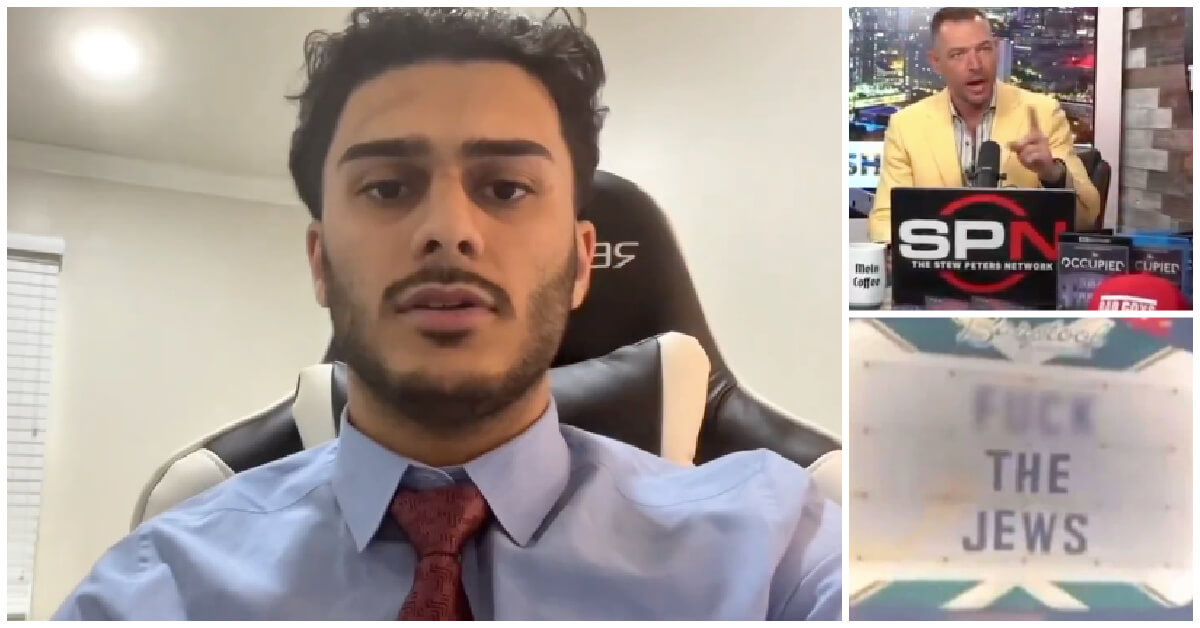

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Fast Forward In first Sunday address, Pope Leo XIV calls for ceasefire in Gaza, release of hostages

-

Fast Forward Huckabee denies rift between Netanyahu and Trump as US actions in Middle East appear to leave out Israel

-

Fast Forward Federal security grants to synagogues are resuming after two-month Trump freeze

-

Fast Forward NY state budget weakens yeshiva oversight in blow to secular education advocates

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.