Israel Budget Can Absorb Gaza War Costs

Image by getty image

Israel’s 2014 budget will be able to absorb the costs incurred during the month-long Gaza conflict and there will be no need to increases taxes, Finance Minister Yair Lapid said on Thursday.

It will take a week or two for the government to determine the total impact of the conflict on the economy, Lapid said, both in terms of military spending and damage to business.

Some government officials have estimated the damage to the Israeli economy at more than 10 billion shekels ($2.89 billion), with one newspaper putting it above 12 billion shekels.

The Bank of Israel has said growth in 2014 – forecast at 2.9 percent – could be harmed by as much as half a percentage point, while the tourism industry could lose some $500 million in the third quarter. Tourism Minister Uzi Landau said he expected a quick recovery.

A 72-hour truce took effect on Tuesday after heavy fighting that began on July 8, and Lapid said Israel was making all diplomatic efforts to ensure that things remained quiet.

“Israel has a very strong, sustainable economy. We are more than capable to digest this operation into the 2014 budget,” Lapid, speaking in English, told Reuters.

“Of course it’s an expense we didn’t expect, but then again, why have a strong economy if not for these occasions in which you have to react to the unexpected.”

Lapid earlier told a news conference: “Taxes will not be raised.”

He noted that the budget deficit target for 2014 was 3 percent, and that prior to the month-long military operation, the deficit was running at less than 2.6 percent.

“This means we have room below the target for unexpected expenses,” he said.

Lapid said the government was acting swiftly to compensate local businesses that were hurt during the military campaign and acknowledged that fresh discussions would be held ahead of the 2015 budget to address any changes in spending priorities, including new defense requirements.

Credit ratings agency Fitch said the fiscal and economic cost of Israel’s incursion into Gaza may cause the government to narrowly miss its budget deficit target this year, but that better than expected performance in the first half of the year would help offset the impact.

“Beyond the one-off costs of this operation, the renewed conflict with Hamas may add to pressure to increase defense spending, limiting fiscal flexibility,” Fitch said in a report published on Thursday.

It cited Finance Ministry estimates that spending could rise 0.3-0.6 percent of GDP, and could be spread across budgets for this year and next. The impact on revenues, though, is harder to predict and depends on any wider economic fallout, Fitch added.

Fitch rates Israel as “A” with a positive outlook.

The central bank has said that to meet a budget deficit target of 2.5 percent of GDP in 2015, the state needs to cut spending and bring in tax income of 20 billion shekels.

It will take a week or two for the government to determine the total impact of the conflict on the economy, Lapid said, both in terms of military spending and damage to business.

Some government officials have estimated the damage to the Israeli economy at more than 10 billion shekels ($2.89 billion), with one newspaper putting it above 12 billion shekels.

The Bank of Israel has said growth in 2014 – forecast at 2.9 percent – could be harmed by as much as half a percentage point, while the tourism industry could lose some $500 million in the third quarter. Tourism Minister Uzi Landau said he expected a quick recovery.

A 72-hour truce took effect on Tuesday after heavy fighting that began on July 8, and Lapid said Israel was making all diplomatic efforts to ensure that things remained quiet.

“Israel has a very strong, sustainable economy. We are more than capable to digest this operation into the 2014 budget,” Lapid, speaking in English, told Reuters.

“Of course it’s an expense we didn’t expect, but then again, why have a strong economy if not for these occasions in which you have to react to the unexpected.”

Lapid earlier told a news conference: “Taxes will not be raised.”

He noted that the budget deficit target for 2014 was 3 percent, and that prior to the month-long military operation, the deficit was running at less than 2.6 percent.

“This means we have room below the target for unexpected expenses,” he said.

Lapid said the government was acting swiftly to compensate local businesses that were hurt during the military campaign and acknowledged that fresh discussions would be held ahead of the 2015 budget to address any changes in spending priorities, including new defense requirements.

Credit ratings agency Fitch said the fiscal and economic cost of Israel’s incursion into Gaza may cause the government to narrowly miss its budget deficit target this year, but that better than expected performance in the first half of the year would help offset the impact.

“Beyond the one-off costs of this operation, the renewed conflict with Hamas may add to pressure to increase defense spending, limiting fiscal flexibility,” Fitch said in a report published on Thursday.

It cited Finance Ministry estimates that spending could rise 0.3-0.6 percent of GDP, and could be spread across budgets for this year and next. The impact on revenues, though, is harder to predict and depends on any wider economic fallout, Fitch added.

Fitch rates Israel as “A” with a positive outlook.

The central bank has said that to meet a budget deficit target of 2.5 percent of GDP in 2015, the state needs to cut spending and bring in tax income of 20 billion shekels.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 4

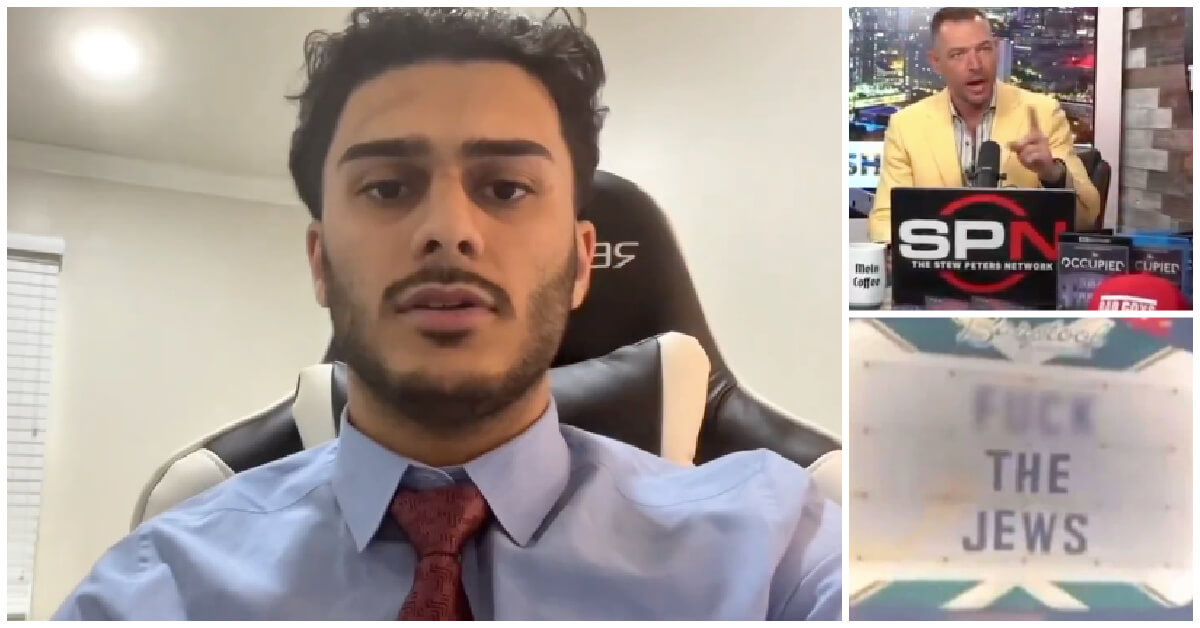

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Culture Should Diaspora Jews be buried in Israel? A rabbi responds

-

Fast Forward In first Sunday address, Pope Leo XIV calls for ceasefire in Gaza, release of hostages

-

Fast Forward Huckabee denies rift between Netanyahu and Trump as US actions in Middle East appear to leave out Israel

-

Fast Forward Federal security grants to synagogues are resuming after two-month Trump freeze

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.