Israeli Tech Game Unit Sells to China for Massive $4.4 Billion

A Chinese consortium has agreed to acquire the Israeli Playtika, Caesars Interactive Entertainment’s online games unit, for $4.4 billion in cash.

Playtika makes its games such as Bingo Blitz and Slotomania available on Apple App Store. Playtika will continue to operate independently with its own management team and its headquarters remaining in Herzliya, Israel, following the deal, the companies said.

Playtika players use virtual currency that cannot be exchanged for real money, although players can spend money by buying items in the games. Caesars’ World Series of Poker and real-money online gaming businesses are not part of the deal, according to the companies.

The consortium which includes game developer Shanghai Giant Network Technology and e-commerce company Alibaba Group founder Jack Ma will buy Caesars Interactive Entertainment from Caesars Acquisition (CAC) and Caesars Entertainment Corp. The sale will be a boon to the two affiliated companies, which are looking for cash as they embark on a complex merger.

The deal follows a period of exclusive negotiations between Caesars Interactive Entertainment and Giant’s consortium that were first reported on July 21 by Reuters. Caesars Entertainment’s main operating unit, Caesars Entertainment Operating Co. (CEOC), is currently involved in an $18 billion bankruptcy and is seeking creditor approval for a restructuring plan. The transaction between CAC and the Caesars Entertainment parent is part of a complex web of deals that have come under scrutiny by CEOC’s creditors.

Chinese companies are eager to expand beyond their home country, which boasts the world’s largest online gaming market. In June, Tencent, China’s biggest gaming group, agreed to buy a majority stake in Clash of Clans mobile game maker Supercell from SoftBank in an $8.6 billion deal.

Giant is one of China’s biggest gaming companies, with nearly 50 million monthly active users and several top-grossing mobile titles. It was taken private in 2014 for $3 billion by a group of buyers that included company chairman Yuzhu Shi and private equity firm Baring Private Equity Asia. It is now valued at more than $12 billion.

The Chinese consortium involved in the deal also includes Ma’s private equity firm Yunfeng Capital, China Oceanwide, China Minsheng Trust, CDH China HF Holdings, and Hony Capital Fund, the companies said.

The merger between the owners of Caesars Interactive Entertainment is intertwined with the bankruptcy of CEOC, whose restructuring plan hinges on billions of dollars of cash and equity from its parent.

CEOC’s creditors have accused the parent company of looting choice assets from its operating unit and leaving it bankrupt. Caesars has said the acquisitions were done at fair value. While proceeds from a Caesars Interactive online games unit sale will help the bankruptcy estate, junior creditors may still object to the distribution of the funds because more money will end up in the hands of first lien banks and lenders. — Reuters

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

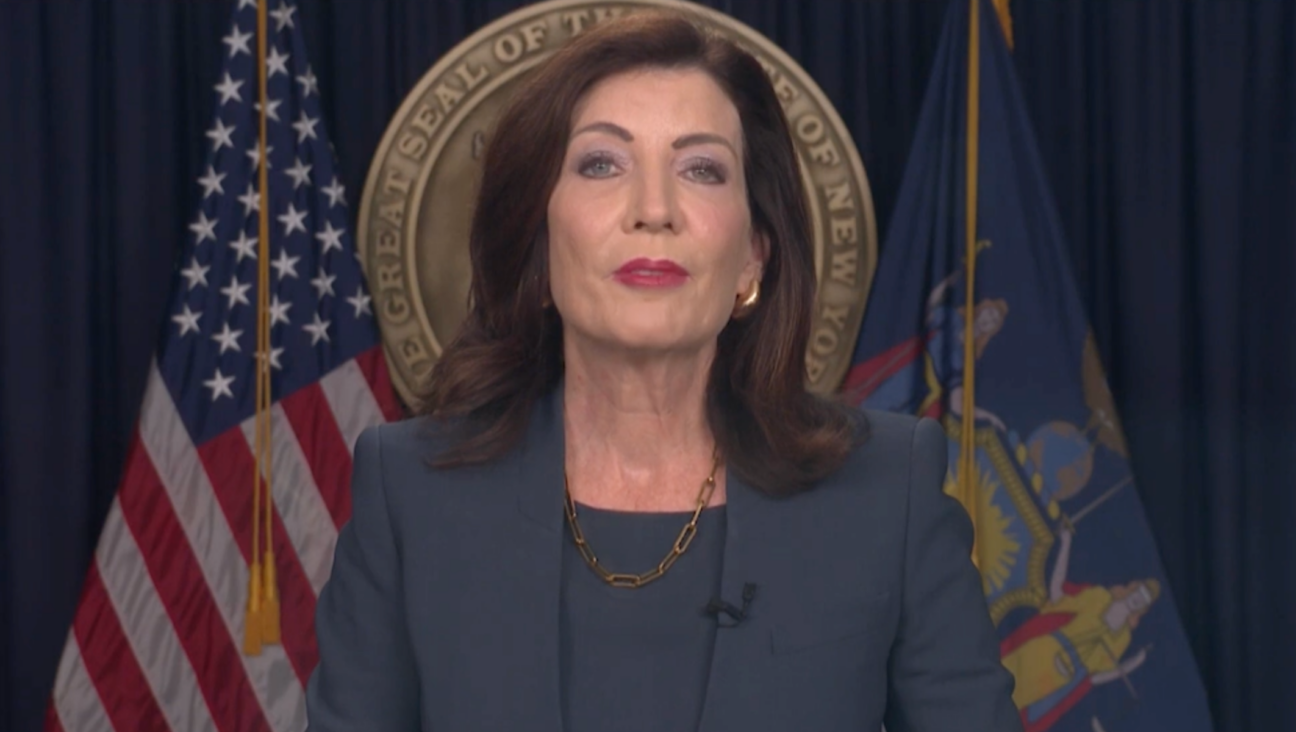

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 4

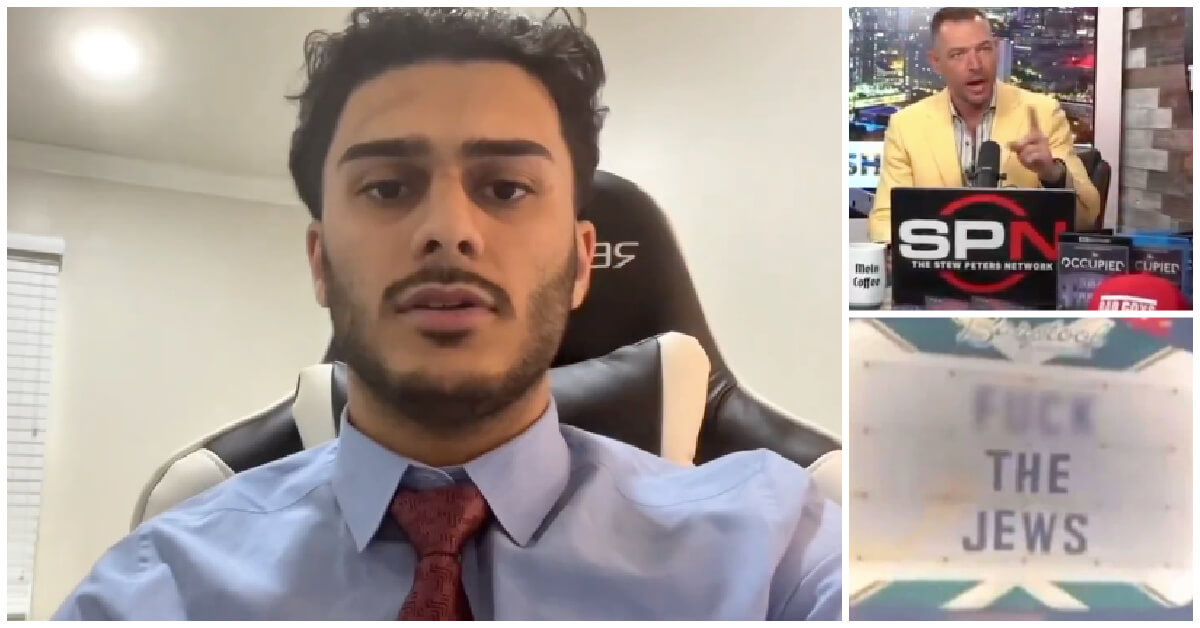

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Culture Should Diaspora Jews be buried in Israel? A rabbi responds

-

Fast Forward In first Sunday address, Pope Leo XIV calls for ceasefire in Gaza, release of hostages

-

Fast Forward Huckabee denies rift between Netanyahu and Trump as US actions in Middle East appear to leave out Israel

-

Fast Forward Federal security grants to synagogues are resuming after two-month Trump freeze

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.