Founder of Hedge Fund Tied to Sprawling New York Corruption Scheme Charged in $1B Fraud

Image by YouTube

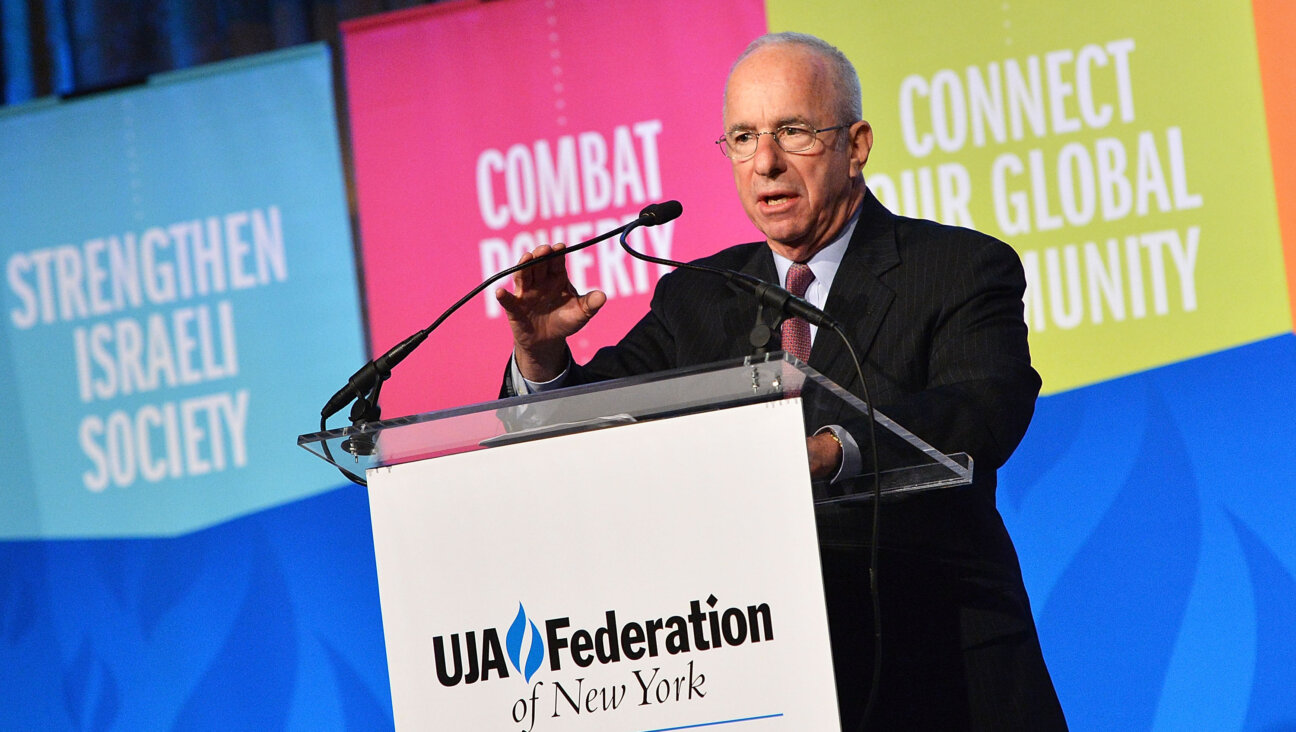

The founder of New York-based hedge fund Platinum Partners was arrested on Monday as prosecutors unveiled an indictment charging him and six others with participating in an approximately $1 billion fraud.

Mark Nordlicht, Platinum’s founding partner and chief investment officer, was taken into custody at his New Rochelle, New York, home in connection with charges contained in an indictment filed in federal court in Brooklyn.

Others arrested included David Levy, Platinum’s co-chief investment officer, and Uri Landesman, the former president of the firm’s signature fund, said Federal Bureau of Investigation spokeswoman Adrienne Senatore.

Platinum is liquidating its hedge funds, two of which have received bankruptcy protection.

The indictment said that since 2012, Nordlicht, Levy and Landesman schemed to defraud Platinum investors by overvaluing illiquid assets held by its flagship fund.

This caused a “severe liquidity crisis” that Platinum at first tried to remedy through high-interest loans between its funds before selectively paying some investors ahead of others, the indictment said.

Nordlicht, Levy and Jeffrey Shulse, former chief executive officer of Platinum’s majority-owned Black Elk Energy Offshore Operations LLC, also defrauded the Texas energy company’s bondholders, the indictment said.

A Platinum spokesman declined to comment. Nordlicht’s lawyer did not immediately respond to a request for comment. Michael Sommer, Levy’s lawyer, said he looked forward to clearing his client’s “good name.”

Lawyers for Shulse and the other defendants could not be immediately identified.

Founded in 2003, Platinum Partners until this year had more than $1.7 billion under management, the indictment said. The flagship fund reported returning profits of more than 8 percent in 2015 and 7 percent from January to April 2016, it said.

But this year, a series of investigations tied to Platinum came to a head, leading to a Cayman Islands court placing its two main funds into liquidation in August.

In June, Murray Huberfeld, a Platinum associate who prosecutors say was a founder, was charged in Manhattan federal court with orchestrating a bribe to the head of the New York City prison guards’ union, Norman Seabrook, to secure a $20 million investment. Both have pleaded not guilty.

Two weeks later, the FBI raided Platinum’s Manhattan offices in a separate fraud investigation that culminated in Monday’s indictment.

Others indicted include Joseph Sanfilippo, the former chief financial officer of flagship fund Platinum Partners Value Arbitrage Fund LP; Joseph Mann, a former Platinum marketing employee; and Daniel Small, a Platinum managing director.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 2

News School Israel trip turns ‘terrifying’ for LA students attacked by Israeli teens

- 3

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 4

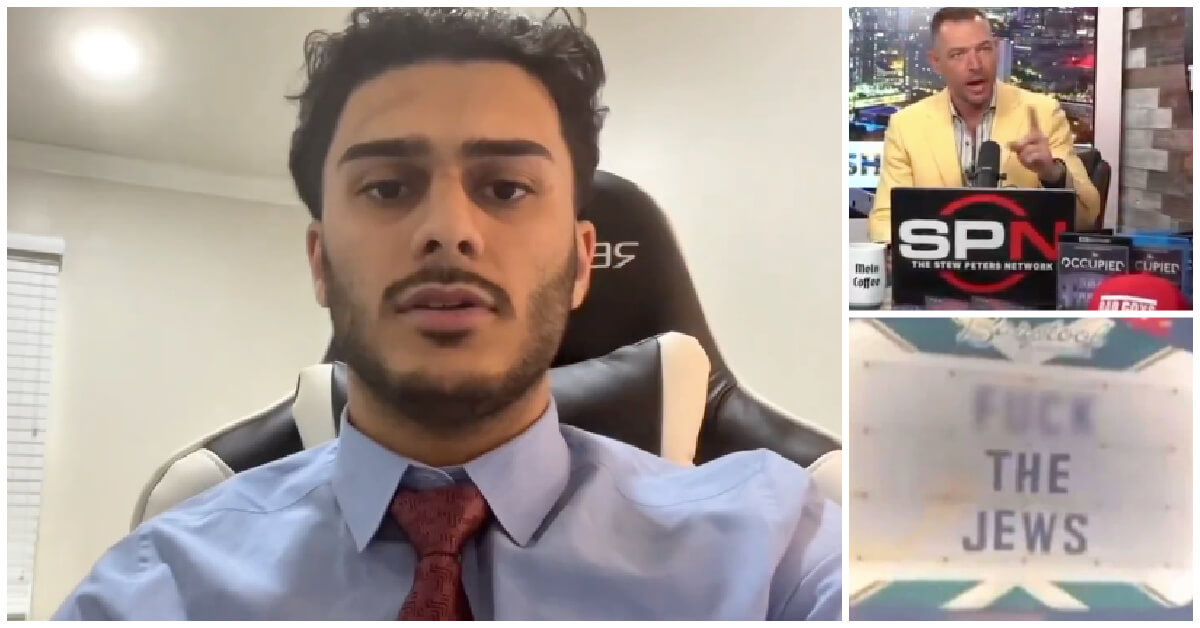

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Yiddish קאָנצערט לכּבֿוד דעם ייִדישן שרײַבער און רעדאַקטאָר באָריס סאַנדלערConcert honoring Yiddish writer and editor Boris Sandler

דער בעל־שׂימחה האָט יאָרן לאַנג געדינט ווי דער רעדאַקטאָר פֿונעם ייִדישן פֿאָרווערטס.

-

Fast Forward Trump’s new pick for surgeon general blames the Nazis for pesticides on our food

-

Fast Forward Jewish feud over Trump escalates with open letter in The New York Times

-

Fast Forward First American pope, Leo XIV, studied under a leader in Jewish-Catholic relations

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.