Flush With Cash, Israeli Tech Firms Hope To Stay Independent Longer

Get Out Nation: Israeli tech entrepreneurs are shunning Tel Aviv amid what they call suffocating regulation in the Jewish state. Image by haaretz

Whenever potential buyers have approached Tel Aviv-based Fiverr, the technology firm has said no; like a growing number of Israeli start-ups, it has enough backing from private investors to stay independent for longer.

Traditionally, many of Israel’s numerous tech companies have sold out at an early stage to global giants like Cisco, IBM and Microsoft. Only a few – such as cyber security leader Check Point Software – have reached a significant size.

But now start-ups are using a sharp rise in private investment to pursue growth, often aiming for eventual stock market flotations. With founders looking longer term rather than trying to make quick money, acquisitions of Israeli technology firms fell in 2016 to their lowest level in six years.

Fiverr, backed by large venture capital funds including California-based Accel and Bessemer, is among those hoping to follow the Check Point model.

Its online marketplace allows freelancers to offer services ranging from logo design to cartoons, and translations to psychic readings. Asking prices range from $5 to $10,000.

A consumer-oriented company focused on the U.S. market, Fiverr raised $60 million in November 2015, bringing its total funding to date to $110 million.

“Fiverr should be a multi-billion dollar business. This is why we aren’t looking to be acquired,” Chief Executive Micha Kaufman told Reuters. “Eventually a company like ours will go public.”

Fiverr declined to disclose the company’s current valuation or name the would-be buyers that have approached it in the past couple of years.

Israel’s high tech industry is well established, using skills of workers trained in the military and intelligence sectors. Tax breaks and government funding have encouraged start-ups, and also drawn in entrepreneurs from abroad.

But acquisitions of Israeli high-tech companies more than halved last year to $3.5 billion, according to PricewaterhouseCoopers.

Stock market listings in the sector are also dwindling as investors increasingly prefer bigger tech companies. After eight initial public offerings valued at $3.4 billion in 2015, only two IPOs totalling $44 million took place in 2016 – one in London and the other in Tel Aviv.

Instead, private investment is rising. In the first nine months of 2016 Israeli start-ups raised $4 billion, up 27 percent from a year earlier, according to the Israel Venture Capital Research Centre (IVC), which has forecast a record year in 2016.

Investment in more established late stage companies surged 47 percent to $1.6 billion in the first nine months, IVC said.

The Aleph VC fund said four of its 12 companies have declined offers from would-be buyers in the hundreds of millions of dollars.

“I’m seeing for first time that many founders are saying no to M&A. It’s a good thing,” Aleph partner Eden Shochat said. “These bigger companies create pockets of knowledge … which is required to build an industry.”

Aleph was structured to allow 12 years for investors to cash in, instead of the seven years typical for the venture capital sector, he said.

Accel, which has just opened an Israeli office, said it can invest $50 million in a growth stage company and has raised a fifth fund of $500 million to invest in Israel and Europe.

“The fact that money is available has clearly impacted the level of exits,” Accel partner Philippe Botteri said.

Adam Fisher, a partner who manages Bessemer’s Israel office, expects this trend of holding out to continue as long as growth funding, especially from new sources such as China, is abundant.

LESS EFFICIENT

Fisher believes the availability of growth capital also has disadvantages. The risk is that generously-funded companies may be less efficient than those running on a shoestring.

Moreover, rejecting an offer to hold out for more money limits the number of potential buyers, while an IPO may also not be possible if stock market investors consider a firm has yet to grow big enough for a flotation.

Gone are the days of the tech boom in the late 1990s when relatively small firms listed on the U.S. Nasdaq market.

“Startups often need growth financing to reach the current IPO threshold of $100 million revenue run rate, but by no means does that imply that growth financing will create an IPO candidate,” Fisher said.

Despite the country’s reputation as a centre for innovation, many global buyers prefer the more established markets of the United States and Europe. Rubi Suliman, high-tech leader for PwC Israel, said there are still not enough buyers who are familiar and comfortable enough with Israeli high-tech to drive a wave of deals.

“When potential buyers are relatively scarce, deal prices are expected to go down,” he said.

Taking the IPO route could also prove difficult for Israeli firms in certain business areas. Some of the largest private companies in revenue terms are in the online advertising sector, which public markets have turned against.

The valuation of Israeli adtech firm Matomy, for example, has nearly halved since it went public in London in 2014.

With Facebook and Google owning much of the distribution and profit from selling ads directly to the advertiser, the pie for adtech firms is much smaller, said Nir Blumberger, Accel’s Israel-based partner and a former corporate development executive at Facebook.

Amounts made by investors exiting adtech firms through sales or IPOs fell to $238 million in 2016 from about $600 million in 2015, according to IVC and the Meitar law firm.

In cyber security technology, the need for firms’ services is growing but a proliferation of start-ups means competition is stiff. Cyber start-ups raised more funds last year than in 2015, but exits nearly halved to $660 million, IVC data shows.

“I still foresee this will be a big area for M&A and IPOs in the future but it will take a while to be built into a revenue stream,” said Shochat.

A third group is automotive tech, boosted by the success of Mobileye which makes driver warning systems aimed at preventing accidents. Investment in start-ups nearly doubled in 2016 to $680 million though exits brought in only $190 million.

Investors caution that companies in this sector require a lot of money over a very long period.—Reuters

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 4

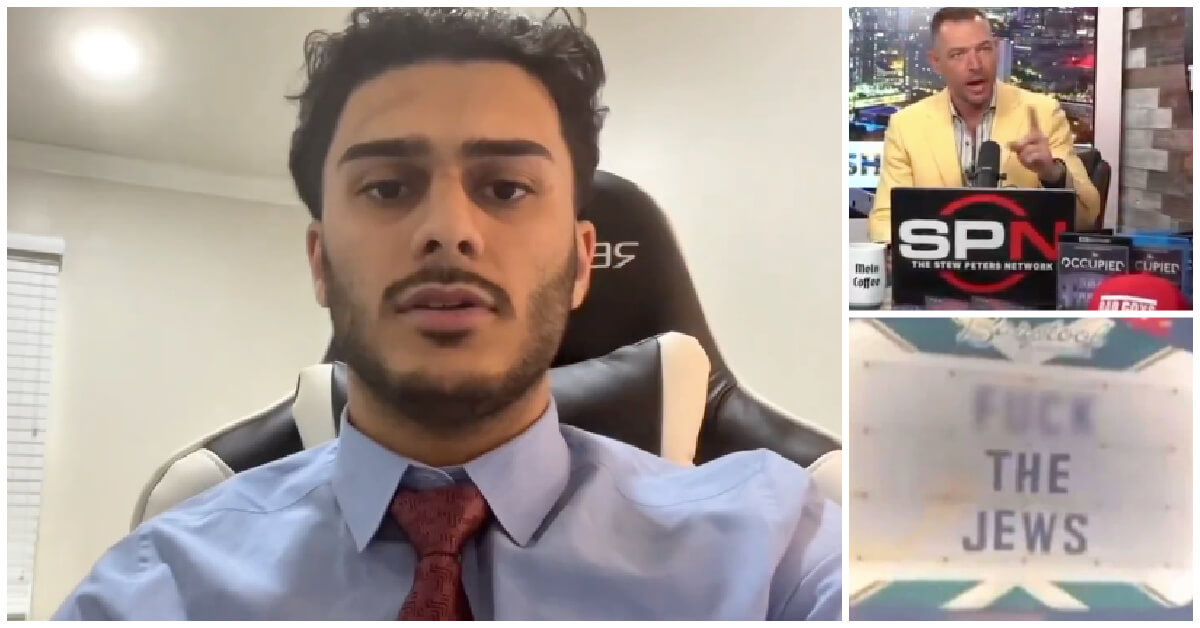

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Culture Should Diaspora Jews be buried in Israel? A rabbi responds

-

Fast Forward In first Sunday address, Pope Leo XIV calls for ceasefire in Gaza, release of hostages

-

Fast Forward Huckabee denies rift between Netanyahu and Trump as US actions in Middle East appear to leave out Israel

-

Fast Forward Federal security grants to synagogues are resuming after two-month Trump freeze

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.