Agencies Must Gird Themselves For a Recession

As Americans increasingly wonder whether the nation will fall into a full-blown recession, many of us are considering the deleterious effect such a development would have on Jewish organizational life. While the complex and caring American Jewish community has survived numerous economic cycles, this time around there are some significant differences.

First, non-profit organizations — which had traditionally been most conservative in their investment strategies — have increasingly in recent years looked toward alternative investments, believing that these can hedge against the volatility of the markets. This occurs as service pressures mount and fixed instruments are viewed as providing lower long-term return than do equities.

Second, as has been reported in these pages, the nature of philanthropy is rapidly changing. Unrestricted umbrella annual giving does not keep pace with inflation, while philanthropic “parking,” with the creation of donor advised funds and other vehicles for continued donor involvement, grow at unprecedented rates.

Leaving it for others to predict the impact on investments in the coming period, there are certain realities that must be faced — and, as with most key moments, those that face these realities early emerge stronger from the experience.

I suspect that there are many foundation officers who are checking on the redemption rules of their investments because, despite the alternative strategy that looked good in a growing market, they want to be at the tiller during a shrinking market. It is my hope that they are avoiding the knee-jerk reaction of running to cash and to cash equivalents.

Many foundations and endowments are designed into perpetuity, and there are opportunities in the long term when one thinks about philanthropic investments for the long term. The volatility today is very different than when their investment committees would count on the fixed, albeit lower, return of Treasuries and Triple A Bonds. Certainly, as in past downturns, the psychology of the marketplace suggests that we will experience retrenchment in grantmaking.

More significant and opportunistic is the potential reaction of the leadership of Jewish organizations. The key element to cutback management is to be ahead of the curve. Often, boards and professional managers live in denial for as long as possible. The consequence of delay is deeper cuts in service and trauma to organizations.

These are the moments when boards of directors and CEOs have the unique responsibility of stewardship and the preservation of community assets through perilous times. There are some specific steps that all organizational boards should consider.

First, monitor budgets more closely. Create a financial dashboard. Compare accounts payable, both the amount and its aging, on a historical basis. Understand the revenue sources and filter projections against changed realities.

Second, use the organization’s mission as a measure against which to look at all programs. If necessary, shrink programs on the margin; strengthen programs in the center.

Third, use the economy as an educational opportunity for the board to better understand its responsibility to assure a balanced budget and operating results. The board needs to “give or get” the funds necessary to keep that budget in balance. Too many boards tend to forget this aspect of the sacred responsibility of organizational leadership.

Fourth, have in place the means to evaluate the organization’s programs so that if cuts are necessary they take place in those programs with less effectiveness. These are the times to eschew sacred cows and to try to make the least-worst decisions, while focusing carefully on the organizational strategy.

Fifth, if necessary go with the counter-intuitive cuts. Organizations often cut back on administration, development and maintenance rather than direct service. I remember a Jewish community center that, in response to the recession in the late 1980s, deferred repairing its pool ventilation system at a cost of $125,000. Several years later it had to do structural steel work because of the damage done by the humidity. This million-dollar repair had a far graver impact to the programs of the JCC than doing the original maintenance.

Sixth, ask questions. Too often agency directors believe that the officers and managers have it all under control in the culture of “going along to get along.” Intelligent dissent is a cherished gift at moments like these.

Seventh, there are opportunities as well for funders. They can clarify the mutual expectations between themselves and beneficiary organizations. For example, even in unrestricted grant making, are there deliverables that are expected? Thousands of non-profit organizations make up the mosaic we call the American Jewish community, and each relies on some mix of revenue sources to fulfill its mission and mandate. These recessionary pressures also offer a moment for self-reflection on mission, programs, strategies, effectiveness and efficiency.

And lastly, long-term financial planning can mitigate against these inevitable fluctuations. For those operating in more than one currency, there are tried and true ways to manage the currency risks. Attempting to spread costs more evenly over time reduces the negative impact of having to liquidate investments at moments like this.

Economic cycles have enormous impact on organizational health and, therefore, on the health of the overall community. We all bear the responsibility to accept the mantle of leadership so that our communal organizations can continue to deliver their services regardless of the economic and environmental stresses — and so that our community can maintain its tradition of incomparable compassion and caring.

Jeffrey Solomon is president of The Andrea and Charles Bronfman Philanthropies.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 2

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 3

News School Israel trip turns ‘terrifying’ for LA students attacked by Israeli teens

- 4

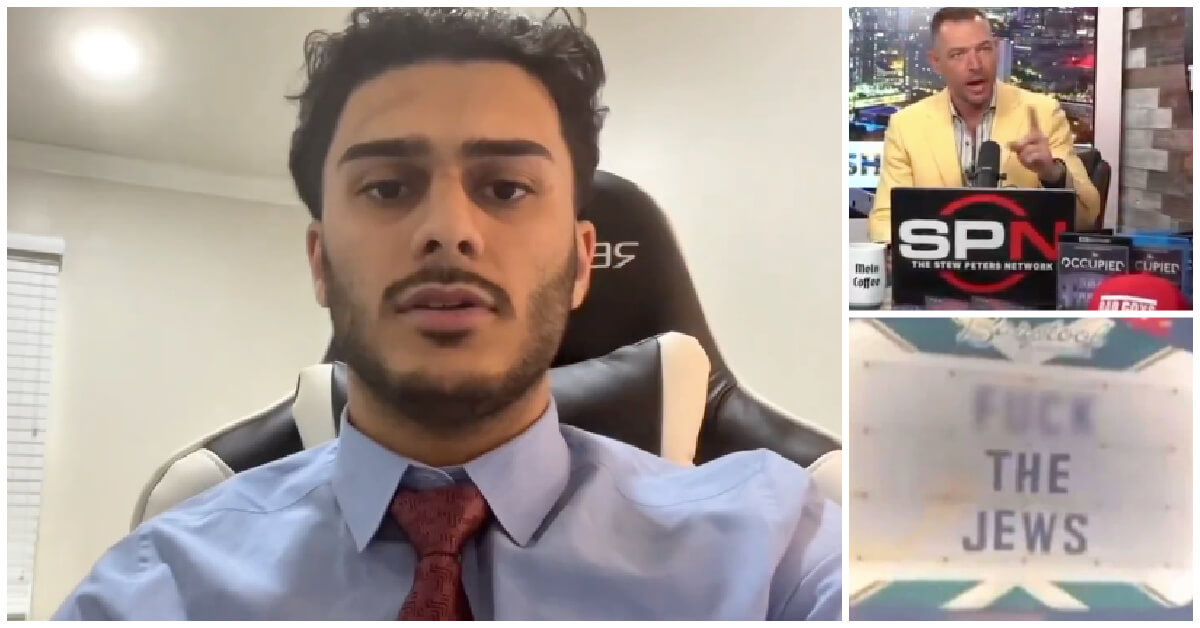

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Yiddish קאָנצערט לכּבֿוד דעם ייִדישן שרײַבער און רעדאַקטאָר באָריס סאַנדלערConcert honoring Yiddish writer and editor Boris Sandler

דער בעל־שׂימחה האָט יאָרן לאַנג געדינט ווי דער רעדאַקטאָר פֿונעם ייִדישן פֿאָרווערטס.

-

Fast Forward Trump’s new pick for surgeon general blames the Nazis for pesticides on our food

-

Fast Forward Jewish feud over Trump escalates with open letter in The New York Times

-

Fast Forward First American pope, Leo XIV, studied under a leader in Jewish-Catholic relations

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.