Meltdown

This moment is one of those turning points in history that the old will describe to their grandchildren and that historians will still be debating a century from now. We are witnessing, it appears, the unraveling of America’s economic system, and perhaps the world’s. What follows will not be what was.

Perhaps the economy will right itself, though that is decidedly a minority viewpoint. Alan Greenspan, the former Federal Reserve chief, calls this a “once-in-a-century event.” Steven Pearlstein, The Washington Post’s Pulitzer Prize-winning economic commentator, writes that it “may be the greatest destruction of financial wealth that the world has ever seen.”

The trouble began with a mortgage crisis. Banks had lent billions of dollars in recent years in so-called sub-prime mortgages, risky home financing for buyers who can’t really afford it. When thousands missed payments and defaulted, the banks were left holding worthless paper. Eventually, some banks held so many bad loans that they themselves became credit risks. Overseas banks, already nervous over the Bush administration’s towering deficits, began withholding the usual short-term loans. Without ready cash, banks were hard-pressed to issue new loans to businesses seeking to expand. Business slowed. Some banks began to fail. That only increased investors’ nervousness, making it even harder for borrowers to find loans.

As the crisis has ballooned into a full-scale meltdown, the presidential candidates have stepped forward with diagnoses and prescriptions that are striking in their cluelessness. John McCain has led the pack, first claiming the “fundamentals” of the economy were sound, then reversing himself hours later and decrying the crisis. He blamed it on “the reckless conduct, corruption and unbridled greed” of Wall Street types. He also attacked regulators in Washington who “haven’t done their jobs right.” He promised to appoint better regulators — and at the same time, paradoxically, he reiterated in a CNN interview his commitment to reducing regulation and scaling back government oversight.

Barack Obama has come closer to the truth. He was arguing last week that the problem wasn’t regulators sleeping on the job, but rather the undercutting of regulators’ ability to regulate. He blamed the “failed economic philosophy” of deregulation, for which he faulted Republicans. Ripping into McCain, he said the Arizona senator has spent 26 years in Washington promoting that philosophy.

That’s a theme that Democrats have been touting throughout the crisis, fingers pointed at the passion for deregulation and free markets that has dominated Washington since Ronald Reagan’s presidency.

They’re half right. It is precisely the philosophy of deregulation and unfettered free markets that got us where we are today. The deregulation craze that swept Washington during the 1980s and 1990s resulted in legalizing a range of business practices that had been prohibited since Franklin Roosevelt’s time. Airlines were permitted to undercut each others’ prices. Banks and stockbrokers were allowed to enter each other’s fields. Profits soared, consumer prices declined in some sectors — and social ills suppressed by regulation reemerged with a vengeance.

Legalizing the banned practices was the government’s choice. Officials can hardly come in good faith now and complain when citizens take them at their word and do things they are now allowed to do. That’s democratic capitalism. If you want to prevent a behavior, outlaw it.

Democrats, for their part, are wrong to blame the Republicans. The two parties were partners every step of the way toward deregulation.

Indeed, the first major step toward repealing New Deal regulation of financial services was enacted in 1980 by Democrats. Jimmy Carter’s Democratic administration, working with a Democratic-led Congress, freed up the highly regulated savings and loan industry to enter risky new areas of commercial banking and aggressive mortgage packaging. The Reagan administration loosened the rules a bit further in 1982 and again in 1984. It was a year later, in 1985, that federal officials began detecting alarming new S&L ventures that would lead eventually to the savings and loan crisis of 1989, a wave of nearly 1,000 S&L failures that cost taxpayers $125 billion to clean up.

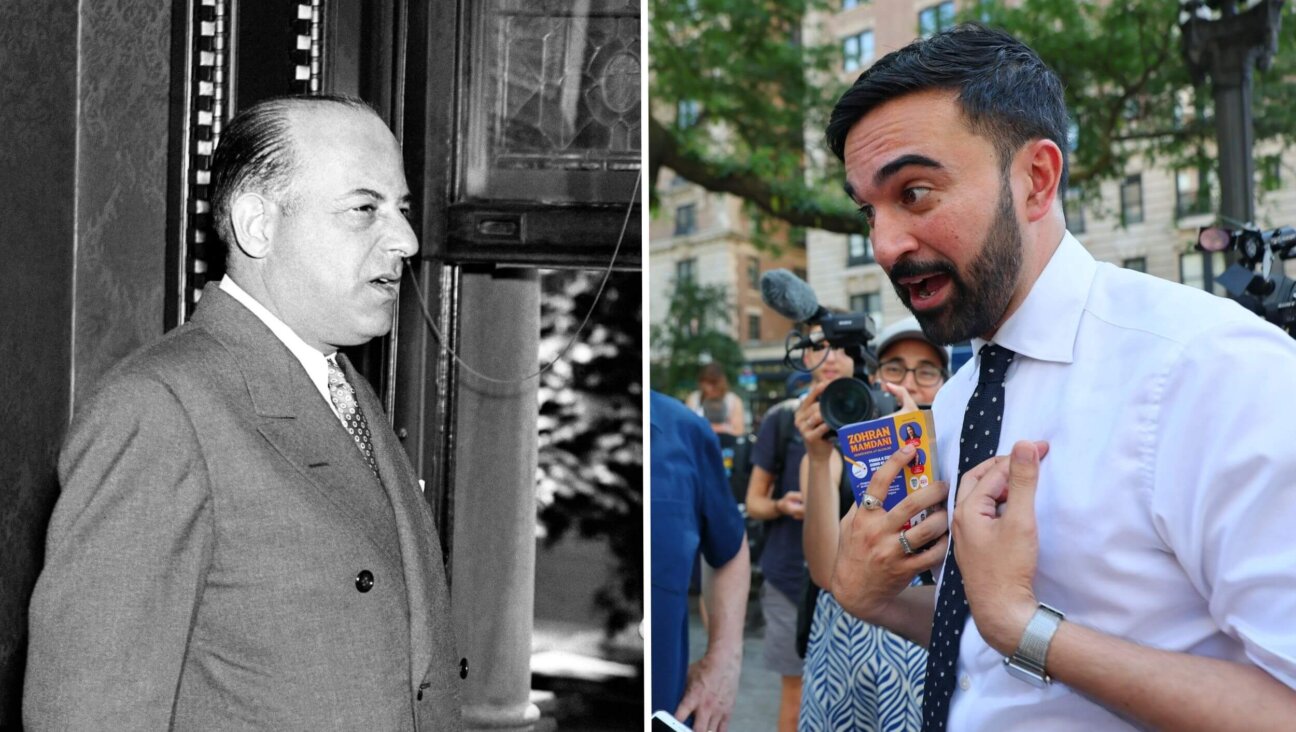

Recall, too, that the S&L crisis was accompanied by an S&L scandal, featuring outright illegalities by the most reckless of the deregulated bankers, Charles Keating. When the government began investigating Keating’s business, five senators who had received Keating donations tried to have the probe dropped. The five ended up disgraced after a Senate ethics investigation. Four of them were Democrats, all now gone and forgotten. The fifth was a Republican, John McCain.

The deregulation of the 1980s had a certain logic. The New Deal regulatory system was obsolete. New technologies — computers, satellite transmission, jet flight, container shipping — had changed the economy beyond recognition. New regulatory systems were needed. But, times being what they were, regulations were scrapped instead of updated. Now we are paying the price.

Regardless, it is time to move forward. We must hope, then, that America gets an administration this fall with the wisdom to confront history and not whistle through it.