Taking Back the Street

For all its malodorous air of refueling a getaway car, the upcoming federal bailout of Wall Street is a lifesaving emergency operation, and it must go forward. It could become a fat giveaway to the rich, as progressives rightly fear, but it doesn’t have to be. Handled properly, the emergency measures will douse the fire that is threatening to consume the American economy, without rewarding the arsonists in the executive suites. With wisdom and luck, the intervention might even lead to a rebuilding of the financial markets on a safer, fairer, more structurally sound foundation. For that to happen, though, progressives must plunge into the details of the rescue so that their values are reflected in the repair.

Tempting though it might seem, we can’t just leave Wall Street to suffer for its sins. Financiers perform a public service no less essential than farmers or truckers. Farmers grow our food. Truckers deliver it to market. Bankers produce the financing that truckers need to fill their tanks, and farmers to buy next year’s seed. Without functioning capital markets, the economy grinds to a halt. That’s what is happening now.

But if the current crisis teaches us the necessity of markets, we should consider the broader implications. Farmers aren’t allowed to sell food that might be poisonous. Nor do good intentions matter; the government steps in at every stage of growing to protect the public. For that matter, truckers aren’t allowed to speed, run on worn ties or drive all night without rest. There are rules.

By the same token, financiers should not be allowed to package finance deals that might leave the rest of us broke and hungry. They need rules and oversight as much as farmers, truckers, pharmacists and electricians. Otherwise, they will end up doing — well, what they just did.

Bankers should not be allowed to package mortgages that lure buyers in with easy terms and then blow up in their faces a few years later. Traders should not be allowed to hide fake mortgages and other flimflams inside opaque pyramid schemes. Firms shouldn’t be permitted to shower billions of dollars on their managers and investors, and then run to the public trough when they lose billions. Companies should not be allowed to raise easy capital only to dismantle their factories and ship the jobs overseas.

All that should be illegal. But it isn’t.

How could that be? It’s illegal for builders to build homes on quicksand. Why are banks allowed to finance them that way?

The answer is simple: fad ideology. Call it the trickle-down theory, or Reaganomics, or the Chicago School or the Washington Consensus. Whatever you call it, it remains a crackpot theory sold to us by generations of snake-oil salesmen: the notion that businesspeople, unlike pharmacists or teachers, can be trusted to police themselves, magically shepherded to wisdom and virtue by the Invisible Hand of the Market.

And if they don’t behave intelligently — and here is the key — it’s nobody’s business but theirs. After all, they’re engaged in private enterprise.

It’s nothing of the sort, of course. As noted, finance is an essential public service, like airline safety. When it goes bad, the public must step in and fix it. If things fall apart, the public suffers. In case of catastrophe, the whole world suffers. Public affairs are everybody’s business. A democracy that governs everything except for what matters most is no democracy.

Our current troubles are not the result of greedy Wall Street executives breaking laws to make a fast buck at everyone else’s expense. Our problems begin with the fact that what they did was perfectly legal. In fact, it was encouraged by the tax code. Washington manufactured this crisis in a three-decade, slow-motion abandonment of the public welfare.

Partly, it was well-intentioned. Changing technology — the Internet, satellite communications, container shipping — rendered old financial regulations obsolete. But instead of reforming the rules, Washington largely abolished them. And now the taxpayers must step in and clean up the mess.

This is the moment to change the rules of the game in the public interest. As Treasury Secretary Henry Paulson told Congress, the Treasury must intervene in the markets and inject nearly a trillion dollars — roughly equal to the entire national debt when Reagan first took office — to buy up the banks’ junk and let them get back to the necessary business of finance.

And, as Congress has told Paulson, the bailout must help the banks, not the bankers. Executives must not be allowed to skim the money we provide to save the system. The rescue must help poor folks losing their homes, not just the bankers who set them up. A process must be launched — beginning now — to rewrite the finance and tax codes so that they serve the public’s interest and not just the bankers’.

Above all, the rescue must be managed by a team of honest, competent, intelligent people. That means it can’t be run by the current administration, with its impeccable record of ideological blindness, cronyism and incompetence. Congress should create an independent commission with the authority to manage the bailout-fund and put things right.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 2

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 3

News School Israel trip turns ‘terrifying’ for LA students attacked by Israeli teens

- 4

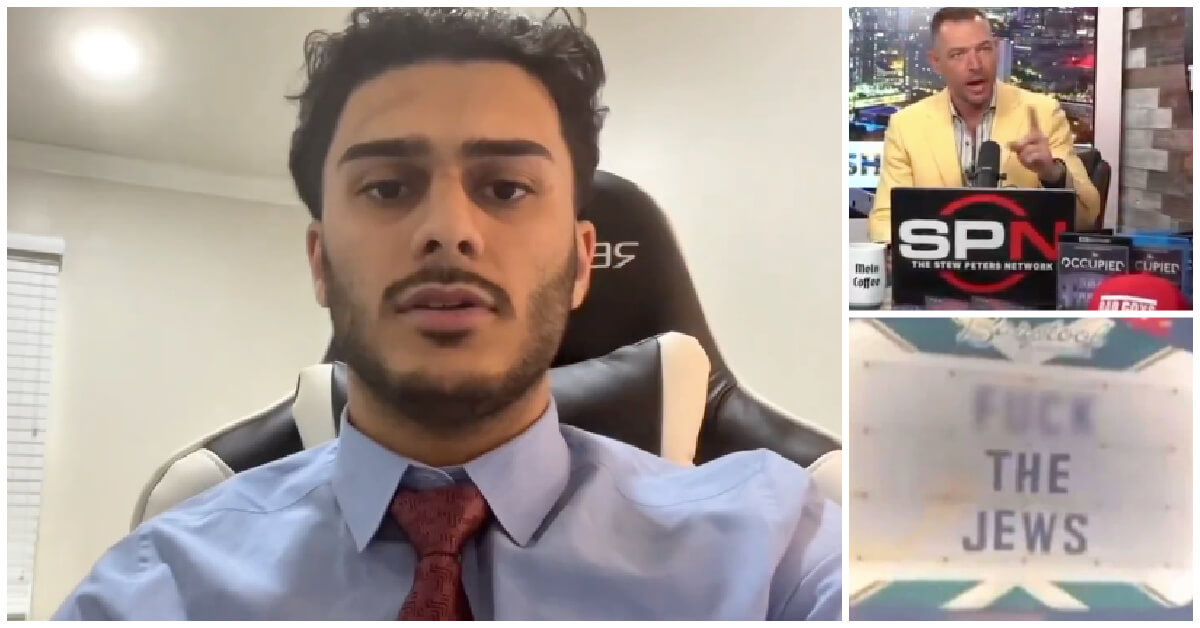

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Opinion This week proved it: Trump’s approach to antisemitism at Columbia is horribly ineffective

-

Yiddish קאָנצערט לכּבֿוד דעם ייִדישן שרײַבער און רעדאַקטאָר באָריס סאַנדלערConcert honoring Yiddish writer and editor Boris Sandler

דער בעל־שׂימחה האָט יאָרן לאַנג געדינט ווי דער רעדאַקטאָר פֿונעם ייִדישן פֿאָרווערטס.

-

Fast Forward Trump’s new pick for surgeon general blames the Nazis for pesticides on our food

-

Fast Forward Jewish feud over Trump escalates with open letter in The New York Times

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.