How Wily Donald Sterling Beat These 5 Investments

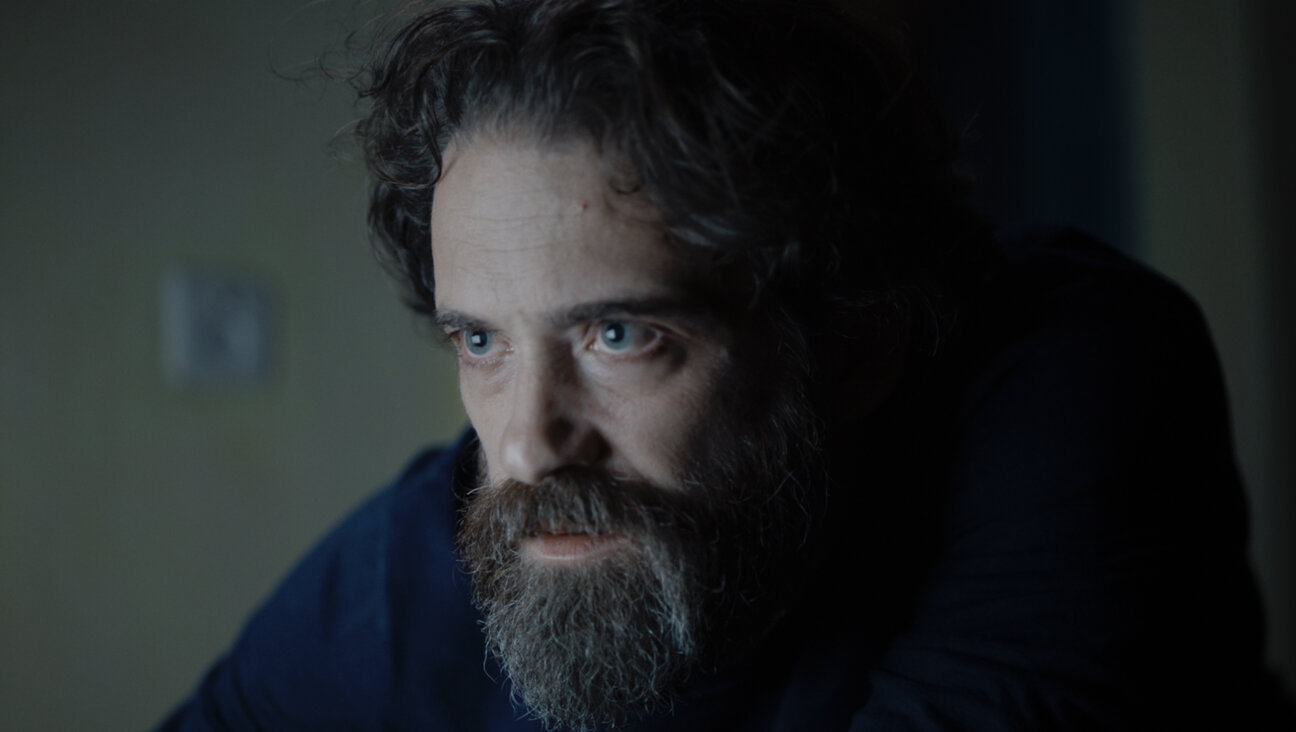

Image by getty images

Getty Images

(Reuters) — Donald Sterling bought the Los Angeles Clippers for 16 million and is set to sell the team for $2 billion.

That’s a 16,000% return or a lofty 16% a year.

Here’s a look at other investments he could have made at the time, and how much less he would have made.

Stocks

Since the start of 1981, the Standard & Poor’s 500 Index has risen about 1,315 percent, or 8.4 percent a year.

Including reinvested dividends, the S&P has delivered a total return of 1,509 percent, or 8.8 percent a year.

The Nasdaq Composite Index is up 1,994 percent, or 9.65 percent a year.

Bonds

The Barclays U.S. Aggregate Index has risen 1,385 percent, or 8.5 percent a year.

Gold

Spot gold is up 113 percent, or just 2.3 percent a year.

Wine

Earlier this month, London-based Liv-ex said its Liv-ex Investables Index had gained 1,504 percent, or just under 11 percent a year, since its launch in 1988.

Real estate

New York City real estate appraiser Jonathan Miller says the average Manhattan apartment has gained just 5.75 percent a year in value over the 25 years he has tracked their prices.