Presbyterians: Choose Impact Investing Over BDS

Members of the Presbyterian Church in Ohio attend a service in 2012 / Getty Images

Since the Presbyterian Church’s General Assembly convened in Detroit on June 14, attendees have been preparing to vote on a resolution to divest from Israel-related investments. If we can assume the goal of the Presbyterian Church is to promote peace between Israelis and Palestinians, attendees should consider a better alternative: Rather than divesting from Israel, they should invest in ways that can improve the situation.

Historically, divestment has been used by socially responsible investors, but it is not effective in promoting compromise between two parties. Instead, a popular new approach called “impact investing” holds much more promise. Impact investors see a challenge in the world, such as climate change or poverty, and proactively pursue investments that attempt to remedy the problem — for example, clean energy or microfinance.

The Israeli-Palestinian conflict is an enormous challenge, but so far investors have had very little positive impact on efforts to reach a peaceful solution. The divestment resolutions sponsored by the BDS (Boycott, Divest, Sanction) campaign damage any real prospects for peace. This one-sided approach targets Israel alone, despite the fact that both sides play a role in the prolonged conflict. BDS does nothing but exacerbate tensions, and creates a new avenue for non-military warfare between the parties instead of creating new avenues for cooperation.

Many BDS proponents are not peace activists seeking a negotiated agreement, but rather anti-Israel activists seeking the elimination of the Jewish homeland. Unfortunately some investors who genuinely want peace have become beguiled by the BDS campaign’s rhetoric.

Impact investing won’t satisfy those who seek Israel’s destruction, but for the subset truly seeking peace, impact investing is a more effective strategy. Investors can help lay the foundation for a sustainable peace and improve the environment for a negotiated political agreement. The private sector, with initiatives such as Breaking the Impasse, Beyond Aid and the Center for Jewish-Arab Economic Development, realizes that Israelis and Palestinians have much more to gain from cooperation than from confrontation.

Currently, there is a great disparity between the Israeli and Palestinian economies, with Palestinians facing 25% unemployment and a slowdown in growth as a result of a decline in international aid. Prospects for peace will only advance to the extent that investors can help grow the Palestinian economy and expand the middle class.

The Portland Trust, a British nonprofit, has researched conflict regions around the world to examine the positive impact provided by business and investment. They concluded that in Northern Ireland “economic discussions became a platform for political settlement and business organizations became a key lobby for peace.” However, in the example of Bosnia and Herzegovina “economic disparities and poor financial prospects endanger a fragile peace accord” and therefore “a strong post-conflict economy is essential for keeping the peace.” Similarly, the substantially weaker Palestinian economy hurts the Palestinian people, leads to despair and radicalization and threatens any future peace deal.

Impact investing creates jobs and strengthens the economic foundation of a future Palestinian state. And there are readily available options across asset classes for investors to consider.

On the private equity side, recently launched Palestinian funds include Siraj, Sadara and Abraaj. New initiatives such as the first eZone business incubator in Ramallah, the Arabreneur angel investor event, and the Palestine StartUp Cup all encourage entrepreneurship.

For public equity investors, the small Palestinian equity market and stock exchange is gaining global credibility, according to Sahem Trading, a Palestinian investment research firm in Ramallah. While there are currently no Palestinian mutual funds, the Rasmala Palestine Equity Fund will launch soon and invest in both public and near-IPO equities.

Rawabi, the first Palestinian planned city, is a green real estate investment and an example of Palestinian-Israeli cooperation. There are many more options available and a number in development, including a fund for Palestinian women entrepreneurs, crowd-funding platforms, exchange-traded funds and solar energy financing.

With the recent growth in Palestinian investment options, investors can help build an economic environment conducive to peace. But some investors still may be uncomfortable with any investment related to conflict or human rights concerns. But if they were to stay true to their values, investors divesting from Israel should also avoid Russia, China, Iran, Turkey, the United States, as well as the entire Middle East and most of Africa. For investors who realize the impracticality of negatively screening the overwhelming majority of companies and countries, impact investing in peace offers a more strategic option.

Strengthening the Palestinian economy and encouraging economic cooperation between Israelis and Palestinians can help lay the necessary foundation for peace to ensue.

Julie Hammerman is the founder of JLens and provides guidance to institutions and foundations on impact investing through a Jewish lens.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Is Pope Leo Jewish? Ask his distant cousins — like me

- 4

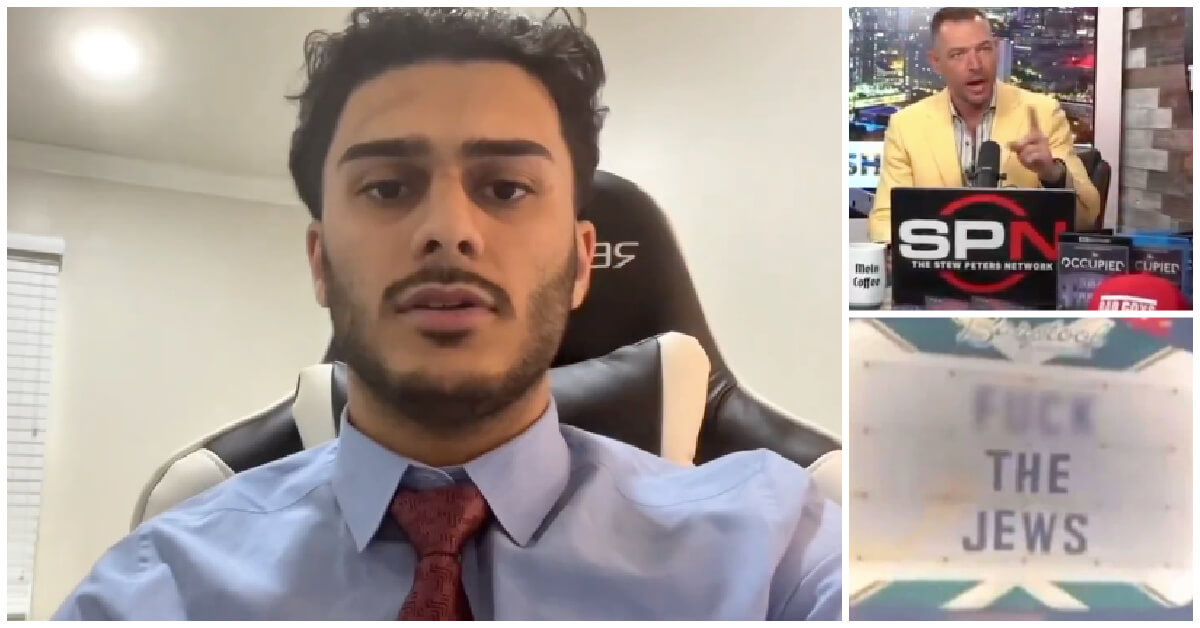

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

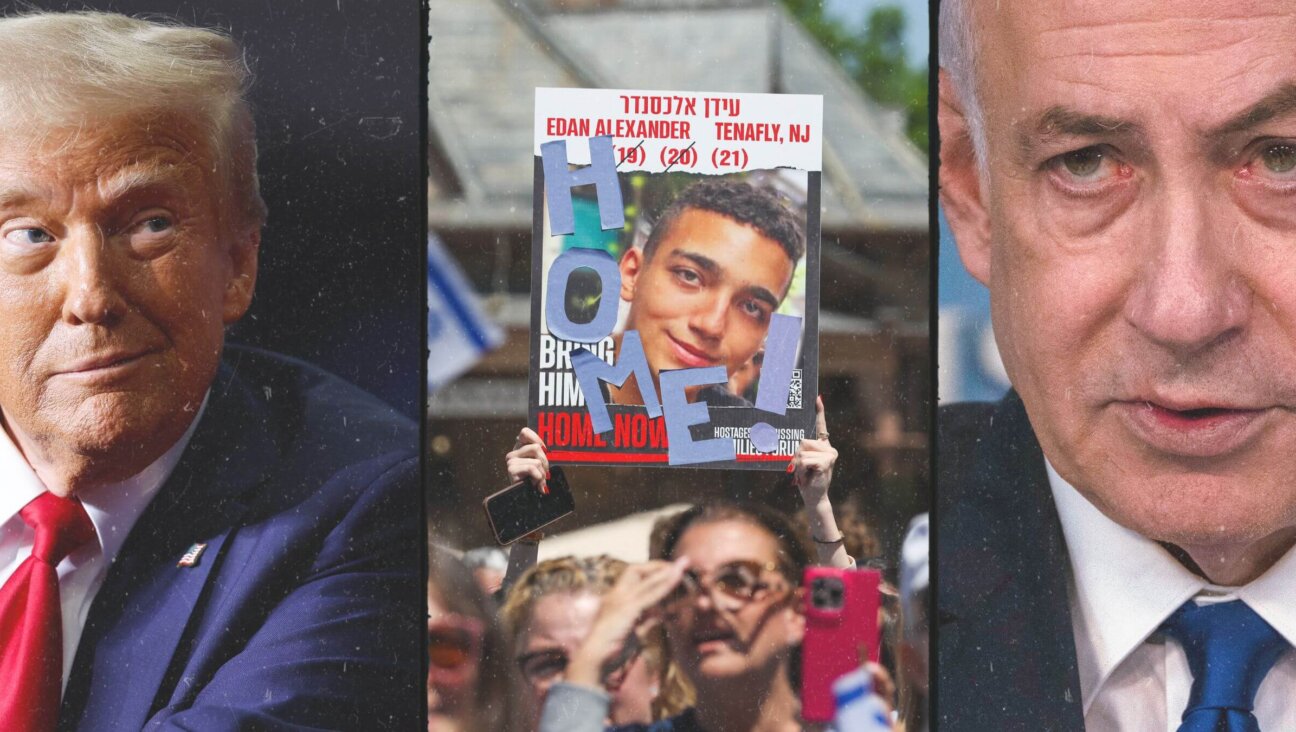

News In Edan Alexander’s hometown in New Jersey, months of fear and anguish give way to joy and relief

-

Fast Forward What’s next for suspended student who posted ‘F— the Jews’ video? An alt-right media tour

-

Opinion Despite Netanyahu, Edan Alexander is finally free

-

Opinion A judge just released another pro-Palestinian activist. Here’s why that’s good for the Jews

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.