Can the Israeli economy survive the judicial overhaul?

While only one of Netanyahu’s proposed reforms has passed, the Israeli economy is already in crisis

Israel’s Prime Minister Benjamin Netanyahu attends the weekly cabinet meeting in the prime minister’s office in Jerusalem on July 30, 2023. Photo by Abir Sultan/POOL/AFP via Getty Images

The Israeli economy has been remarkably resilient through 75 years that have included periods of war, terrorism, debt crises, hyperinflation, deep market reforms and political instability.

Judicial overhaul threatens to change all of that. The events we have witnessed since January, after the formation of Benjamin Netanyahu’s new government, confirm how the reforms slowly being implemented amount to nothing less than an existential threat to the Israeli economy.

Despite lofty promises, Netanyahu’s coalition has only just now managed to pass its first piece of judicial overhaul legislation. It amounts to little more than a minor reduction in the extent of the Supreme Court’s power of judicial review. And yet the economic implications have already been felt strongly across the Israeli economy.

Who could have predicted this? Nearly all Israeli economists, including us. In a public letter, we warned in no uncertain terms about the grave long-term economic consequences that could result from the implementation of judicial overhaul.

Unfortunately, we were right. In the absence of the judicial overhaul, the shekel was likely on track to appreciate. But it has gone in the opposite direction, and the turmoil has likely contributed to weakening the Israeli Shekel vis-a-vis the U.S. dollar by 15%, according to formal estimates by the Israeli Democracy Institute. The depreciation of the shekel was immediately felt by Israelis. It contributes to inflationary pressures and to the already skyrocketing cost of living in the country.

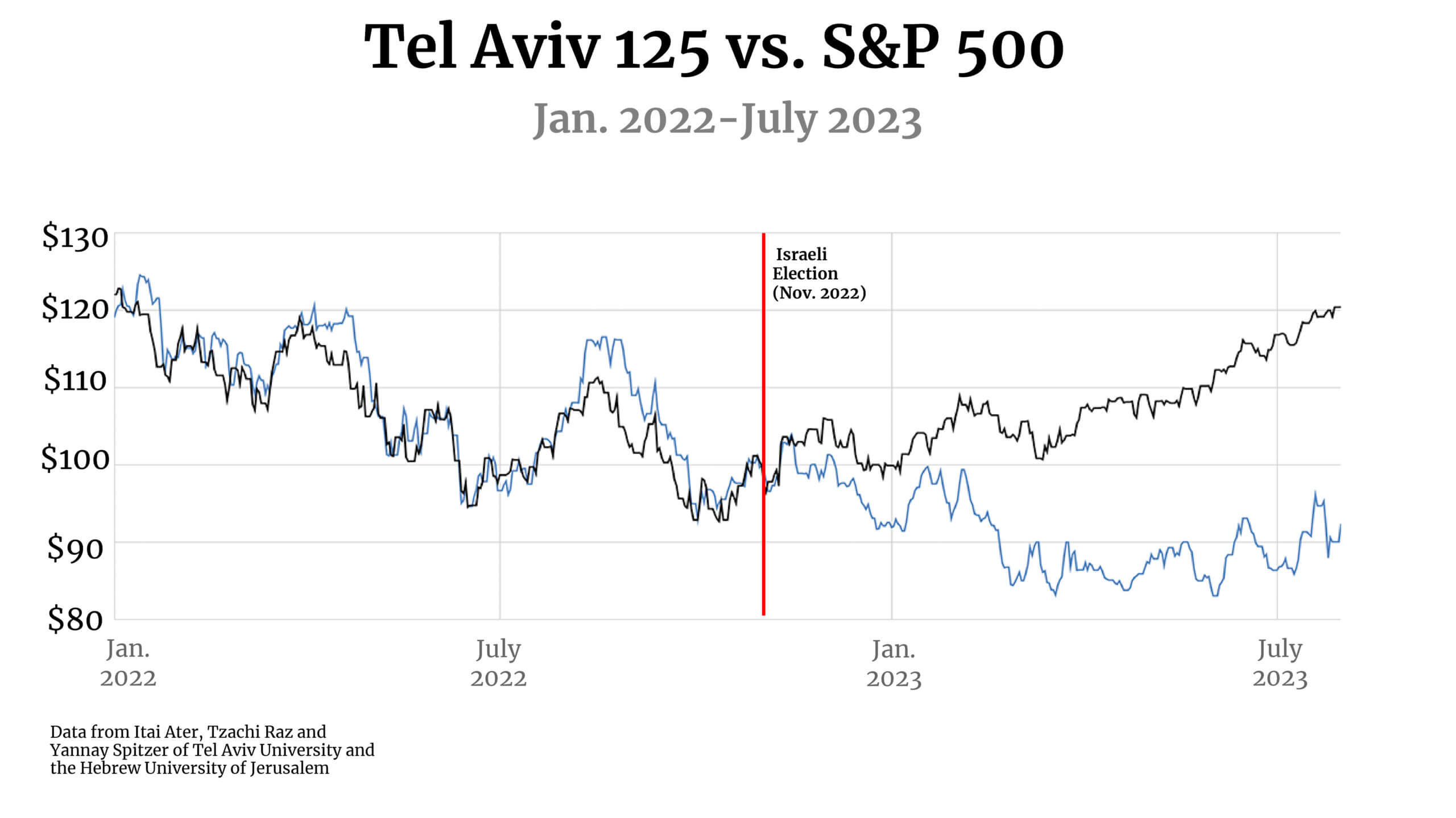

The value of the Israeli stock market has likewise plummeted in an otherwise inexplicable manner. Until election day in Israel on November 1, the Tel Aviv Stock Exchange was humming along at a similar pace to the S&P 500.

Shortly after the elections, the Israeli market dropped precipitously. While a gap between the two indices is not unprecedented, the current difference of roughly 25% is unusual. The divergence is likely largely explained by the looming threats of judicial overhaul and the ensuing political turmoil. It amounts to a wealth loss of 300 billion shekels (approximately $80 billion), or more than 15% of Israel’s GDP.

Venture capital runs dry

Israel’s currency tanked. Its stock market plummeted. And the flow of foreign funds to its high-tech sector has run dry.

While global venture capital investment in high-tech has temporarily declined by about half in the first quarter of 2023 as compared to a year earlier (due to rising interest rates), the crash of investment in Israel exceeds the global average with an almost 70% decline during the same period becoming increasingly clear that the decline partly responds to the reform.

Many new Israeli startups no longer register in Israel, but in Delaware, a precautionary measure that will facilitate future relocation of business activities and of earnings abroad . This is particularly concerning: During the past three decades, Israel’s growth has been driven by the miraculous expansion of its mighty high-tech sector.

The success of Israel’s tech scene relies on two pillars: talent and a sound institutional environment.

The judicial overhaul risks both. Foreign direct investment, which funds almost all Israeli tech companies, is hypersensitive to the institutional environment. If Israel’s government is seen as irrational, investors are likely to get skittish. And the incredible pool of highly skilled, tech-savvy and entrepreneurial Israelis is the most geographically mobile segment of the labor force, making the risk of a long process of brain-drain all too real.

International financial agencies, such as Morgan Stanley, have already cautioned against investments in Israel. Moody’s has already lowered Israel’s credit rating forecast, and it is likely that other credit agencies will follow. This would lead to Israel paying more interest on its debt, likely an amount that — according to the Israeli Economics Association — would be the equivalent of the entire current budget of the Welfare Ministry.

The protests continue

Fortunately, Israeli civil society and the pro-democratic movement remain in the streets. For 30 weeks, Israelis have continued to put up stiff resistance via massive public protests. A widespread understanding of the severity of the expected economic consequences no doubt plays a role.

If Israeli protesters manage to stop the judicial overhaul plan from coming to fruition, would it be the perfect antidote to the poison that has been thrown at Israeli society, institutions, security, and the economy?

Unfortunately, we think the answer is no. Whether Israel’s democracy will end up as a cautionary tale or endure as an exemplary case of a society averting democratic backsliding will be decided through a long and arduous struggle that will surely take years.

Netanyahu, in his first year back, has done enormous damage. He has brought Israel to the brink of a constitutional crisis. He has empowered the most extreme elements of the Israeli political map. He has yielded to unprecedented demands for exorbitant funds to Jewish ultra-Orthodox institutions. And he has jeopardized Israel’s national security by ignoring ruptures within the military establishment.

Netanyahu has crossed the Rubicon, and nothing protesters do can quickly restore the country to its previous glory.

Even if judicial overhaul is abandoned, the specter of a second round will forever haunt Israeli democracy. Investors contemplating owning a stake in the Israeli economy, Israel’s talented, entrepreneurial and geographically mobile workers, and a whole generation of young Israelis wanting to live in the liberal democracy they were promised will not ignore this reality.

Aborting plans for a full judicial overhaul is crucial. But even if it happens, Israel will forever remain bruised and traumatized by this experience.

To contact the authors, email [email protected].