Hadassah To Pay $45 Million To Settle Claims in Bernard Madoff Ponzi Scheme

Image by Getty Images

The clouds gathered over the women’s Zionist group Hadassah began to part on December 9, when the organization announced that it had reached a tentative settlement allowing it to pay back about half the money it earned in Bernard Madoff’s multibillion dollar Ponzi scheme.

The news came amid a flurry of developments in the Madoff case — including, most startlingly, the December 11 suicide of Mark Madoff, the convicted fraudster’s 46-year-old son. The former investor hanged himself in his Manhattan apartment, reportedly with a dog leash, on the morning of the second anniversary of the exposure of his father’s fraud.

The developments mark a new stage in the ongoing effort to unravel Bernard Madoff’s scheme. As the statute of limitations for certain Madoff-related lawsuits expired December 11, some parties involved in the case, like Hadassah, seem primed to move on. Others, meanwhile, face the prospect of long years extracting themselves from its unfolding complexities.

Hadassah’s settlement — first announced on December 9 in a letter by Hadassah’s national president to members of the group — still awaits the approval of Burton Lifland, the judge overseeing the Madoff bankruptcy cases. Under its current terms, according to press releases by both Hadassah and Irving Picard, the court-appointed trustee in the Madoff bankruptcy, the not-for-profit group will pay $45 million to settle all claims.

Those claims arise from Picard’s effort to recover funds from individuals and groups that withdrew amounts from their accounts with Madoff that exceeded the amounts they invested — the so-called “net winners.” Due to the nature of the Ponzi scheme, these supposed profits were actually other people’s investments and are now subject to “clawback” by the trustee. The recovered funds are then available for distribution to all those whom Madoff defrauded. Lifland has accepted this method of calculating Madoff claims, though the decision is being appealed.

According to Hadassah national president Nancy Falchuk’s letter announcing the settlement, the organization earned $97 million in profits over the course of its Madoff investment. The group is being allowed to keep $52 million.

“We consider the good works of the charities involved, as well as special circumstances such as restricted gift structures, when we negotiate with these groups,” Picard said in a statement. “We don’t want to compound the damage done by Madoff or hamper the work of these worthy organizations.”

The settlement is proportionally in line with a settlement announced December 7 between Picard and Boston-based investor and philanthropist Carl Shapiro and his family. Shapiro will pay the trustee $550 million; Picard alleged in December 2009 that Shapiro had earned $1 billion in the fraud.

A spokesman for Picard said that the trustee is not currently speaking to the press. A press representative for Hadassah declined to make Falchuk or any other Hadassah staff member available for comment.

Eyebrows were raised in August 2009 when former Hadassah chief financial officer Sheryl Weinstein published a book revealing that she had had an affair with Madoff while working at the organization. But that incident, which could imply a potential conflict of interest, was not mentioned in either party’s release.

One attorney representing victims in the Madoff case, who has been among those to oppose Picard’s claims formula, said that other net winners would welcome news of Hadassah’s settlement. “I think net winners are going to be happy, because when you’re talking about the big fish, [Picard is] basically limiting the settlements to half of the net winnings,” said Barry Lax, an attorney at Lax & Neville.

Lax said that he could understand why net losers might oppose the settlement, by which Hadassah is allowed to keep money that was essentially stolen by Madoff. “My answer to net losers would be, it sounds like you’re going to be paid in full,” he said. Lax pointed to the nearly $6 billion in Madoff claims that Picard has allowed so far, in contrast to more than $50 billion filed so far in clawback suits.

Ongoing litigation could bump up the total amount of allowed claims.

Picard only filed clawback suits against those who had invested directly in Madoff’s fund. Organizations and individuals that invested through Madoff feeder funds like those operated by J. Ezra Merkin were not subject to such suits, though some could be sued by the court-appointed trustees for those feeder funds at a later date. Yeshiva University was among those that invested in Merkin’s fund, even as Merkin sat on the school’s investment committee. But it is not known if the university is a net winner.

The trustee sued the Deborah and Andrew Madoff Foundation, a not-for-profit organization run by Bernard Madoff’s son and daughter-in-law, December 8 for $2 million. The foundation gave away more than $200,000 per year in 2007, 2008 and 2009, often to New York-based charities, including Central Synagogue, the Metropolitan Museum of Art, the Asphalt Green athletic facility and the Dalton School. In its 2009 public tax filing, the group claimed that it was no longer “an operating foundation,” but nevertheless gave grants that year to a music instructor and a donor-advised fund. Mark Madoff was a director of the foundation.

Contact Josh Nathan-Kazis at [email protected] or on Twitter @joshnathankazis

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a Passover gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Most Popular

- 1

News Student protesters being deported are not ‘martyrs and heroes,’ says former antisemitism envoy

- 2

News Who is Alan Garber, the Jewish Harvard president who stood up to Trump over antisemitism?

- 3

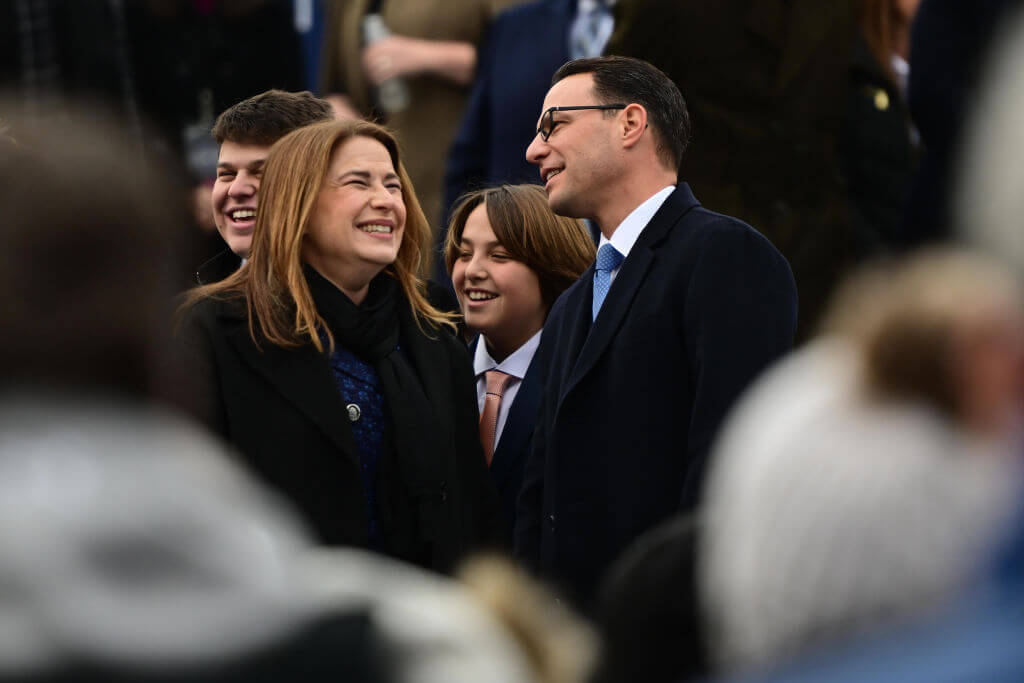

Fast Forward Suspected arsonist intended to beat Gov. Josh Shapiro with a sledgehammer, investigators say

- 4

Politics Meet America’s potential first Jewish second family: Josh Shapiro, Lori, and their 4 kids

In Case You Missed It

-

Opinion Why can Harvard stand up to Trump? Because it didn’t give in to pro-Palestinian student protests

-

Culture How an Israeli dance company shaped a Catholic school boy’s life

-

Fast Forward Brooklyn event with Itamar Ben-Gvir cancelled days before Israeli far-right minister’s US trip

-

Culture How Abraham Lincoln in a kippah wound up making a $250,000 deal on ‘Shark Tank’

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.