What Sort of Man? Madoff on the Couch

In Shakespeare’s play “The Merchant of Venice,” Shylock, the usurious lender, attains the status of literature’s classic antisemitic stereotype, in part because of his relentless preying upon non-Jews.

But the victims devastated by Bernard Madoff, the investment guru charged with running an alleged Ponzi scheme that blew through $50 billion of other people’s money, were primarily his own.

In this, say observers looking at the case through a psychological lens, Madoff achieved a wholly different level of notoriety.

“Hitherto, all ethnic groups who ascended into a national class of benefactors made their wealth off other ethnic groups,” said Nelson W. Aldrich, author of the 1996 book “Old Money: The Mythology of Wealth in America.” “They soaked the Irish or sued the French Canadians. They wouldn’t dream of doing what Madoff did.”

This is not to say that Madoff excluded non-Jews from his ruinous scheme. Several large European banks and other non-Jewish institutions and individuals lost millions, even billions, through their investments with Madoff. But in interviews with the Forward, mental health experts agreed that from a psychological point of view, Madoff’s exploitation of his vast Jewish network of friends — many of them close — and acquaintances to bring investors into his alleged Ponzi scheme constituted a level of behavior verboten even as criminal actions go.

“He might have violated a primitive rule against hurting your own tribe,” said Ira Moses, director of Clinical Services at the William Alanson White Institute, a psychoanalytic training center. “He may have broken a taboo amongst criminals.”

(Like other psychologists interviewed, Moses cautioned that he could only hypothesize, as he does not know Madoff personally.)

The novelist Nathan Englander said that he generally has no patience for the idea that Jewish misdeeds will stoke antisemitism. But he said that the Madoff scandal — with its long lists of bilked Jewish charities and individuals covered in major newspapers — embarrassed even him.

“It really raises up for me this primal thing of, ‘This is the kind of thing that looks bad in a general Jewish way,’” Englander told the Forward. “It gave me that ‘circle the wagon’ mentality that I don’t have very often.”

Yet this kind of betrayal from inside a community is not unheard of — there is even a name for it: affinity fraud — but it is unusual.

How Madoff might have justified to himself his exploitation of his own community — in which he was not only a major philanthropist, but also actively engaged in an elite country club scene in Palm Beach, Fla., and New York — would depend on the extent to which he believed his own lies, psychologists said.

Had Madoff deluded himself into believing that his scheme could go on forever, he actually might have seen his victims as beneficiaries, psychoanalyst and Yale professor Dori Laub pointed out.

“It’s possible that what we’re dealing with is a man who’s essentially depressed and as a compensation begins to feel some omnipotence to fight the emptiness,” Laub said. “If you end up really being the messiah, you’ll be glorified.”

At the other end of the spectrum, some psychologists posited that unconscious hostility toward the Jewish community may have provoked him to choose his victims as he did. Noah Shaw, who has studied the psychology of money, said that he had worked with patients who generalized their hostile feelings toward their own family into antagonism directed at their ethnic community.

Stephen Rittenberg, a former director of treatment at the New York Psychoanalytic Institute who collaborated with Shaw on his research, had a similar assessment.

“If he were my patient I would try to address that aspect: Was there some kind of psychological hatred of his own family, his own community?” Rittenberg said.

But Shaw speculated as well that Madoff may have given his victims little thought at all and chose them simply because the Jewish community was the group most accessible to him.

“When people have feelings of inferiority or inadequacy, they need to beat the system, to outsmart the rules,” he said. “It works in an extremely temporary way. It’s the psychological mirror of a Ponzi scheme: If you don’t keep doing it, you collapse.”

Madoff’s motives are further obscured by the fact that there is something suicidal about the very structure of a Ponzi scheme, which has no way of working indefinitely.

“Maybe the ‘deal’ with Madoff is that on some deep level he’s not able to believe that the future exists,” said Rivka Galchen, author of this year’s novel “Atmospheric Disturbances” and a trained psychiatrist herself. “Otherwise he wouldn’t have been able to sleep at night for pretty much the majority of his professional life.”

With additional reporting by Amanda Gordon.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a Passover gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Most Popular

- 1

Opinion My Jewish moms group ousted me because I work for J Street. Is this what communal life has come to?

- 2

Fast Forward Suspected arsonist intended to beat Gov. Josh Shapiro with a sledgehammer, investigators say

- 3

Fast Forward How Coke’s Passover recipe sparked an antisemitic conspiracy theory

- 4

Politics Meet America’s potential first Jewish second family: Josh Shapiro, Lori, and their 4 kids

In Case You Missed It

-

Opinion This Nazi-era story shows why Trump won’t fix a terrifying deportation mistake

-

Opinion I operate a small Judaica business. Trump’s tariffs are going to squelch Jewish innovation.

-

Fast Forward Language apps are putting Hebrew school in teens’ back pockets. But do they work?

-

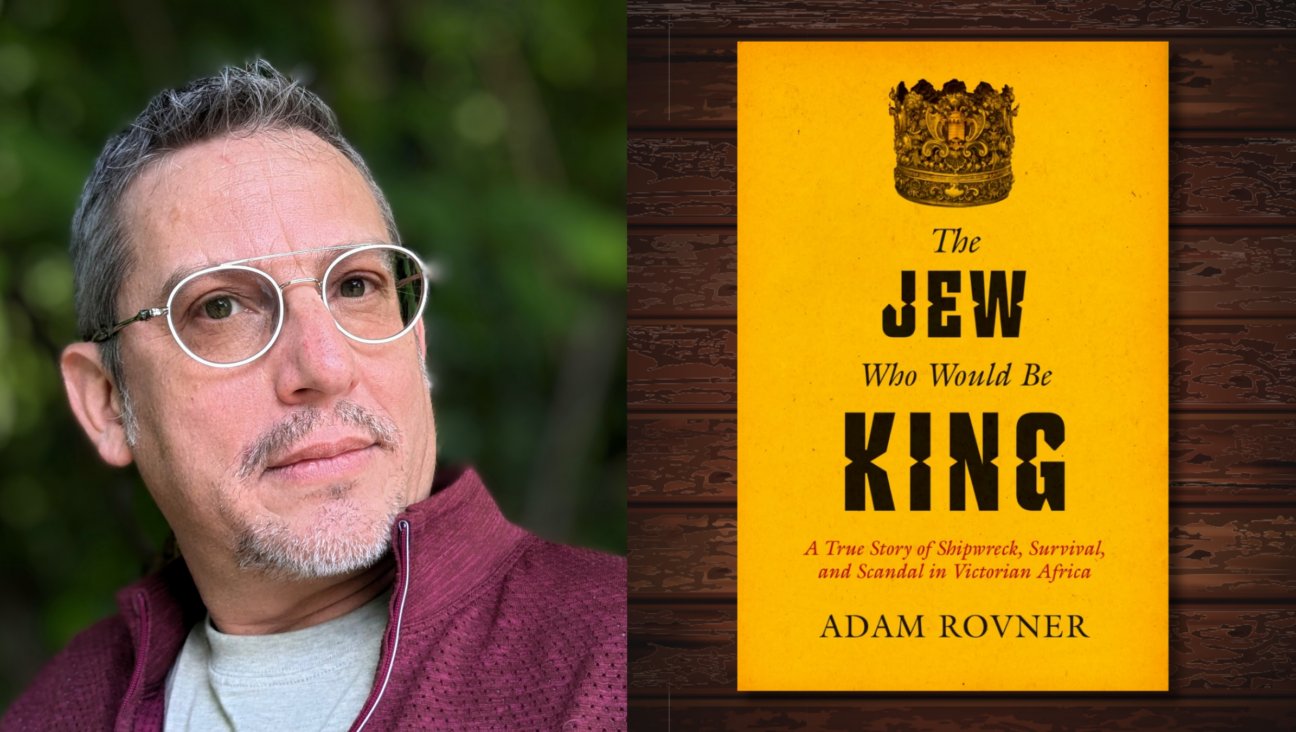

Books How a Jewish boy from Canterbury became a Zulu chieftain

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.