Harness the Potential of Philanthropic Partnerships

Warren Buffet had enough money to create the largest or second largest foundation in the United States. He could have made all of the expenditure decisions himself and pursued all of his own passions, and the stationery would have had his name on it. So when it came to putting $31 billion of his hard-earned money to charitable use, why did Buffet choose to partner with Bill Gates’ foundation?

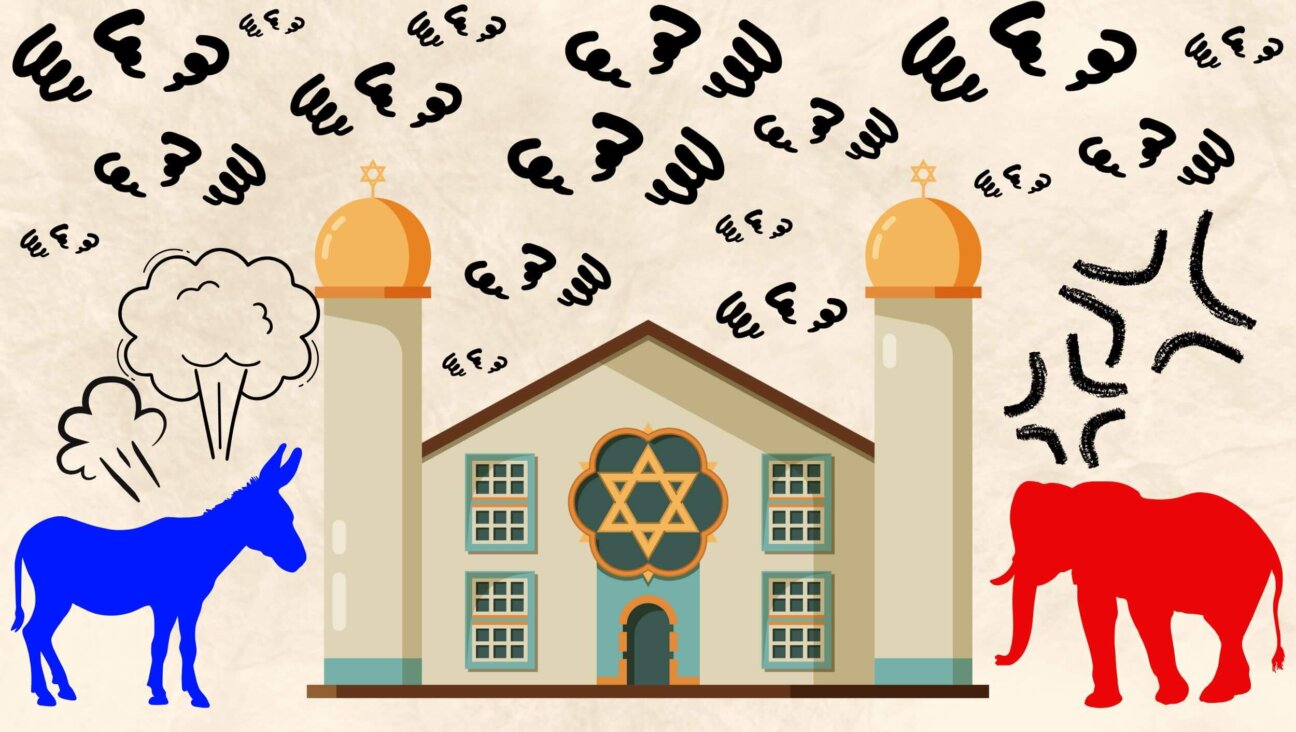

The same question might just as well be asked of Jewish philanthropists. They are becoming more entrepreneurial in their funding, and an expansion in the number of active, living donors is driving a demand for greater control and independence. Creating philanthropic partnerships is a notably important element of this new funding landscape.

Why? Philanthropists want to be involved in the process — and they want to see results. Partnership can provide the ideal vehicle for these ambitions, while allowing funders the ability to leverage their assets to achieve broader philanthropic objectives. Directed-giving philanthropy lends itself to dynamic and often unconventional partnerships, which are becoming an ever more prominent feature of Jewish philanthropic life.

Philanthropists today are broadening their vision and setting higher goals. No longer content simply to write a check, many Jewish donors today demand more influence and are seeking to collaborate with each other in more flexible arrangements, rather than deferring to a central bureaucracy.

But the news is not all good. While philanthropic partnerships have the potential to achieve tremendous societal good, that potential is put at risk when the arrangement is entered into without proper reflection. Partnership requires far more exploration in thought and deed than is currently standard in the field. Partnership is a grossly overused term, which, without greater focus and definition, has the potential to disappoint and demotivate.

Done well, a funding partnership can leverage all participants’ money. As with Gates and Buffett, it can build confidence among the partners to engage in more, and bolder, projects. Additionally, foundations, often supported by living donors, increasingly engage in operating programs but seek out funding partners for their work.

There is much to recommend in partnership as a philanthropic tool. The principle of leverage allows funders to transform what would once have been a pet project into an initiative with a far broader base of support. Active engagement creates a sense of commitment, with donors having a greater stake in seeing initiatives succeed. At the same time, the dynamic of partnerships increases the knowledge and broadens the horizons of individual funders.

The rise of philanthropic partnerships is due in no small measure to the increase in living donors, many with business experience. For such funders, their entrepreneurial background tends to instruct their philanthropic methods. They clearly understand and appreciate the “Other People’s Money” rule and like the notion of using leverage to accomplish their philanthropic goals. Indeed, the economic boom that allowed these passionate entrepreneurial givers to emerge is transforming the business of giving.

Additionally, the trend toward increasing privatization is having an impact on philanthropy. As services continue to shift to the private sector in North America and around the world, people have come to expect a more results-oriented not-for-profit sector, where entrepreneurs play a critical role in management and accountability, in addition to the role traditionally played by not-for-profits.

Partnership doesn’t mean finding someone else to fund or help to fund your pet project. Partnership is about shared passions. It is crucial that those involved share a vision for success. Whatever form the partnership takes, its structure and roles should be clearly defined and agreed upon by all.

There are at least three prevalent business inspired models to follow. The general partnership model of equal funders with equal commitments, equal rights and equal responsibilities; the managing partner/limited partner scenario, in which the managing partner has greater financial commitment and greater responsibilities than the limited partners; and the general partner/targeted partner model, in which a funder assumes primary responsibility for a certain element of the project and enjoys managing partner status over a specific piece of a project.

The history of Birthright Israel provides a rich illustration of some of these components. Its two founders, joined later by a third, were committed to assuming all of the risk in order to give the program an expeditious and bold start. The first trip, in the winter of 1999-2000, had a price tag of $16 million. Because there were only two stakeholders at the time, the first trip set a framework that continued throughout Birthright Israel. The fact that little consensus had to be obtained allowed for a simple but bold execution approach.

While in reality Birthright Israel was soliciting general partners, it was at first operating according to the managing partner/limited partner model. And while some philanthropic partners were prepared to provide substantial support to the program without exercising either governance or involvement, others wished to be more involved and were disappointed in their limited role.

As the government of Israel and international Jewish communities became financial partners, through the federations and Keren Hayesod, they also became governance partners, as did the Jewish Agency. With more than 100,000 participants in just six years, today Birthright Israel has a waiting list of tens of thousands — and the pressure created by these demands has tended to further complicate the partnership relationships.

Some partners are prepared to move more quickly to greater financial commitment than others. The continuous pressure of finding the right level of involvement and governance is complicated by the very success of the fundraising strategy. To date, there are more than 20 gifts of more than $5 million, with almost half of them at $10 million or more. While the Birthright Israel example carries with it the halo of the extraordinary qualitative and quantitative success of the program, the complications of partnership taxonomy and definition is a continuing legacy of its early years.

As Buffett has generously illustrated, partnerships have a unique capacity to generate enormous social good. They hold the power to reshape the very landscape of philanthropy, and sometimes of society. The better we understand these concepts and the more closely we hew to solid principles, the more we will be able to realize their extraordinary potential for our community and for the greater good.

Jeffrey Solomon is president of the Andrea and Charles Bronfman Philanthropies. Mark Charendoff is president of the Jewish Funders Network.