Israeli Economists’ Dangerous Minds

In discussions of the Israeli government’s economic program in various forums in the economics department at Ben-Gurion University of the Negev, the students expressed firm opinions against the poor who don’t work, against the welfare state and against the public sector. In a conversation with the professors, the students said, “What do you want? We learned these things from you.”

Studies carried out at universities in the United States found that students of economics are more selfish than their classmates. In the famous “ultimatum game” experiment, one of the students, “the allocator,” is given the opportunity to decide how to divide a certain sum of money between himself and another student, who is also participating in the experiment. If the second student, “the recipient,” agrees to the allocation — it is carried out. If not, they both receive nothing. If both players are rational, the allocator will offer an amount that will be agreeable to the recipient.

Surprisingly, in such experiments, it has been found that the fair division of 50-50 is most common, and that the allocator doesn’t exploit his preferential status. But among economics majors, it is statistically clear that the allocator consistently receives more than in other disciplines.

The real test of economics students comes in the introductory course on economics. Many economists have told me that the most important part of their studies was the introduction to economics. The course was structured by the father of economic teaching and research in Israel, Dan Patinkin. The introduction to microeconomics, which deals with the operation and efficiency of markets, has remained almost unchanged after decades of teaching. I learned it as a freshman in 1966 and have taught it many times since then. With the aid of a series of economic models, the course succeeds in causing its graduates to internalize open and latent messages.

The open messages: Free competition in the market is optimal, and there is no need for intervention. There is room for government activity in the economy only when there are failures in the market. The latent messages: The course discusses “intervention of the government in the free market”; In other words, the government undermines individual freedoms. An analysis of taxes deals only with how taxes interfere with market activity, and there isn’t a word about the necessary activity that the taxes fund. Taxing only causes damage. Market failures are only in marginal industries, like air pollution, and therefore the government has to be small.

These messages show that the market is good and efficient, and government is superfluous and inefficient. The messages are reinforced in the study of macroeconomics during the second year. Is it any wonder that our students think that there is nothing as good as the market, and nothing as bad as the public sector, with the logical conclusion that there is nothing better than privatizing the public sector?

Economics research during the past 30 years has led to a better understanding of the reasons for market efficiency. The research has taught us that what brings about efficiency in the competitive market is not a mystical element of freedom from government intervention, but the incentives that competition brings with it. From this we can conclude that with proper planning of incentives, the public sector can operate efficiently, whereas with distorted incentives, the private sector will operate inefficiently.

A good example is Bezeq, a government telephone company that provides incentives for its technicians by payment for each installation of a new telephone. In the 1980s there was no system of incentives, and four Bezeq workers would come to install a telephone: One worked and three drank coffee. Now one worker comes, and he doesn’t stop running. On the other hand, giving incentives to directors of business corporations in America in the form of huge bonuses related to the profits of the company they directed led to false accounting and the fall of Enron.

The introduction to economics course and the rest of bachelor’s degree studies in economics must undergo a profound change in order to become more balanced and relevant to the modern economy. It’s our job, as professors of economics.

The typical training of those who determine economic policy in Israel is a bachelor’s degree in economics and a master’s degree in administration. There is a need for a basic change in this training and in the public discourse in order to stop the deterioration of the public sector and the damage to its professionalism.

If not, elementary and secondary education will not recover from their sad state, and the universities will find themselves in a deep financial crisis. The relative advantage of the State of Israel — its human capital — will disappear. Institutions such as the National Insurance Institute and the Bank of Israel will lose professionals to the private sector, and Israel’s good standing in international bodies will become eroded. And the quality of life in Israel, instead of advancing toward that of the West, will deteriorate to the level of the Third World.

Avia Spivak is the deputy governor of the Bank of Israel and a lecturer in economics at Ben-Gurion University of the Negev. This article originally appeared in Ha’aretz, whose Web site is www.haaretzdaily.com.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

Readers like you make it all possible. We’ve started our Passover Fundraising Drive, and we need 1,800 readers like you to step up to support the Forward by April 21. Members of the Forward board are even matching the first 1,000 gifts, up to $70,000.

This is a great time to support independent Jewish journalism, because every dollar goes twice as far.

— Rachel Fishman Feddersen, Publisher and CEO

2X match on all Passover gifts!

Most Popular

- 1

Film & TV What Gal Gadot has said about the Israeli-Palestinian conflict

- 2

News A Jewish Republican and Muslim Democrat are suddenly in a tight race for a special seat in Congress

- 3

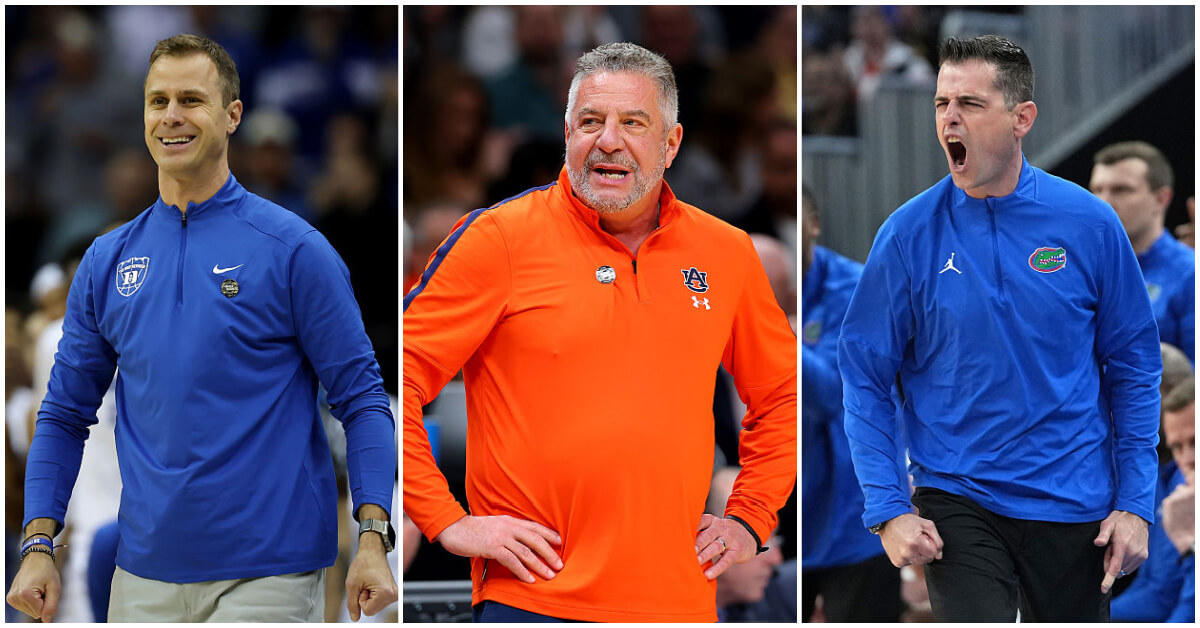

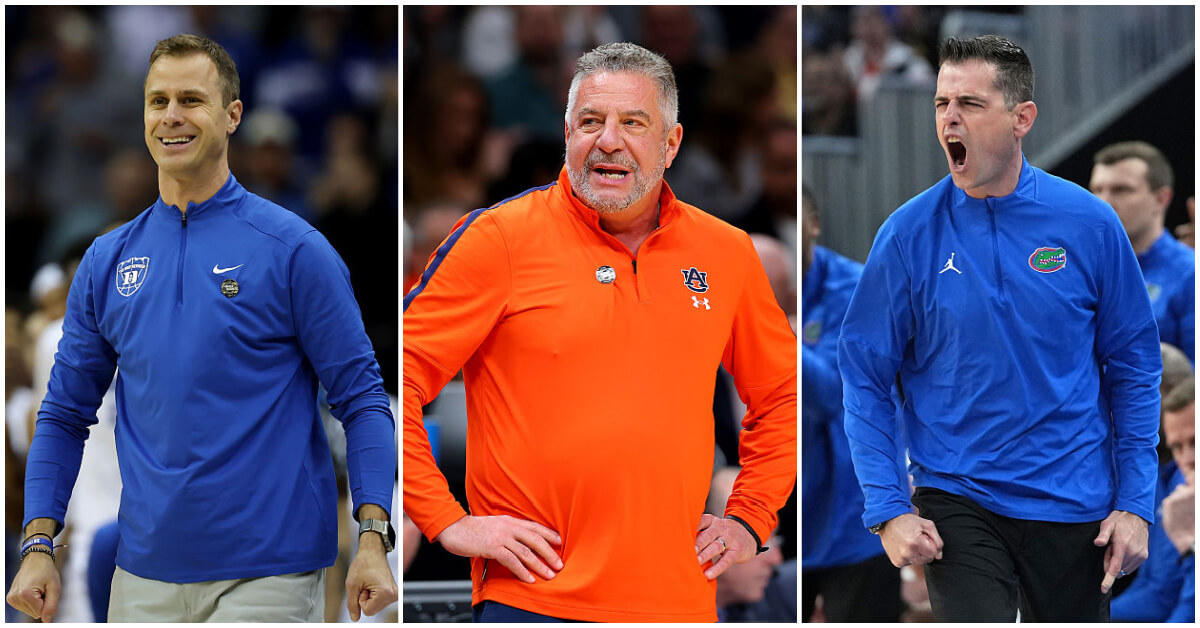

Fast Forward The NCAA men’s Final Four has 3 Jewish coaches

- 4

Culture How two Jewish names — Kohen and Mira — are dividing red and blue states

In Case You Missed It

-

Books The White House Seder started in a Pennsylvania basement. Its legacy lives on.

-

Fast Forward The NCAA men’s Final Four has 3 Jewish coaches

-

Fast Forward Yarden Bibas says ‘I am here because of Trump’ and pleads with him to stop the Gaza war

-

Fast Forward Trump’s plan to enlist Elon Musk began at Lubavitcher Rebbe’s grave

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.