Jack Lew Faces $1M Caymans Snag on Path to Treasury Confirmation

Surprise Snag: Will the $1 million bonus Jack Lew received from bailed-out Citi turn into a surprise roadblock in his path to confirmatio as treasury secretary? Image by getty images

Jack Lew, President Barack Obama’s pick to be U.S. treasury secretary, is expected to come under fire for the administration’s budget policies and a nearly $1 million bonus he received from bailed-out bank Citigroup when he testifies on Wednesday before a Senate panel vetting him for the job.

The hearing will briefly become ground zero in the pitched political battle over the federal budget, with Republicans set to attack over what they contend is Lew’s devil-may-care attitude to reducing the U.S. budget deficit.

Republicans have signaled that Lew, Obama’s former chief of staff and budget director, will be critiqued for his role in preparing proposals that piled on deficits and probed on the president’s plans to put government-run healthcare and retirement programs on sounder footing.

“He’ll be used as a political ping-pong ball,” said Ted Truman, a senior fellow at the Peterson Institute for International Economics who served briefly as an adviser to Obama’s former treasury secretary, Timothy Geithner. Geithner left the administration in January.

Lew, who would be the first Orthodox Jew to hold the post, was the administration’s point person during budget talks in 2011 that ended with a deal to raise the nation’s debt ceiling, cap discretionary spending and put in place $1.2 trillion in automatic budget cuts over 10 years.

During those negotiations, his hard-line position in defense of government-run benefit programs angered Republicans.

Most Republicans, however, have said they will reserve judgment on Lew until after Wednesday’s hearing, and he is widely expected to win the Senate’s needed backing even if he ends up facing substantial opposition.

Republican lawmakers are expected to push Lew on his earlier resistance to proposed changes to the Medicare healthcare and Social Security retirement programs, such as using an slower growing inflation index to calculate retirement benefits.

“We need a better understanding … of what kind of plan the Obama administration has to confront our skyrocketing debt and our broken entitlement programs,” said Senator Orrin Hatch, the top Republican on the finance panel.

Realistically, it does not appear Lew could win confirmation earlier than Feb. 25. After the hearing, the former budget chief will need time to respond to any additional questions senators may have and Congress begins a one week break on Friday.

That means the Senate would not be able to confirm Lew in time for him to attend a meeting of finance chiefs from the Group of 20 nations in Moscow on Friday and Saturday.

CITIGROUP AND THE CAYMAN ISLANDS

At the hearing, Republicans plan to zero in on Lew’s short stint at Citigroup. Lew, who has publicly said that he has scant expertise in financial markets, spent two years at the bank during Wall Street’s meltdown, earning a combined $2.65 million in 2007 and 2008, according to a transcript of his confirmation hearing in 2009 for a State Department post.

Hired with a recommendation from then-Citi executive and former Treasury Secretary Robert Rubin, Lew became chief operating officer of Citigroup’s global wealth management division in July 2006. He later became COO for Citi Alternative Investments, a largely administrative role that was apart from investment decisions that hurt the bank.

Republican Senator Charles Grassley said he will ask Lew about a $940,000 bonus he was given just before the bank received a taxpayer-funded bailout. The bonus came as Lew was getting ready to serve as a State Department deputy for the Obama administration.

“The Treasury secretary can’t owe anyone on Wall Street any favors,” Grassley, a member of the Finance Committee, said in an emailed statement. “He has to be independent from special interests and put taxpayers first.”

Lew’s record at Citigroup came up during his confirmation hearing for the State Department position, but it failed to prove a stumbling block.

“This is not his first rodeo,” said Jared Bernstein, a former adviser to Vice President Joe Biden who is now with the Center on Budget and Policy Priorities. “It just doesn’t seem to me that there’s a smoking gun there.”

Republicans also want to ask Lew about a $56,000 investment he once had in a Citigroup venture capital fund registered in the Cayman Islands. Lew lost $1,582 when he had to divest his position in the fund to serve as Obama’s budget chief.

The CVCI Growth Partnership II fund’s registered office is listed as the Ugland House, according to a securities filing, a Cayman Island office building with thousands of companies registered that has become a symbol of offshore tax evasion. Ugland House was criticized by Obama when he was campaigning for president.

The White House said Lew’s investment was disclosed during both his confirmation for the State Department post and for White House budget director.

“(Lew) played no role in creating, managing or operating the fund and he sold his investment in 2010 at a net loss,” said White House spokesman Eric Schultz. “There are no new facts that provide a basis for senators to reach a different conclusion about Mr. Lew’s nomination than they reached twice before.”

Although Democrats control the Senate 53-45, they would need at least seven Republicans to support Lew if any lawmaker decides to throw up a procedural hurdle.

Senator Jeff Sessions, the top Republican on the Budget Committee, has said Lew is not fit to become treasury secretary and has threatened to make the confirmation difficult unless the White House clears up a healthcare law dispute.

Bernie Sanders, an independent who caucuses with the Democrats, has also said he will vote against Lew.

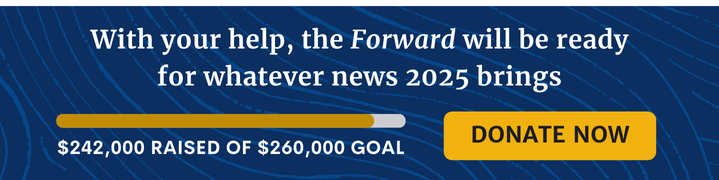

A message from our Publisher & CEO Rachel Fishman Feddersen

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism during this critical time.

We’ve set a goal to raise $260,000 by December 31. That’s an ambitious goal, but one that will give us the resources we need to invest in the high quality news, opinion, analysis and cultural coverage that isn’t available anywhere else.

If you feel inspired to make an impact, now is the time to give something back. Join us as a member at your most generous level.

— Rachel Fishman Feddersen, Publisher and CEO