Y.U. Debt Rating Downgraded to Junk

Image by © Matthew X. Kiernan/New York Big Apple Images

Bond rating agency Moody’s has once again downgraded Yeshiva University’s debt, this time to junk bond status.

In a statement on January 9, Moody’s announced it was dropping the troubled Modern Orthodox institution’s rating to B1 from Baa2, saying that it might fall farther in the future.

This marks the first time that Y.U.’s debt rating has fallen below investment grade, into the broad category known as junk. B1-rated debt is considered speculative and subject to high risk, according to Moody’s. It is a number of levels worse than Baa2, the rating Moody’s gave Y.U. in October.

“The magnitude of the downgrade to B1 reflects the depth of operating and cash flow deficits concurrent with extremely thin unrestricted liquidity and lack of a clear strategy to regain financial equilibrium,” the Moody’s report read.

Y.U. responded to the report in a statement on January 10, saying that the school was working to fix the problems that it detailed. “The recent decision by Moody’s was not unexpected based on its previous commentary and, in fact, we are already addressing many of the issues outlined in the report,” the statement read.

Y.U.’s finances have been in acute crisis in recent months. According to data included in a report from Moody’s rival Standard & Poor’s, the school’s operating deficit in 2013 was significantly larger than its $106 million deficit in 2012.

The school also faces a $380 million lawsuit from victims of alleged sex abuse at the high school for boys attached to Yeshiva University. A judgment on the school’s motion to dismiss in that case is pending.

This marks the third recent downgrading of Y.U.’s debt by a credit rating agency in recent months. Moody’s dropped the school’s rating in October, and Standard & Poor’s followed in December.

There have been some bright spots for the school in recent months as well: Y.U.’s medical school received a $160 million bequest in 2013.

According to the report, Y.U. currently has $567 million in outstanding debt. Some of that debt is newly incurred — the school took a $60 million, six-month loan from Bank of America in December 2013. The school expects to run deficits in each of the next three fiscal years.

“The university has become increasingly reliant on external credit facilities to support operations,” Moody’s wrote. “Deep structural operating imbalance is expected to continue for the intermediate term.”

Moody’s also reported that the school is relying heavily on its endowed funds to pay its day-to-day operating costs and to cover interest on its debt. The analysts have little hope for Y.U. to recover soon.

In its response to the rating drop, Y.U. emphasized the few positive statements in the Moody’s report. “Moody’s noted several positive considerations including our history of strong donor support and healthy revenue diversity, as well as the relatively large size of the University’s assets (including marketable real estate and the endowment),” Y.U. wrote. “We will continue to confer with our rating agencies and other financial institutions to keep them fully informed of our remedial plans and actions to earn their increased confidence over time.”

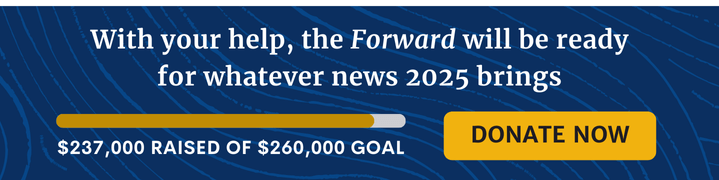

A message from our Publisher & CEO Rachel Fishman Feddersen

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism during this critical time.

We’ve set a goal to raise $260,000 by December 31. That’s an ambitious goal, but one that will give us the resources we need to invest in the high quality news, opinion, analysis and cultural coverage that isn’t available anywhere else.

If you feel inspired to make an impact, now is the time to give something back. Join us as a member at your most generous level.

— Rachel Fishman Feddersen, Publisher and CEO