Steve Mnuchin’s Bank ‘Robo-Signed’ 6,000 Foreclosures a Week

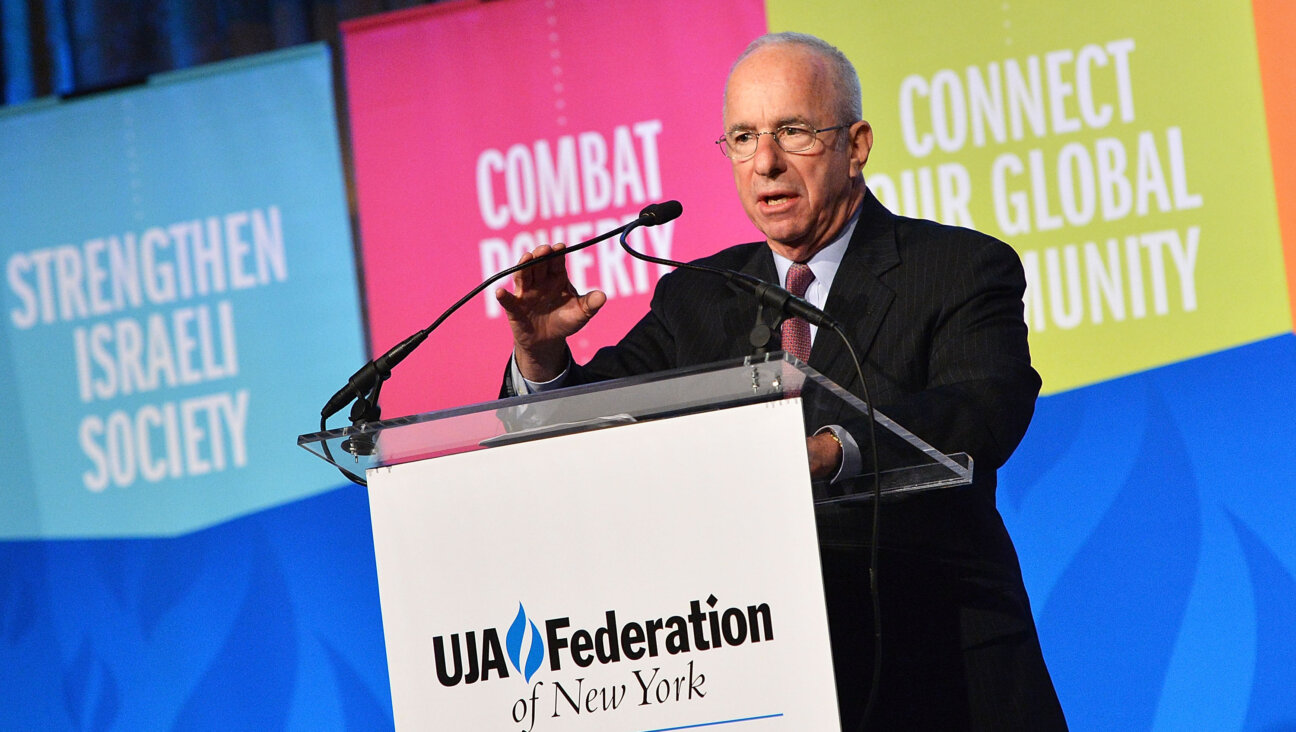

Image by Getty Images

Steve Mnuchin’s financial skeletons could come back to haunt him as he tries to win confirmation as President-elect Donald Trump’s Secretary of the Treasury. A leaked memo from the California Attorney General’s office that alleges his bank routinely violated the state’s laws in foreclosing on homes.

A bank executive admitted “robo-signing” foreclosures every 30 seconds, for a total of 6,000 a week at the height of the 2009 financial crisis, according to the document, given to the Intercept by an unnamed source.

Mnuchin’s OneWest bank violated California rules by failing to observe notice and waiting period requirements, backdating documents key to the foreclosure process and fixing home auctions in their favor. Staffers at the office’s Consumer Law section recommended that Attorney General Kamala Harris investigate, which she declined to do so, vexing consumer advocates.

OneWest (originally IndyMac), which Mnuchin bought in 2009 and sold in 2015, already was facing scrutiny for its foreclosure practices, which included tossing out a homeowner in a blizzard and foreclosing on a property due to an underpayment of 27 cents. Democrats have vowed to closely scrutinize Mnuchin’s nomination for this reason.

Contact Daniel J. Solomon at [email protected] or on Twitter @DanielJSolomon

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 2

News School Israel trip turns ‘terrifying’ for LA students attacked by Israeli teens

- 3

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 4

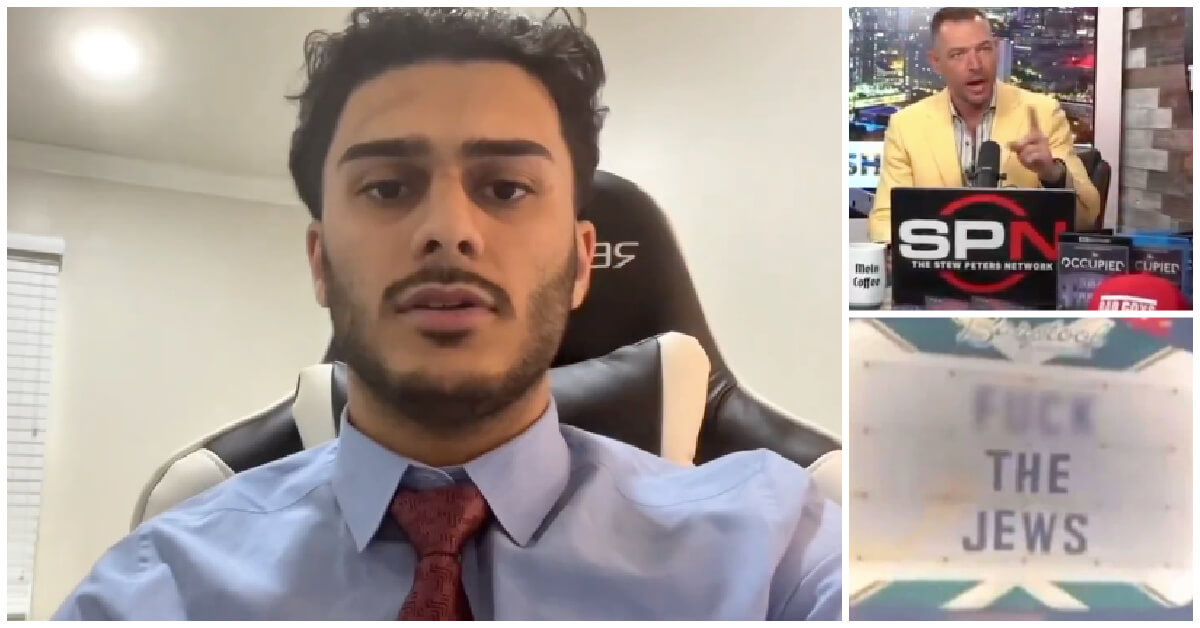

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Yiddish קאָנצערט לכּבֿוד דעם ייִדישן שרײַבער און רעדאַקטאָר באָריס סאַנדלערConcert honoring Yiddish writer and editor Boris Sandler

דער בעל־שׂימחה האָט יאָרן לאַנג געדינט ווי דער רעדאַקטאָר פֿונעם ייִדישן פֿאָרווערטס.

-

Fast Forward Trump’s new pick for surgeon general blames the Nazis for pesticides on our food

-

Fast Forward Jewish feud over Trump escalates with open letter in The New York Times

-

Fast Forward First American pope, Leo XIV, studied under a leader in Jewish-Catholic relations

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.