‘Shadow Economy’ Grows Fast Outside Israeli Taxman’s Reach

Show Me the Money: Israel’s shadow economy means the state loses out on billions of shekels per year that could be used for public services. Image by Getty Images

When Israeli tax authorities visit Rena’s craft supply stores in East Jerusalem, Rena’s off-the-books employees know the drill: Either leave the building or pretend to be a customer. The charade is practically second nature to Rena’s staff; in the 60-plus years her family has owned and operated businesses in Jerusalem, they have always supplemented a small number of legal employees with off-the-books workers in order to boost business without paying extra taxes.

“Everyone does this,” said Rena, whose real name is withheld in order to protect her from the tax authorities. “You think, ‘Okay, it’s fine.’”

Rena’s situation is representative of a larger reality in East Jerusalem and Israel in which evading taxes is part and parcel of running a small business. Whether hiring off-the-books employees, underreporting wages or offering customers a lower price for paying cash and forgoing a receipt, countless employers conceal a portion of their earnings from the government. The result is that Israel has a vast “shadow economy” of hidden income earned from legal economic activity.

According to a new report from the Taub Center for Social Policy Studies in Israel, Israel’s shadow economy is more than twice as big as that of the United States and amounts to more than a fifth of Israel’s gross domestic product. Relative to its GDP, Israel has the 12th-largest shadow economy of the 34 countries in the Organisation for Economic Co-operation and Development. (Switzerland has the smallest shadow economy by the same metric, and Estonia has the largest one.)

What’s more, Israel’s shadow economy means the state loses out on billions of shekels per year that could be used for public services. (The report’s scope includes East Jerusalem, which Israel annexed after the 1967 War but which the international community considers occupied territory.)

Tax concealment in Israel is so widespread that it has become a “cultural sport,” said Guy Levi, spokesman for former deputy minister of finance Mickey Levy. “In Israel, everyone does it. It is not considered a bad thing. It is a legitimate thing.”

There are many reasons that Israel has such a large shadow economy, not the least of which is that it is a relatively young country. According to Noam Gruber, author of the Taub Center report, many countries start out with informal economies that eventually become streamlined as electronic payments, and checks replace cash transactions. “I think Israel’s economy is heading that way but it still has islands of shadow economy,” he said.

But Israel’s economy reality has also been shaped by tax policy and international politics. When the Arab League boycott of Israel kicked off after the 1948 war, Israel had trouble attracting overseas investment, which in turn led the government to eventually favor big business as a way to bolster the economy. Historically, large corporations have been far more effective than small businesses in Israel at lobbying for tax breaks. Today, some major multinational and Israeli companies pay as little as 5% in income tax, while small businesses pay 26.5%. Add to this the burden of tax filing — which in Israel’s bureaucratic system can take up to 235 hours per year — and small business owners feel they must cheat to get by.

It is widely thought that Arab and Haredi communities are major contributors to the shadow economy, since lack of employment encourages people to take any job, even underground labor. In recent years, the largely unregulated rental housing industry has also become a large component of the shadow economy.

In Rena’s case, hiring workers off the books allows her to save money on wages and also on bituach leumi, the national Social Security plan into which all Israeli citizens and East Jerusalem Palestinian residents, such as Rena herself, must contribute. Rena said that there is no shortage of people willing to work under the table. In late January, she recalled, she offered a woman a full-time job for just 1,500 shekels per month (about $380), less than half of what she pays her more seasoned — and legal — employees. Rena was shocked when the woman accepted. “I said, ‘Why don’t you have a problem? I know it’s a very small amount.”

But business owners like Rena are also unlikely to get caught. According to Gruber’s report, Israel’s Tax Authority spends less than 1% of its budget on enforcement, which, he said, consists of “randomly auditing tax filings by hand.” The Tax Authority, which is just starting to switch out its long-outdated computer equipment, is notoriously nontransparent and hasn’t published an annual report since 2009. “It is problematic for me to pass criticism on a body this opaque,” Gruber said. “I have very little material to say anything about it.” A call to the Tax Authority went unreturned.

In addition, the Israeli public is complicit in the shadow economy. Unlike in the United States, where a family can get tax deductions based on its expenditures, Israelis are taxed on their wages. “Customers do not have that incentive to ask for a receipt,” Gruber said. In Israel, many service-oriented businesses — such as car mechanics — have a special no-tax rate for customers who pay by cash. “We are splitting the tax amongst ourselves,” Gruber said. “It is good for me and good for you. I pay less, and you get to keep more money.”

Image by Getty Images

Yet while the individual cost of evading taxes is low, the cost to Israeli society is steep. According to the report, if the shadow economy were halved, Israel could recoup some 30 to 40 billion shekels (about $7.5 billion to $10 billion), increasing state revenues by 3% to 4% without ever having to raise taxes.

Tackling the shadow economy, in fact, was a major project of Levy, who is running on the Yesh Atid ticket in the March election. During his two-year tenure, Levy met with thousands of Tax Authority workers the country over to streamline their tax collection process and set goals for each individual office. The payoff was evident: In 2014, the Tax Authority raked in 4 million shekels, or $1 million, more than its goal for the year. The extra funds went to education, welfare services and care for Holocaust survivors. “It’s a lot of money to play with,” Levi said.

Yet despite its successes, Levi said that Yesh Atid won’t specifically address the shadow economy in its election campaign. “It’s not a sexy issue,” he said. “Mickey did a lot of things, and he had good success that nobody knows about in Israel. The public doesn’t care.”

Gruber added that while the Israeli public has become more invested in economic issues in recent years — as evidenced by the 2011 social justice protests — security issues will always sway voters more than bread-and-butter concerns.

“It makes the public discussion in Israel very one-dimensional,” he said. “It is live or die, war or peace, peace process yes and no, and Israelis have become used to relying on the state as ‘Big Brother,’ a fatherly organization that protects them. Public discussion in Israel is much more pro-Big State, the state as the solution, versus in the United States, where the state is the problem.”

As far as Rena is concerned, the shadow economy is simply business as usual. She said that every shop owner she knows also hires workers off the books, though no one admits to it. “Everyone knows that everyone does it,” she said. “We don’t talk about this.”

Contact Naomi Zeveloff at [email protected] or on Twitter, @naomizeveloff

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 4

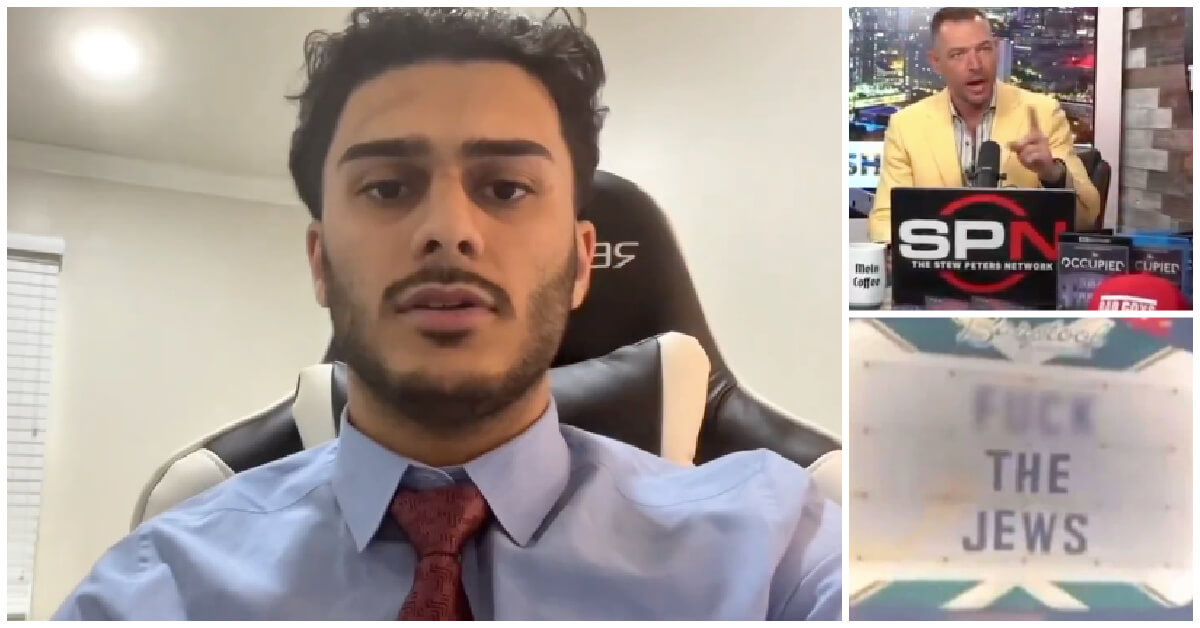

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Culture Should Diaspora Jews be buried in Israel? A rabbi responds

-

Fast Forward In first Sunday address, Pope Leo XIV calls for ceasefire in Gaza, release of hostages

-

Fast Forward Huckabee denies rift between Netanyahu and Trump as US actions in Middle East appear to leave out Israel

-

Fast Forward Federal security grants to synagogues are resuming after two-month Trump freeze

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.