Israel Raises Taxes on the Rich

Prime Minister Benjamin Netanyahu’s cabinet approved the taxation portion of the Trajtenberg report on Sunday, levying heavier taxes on both corporations and the extremely wealthy.

Earlier this month, the cabinet approved in principle the report by the Trajtenberg Committee for socioeconomic change, the result of a social protest movement which swept Israel all summer.

The Trajtenberg taxation recommendations, which were voted in unanimously on Sunday, included raising the highest tax bracket from 45% to 48%, as well as raising the tax on interest, dividends, stock market profits by 5%.

An additional tax of 2% will also be levied on those with exceptionally high salaries, and the corporate tax is planned to go from 24% to 25% in 2012.

The report’s chapter approved Sunday also included tax breaks for young parents, worth NIS418 for every child under 3 years old, as well as a drop of NIS0.4 in gasoline prices. The benefits are planned to go into effect in 2012.

All of the recommendations approved by the government need to pass in the Knesset as well, where they will go up for a vote toward the end of this year.

For more go to Haaretz.com

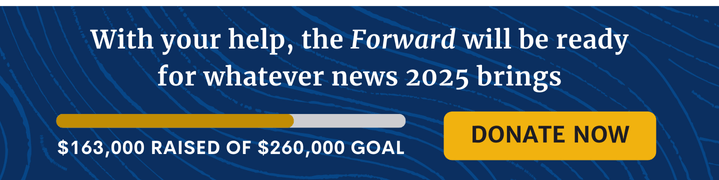

A message from our Publisher & CEO Rachel Fishman Feddersen

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism during this critical time.

We’ve set a goal to raise $260,000 by December 31. That’s an ambitious goal, but one that will give us the resources we need to invest in the high quality news, opinion, analysis and cultural coverage that isn’t available anywhere else.

If you feel inspired to make an impact, now is the time to give something back. Join us as a member at your most generous level.

— Rachel Fishman Feddersen, Publisher and CEO