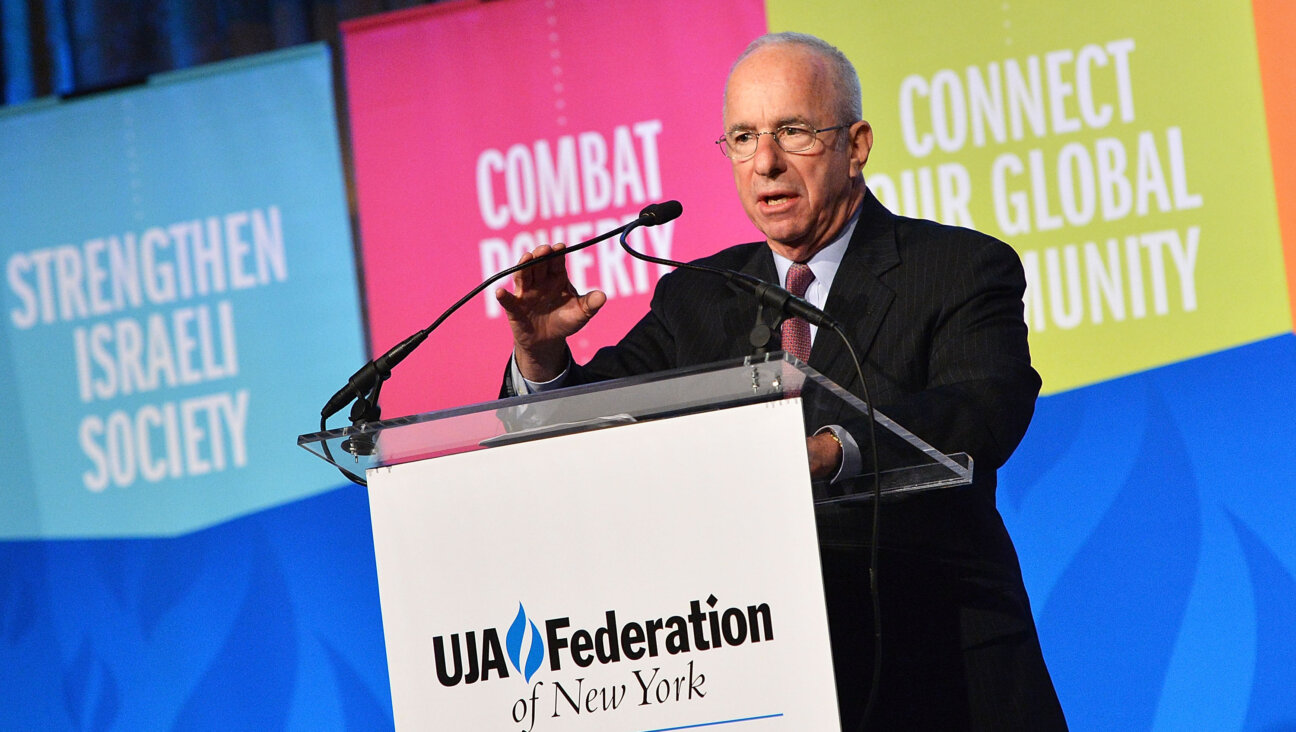

Treasury Pick Jack Lew Faces Senate Grilling on Caymans, Bonus

Image by getty images

Jack Lew, President Barack Obama’s nominee to lead the U.S. Treasury Department, faces a grilling about a big bonus he received from Citigroup and his plans for the government’s finances when he testifies before a Senate panel on Wednesday.

Lew, a 57-year-old New Yorker who is White House chief of staff, is a budget wonk who would rather avoid television cameras, Obama has said.

But he will be in the spotlight on Wednesday over his own finances, namely a $940,000 bonus he received in January 2009 after a brief stint at Citigroup, just before the bank received a taxpayer-funded bailout.

Republicans on the Senate Finance Committee, which will vet Lew for Treasury secretary, also plan to ask him about his role at the Wall Street bank, especially as chief operating officer of Citi Alternative Investments.

“If taxpayers are going to prop up failed banks, they have a right to know what a key executive like Mr. Lew did at that time,” Senator Orrin Hatch, the ranking Republican on the Finance Committee, said in a statement.

Lew and others familiar with his work at Citi have said his role was largely administrative and was separate from any financial portfolio decisions. In remarks prepared for delivery to the Senate panel and obtained by Reuters, Lew said his work at Citi focused on “trying to drive organizational change.”

Nonetheless, Lew’s confirmation hearing will serve as a battlefield in the budget wars that have divided Washington. The senior Republican on the Senate Budget Committee, Senator Jeff Sessions of Alabama, has already said Lew is unfit to serve.

However, there is no widespread opposition to the nomination and with Democrats controlling the Senate 53-45, Lew is widely expected to win confirmation later this month.

At the hearing, Republicans also plan to focus on a $56,000 investment Lew once had in a Citigroup venture capital fund registered in the Cayman Islands.

Obama criticized such offshore accounts when he campaigned for re-election last year. But the White House said the investment should not get in the way of Lew’s confirmation given that it was already known when he was confirmed for two other government positions, including White House budget chief.

Hatch and others also said they will ask Lew about his knowledge of financial markets, where Lew has admitted to a lack of experience, despite his time at Citigroup.

The treasury secretary serves as chair of the Financial Stability Oversight Council, a panel of banking and market regulators that is close to imposing additional rules on a handful of large, complex financial institutions meant to ensure they do not threaten the stability of the financial system.

Lew lacks the international stature of his predecessor, Timothy Geithner, who had met regulators from around the world as president of the New York Federal Reserve Bank and who was a senior financial diplomat in a prior stint at the U.S. Treasury.

Lew served as deputy secretary of state under Hilary Clinton, but his main responsibility there was managing the State Department’s resources.

His real passion is for budgets. He worked as the White House budget chief twice, first under President Bill Clinton.

“Budgets aren’t books of numbers. They’re a tapestry, the fabric, of what we believe,” he told Congress in 2010.

Analysts said the choice of Lew as the administration’s top economic official signals the importance Obama places on ongoing battles in Washington over the government’s budget.

If confirmed, Lew will take the helm at Treasury as the White House heads into another round of difficult talks with Congress on how to put the United States on a sound fiscal footing.

Senate Democrats are expected this week to reveal a series of targeted spending cuts and tax increases on high earners to replace across-the-board federal spending cuts due to kick in on March 1. Senate Republicans are likely to reject any proposal that includes tax hikes.

In his prepared testimony, Lew spoke out strongly against allowing the automatic cuts to take place on March 1, saying they would impose “self-inflicted wounds” on a fragile economic recovery.

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 2

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 3

News School Israel trip turns ‘terrifying’ for LA students attacked by Israeli teens

- 4

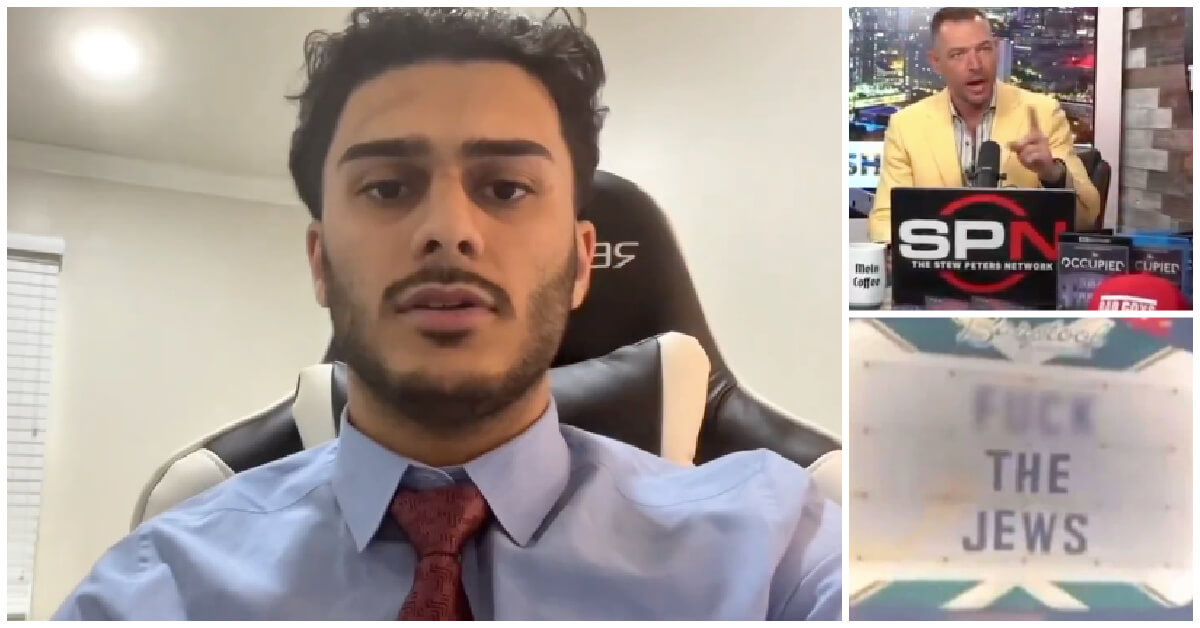

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Opinion This week proved it: Trump’s approach to antisemitism at Columbia is horribly ineffective

-

Yiddish קאָנצערט לכּבֿוד דעם ייִדישן שרײַבער און רעדאַקטאָר באָריס סאַנדלערConcert honoring Yiddish writer and editor Boris Sandler

דער בעל־שׂימחה האָט יאָרן לאַנג געדינט ווי דער רעדאַקטאָר פֿונעם ייִדישן פֿאָרווערטס.

-

Fast Forward Trump’s new pick for surgeon general blames the Nazis for pesticides on our food

-

Fast Forward Jewish feud over Trump escalates with open letter in The New York Times

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.