Jack Lew Wins Over Treasury Critics With Tax Reform Call

Jack Lew, President Barack Obama’s pick to be U.S. treasury secretary, on Wednesday defused heated questions from lawmakers about his work at Citigroup and managed to find common ground with critics over the need for tax reform.

At a hearing on his nomination, Republicans blasted Lew with questions about his investment in a fund linked to the Cayman Islands and his time at Citigroup, especially a $940,000 bonus he received just before the bank got a taxpayer-funded bailout.

Lew, sounding calm and confident, told the Senate Finance Committee that his compensation at Citigroup was in line with others who worked in the financial industry.

His background at the bank aside, the hearing underscored differences between Democrats and Republicans on how best to rein in U.S. budget deficits but also highlighted a common desire to reform the tax code. Lew struck a conciliatory stance, repeatedly saying he looked forward to working with Congress on a bipartisan basis.

He said revamping the tax code would be “at the very top” of his priorities.

The questioning was largely respectful and free of drama. Even the top Republican on the committee, Orrin Hatch, one of Lew’s most persistent critics, had only nice things to say at the end of the 3-1/2-hour vetting.

“Frankly, I think you’ve done really well,” he told Lew.

The smooth performance further cemented Lew’s prospect of winning the Senate’s needed backing. While most Republicans have withheld judgment, Democrats control the Senate 53-45.

CITI STINT

During the hearing, Hatch zeroed in on Lew’s work as an executive at Citigroup as a possible conflict of interest for a job that would have him overseeing financial markets.

Hatch said he was unclear about what Lew did as chief operating officer at two Citigroup units, one of which engaged in proprietary trading. As treasury chief, Lew would oversee rules that seek to prevent such trading.

“If you were to be confirmed, it could lead to an awkward situation in which … you would effectively be saying to financial firms: Do as I say, not as I did,” Hatch told Lew.

Lew said there were no conflicts of interest. While at Citigroup, he said he was mainly in charge of managing an operating budget and was not involved in investment decisions.

Lew was also grilled about a $56,000 investment he once had in a Citigroup venture capital fund registered in the Cayman Islands. Republican Senator Pat Roberts briefly displayed a blown-up picture of Ugland House, a Cayman Island office building where thousands of companies registered, including the fund in which Lew invested.

Obama has criticized the use of offshore tax havens and had singled out Ugland House in his first election campaign.

“There’s a certain hypocrisy in what the president says about other taxpayers, and your appointment,” Republican Senator Chuck Grassley said during the hearing.

Lew told the panel he did not initially know his investment was registered in the Cayman Islands. He said he did not receive any tax benefit from the investment, as he sold it at a loss.

“I think it’s clear I recorded all income that I earned. I paid all taxes as appropriate,” Lew said. “I very strongly believe that we should have tax policies that make it difficult if not impossible to shelter income from taxation.”

HARD TAX CHOICES

The need to reform the tax system, which has not had an overhaul since 1986, was a central focus of the hearing, with much of the questioning centering on the corporate tax code.

Obama has proposed cutting the top corporate rate to 28 percent from 35 percent. Republicans want it dropped to 25 percent.

“As a general rule, if there were a lot of easy decisions on tax reform, it would have happened a long time ago,” Lew said. “There are going to be hard choices.”

A 57-year-old New Yorker who until recently was White House chief of staff, Lew is a budget wonk who has spent much of his career in public service in Washington.

Lew’s lack of financial markets experience has worried some business executives. But during the hearing, the former budget chief was able to answer fairly detailed questions on credit derivatives and financial regulation.

The nominee also pledged fealty to the long-standing U.S. policy view that a strong dollar is in the nation’s interest and repeated the administration’s position that China’s currency remains undervalued, signaling an intent to keep pressing Beijing to let market forces more freely determine its value.

“We work through the international bodies, the G7, the G20, to advance the view that it’s not just the United States, but the organized nations of the world that insist on having currency policies which are market-determined,” he said.

Lew lacks the international stature of his predecessor, Timothy Geithner, who had met regulators from around the world as president of the New York Federal Reserve Bank and was a senior financial diplomat in a prior stint at the U.S. Treasury.

But Lew said he met plenty of foreign dignitaries while serving as a deputy secretary of state under Hillary Clinton, where his main responsibility was managing the State Department’s resources. He also met with top leaders while at the White House as chief of staff, he told lawmakers.

Lew’s real passion is for budgets. He worked as the White House budget chief twice, first under President Bill Clinton.

Analysts said the choice of Lew as the administration’s top economic official signals the importance Obama places on ongoing battles in Washington over the government’s budget.

Senator Max Baucus, the chair of the Finance Committee, said he expects to hold a vote on Lew’s nomination after Congress returns from a week-long break in late February. Lew would then have to be confirmed by the full Senate.

That would come as the White House and Congress near a March 1 deadline to deal with $85 billion in automatic budget cuts that Lew said would impose “self-inflicted wounds” to the U.S. economic recovery.

At the end of the hearing, Baucus and others repeatedly questioned if Lew had sufficient gravitas to be the chief U.S. economic spokesman.

“On the things I believe, I’ve never withheld my judgment,” Lew said. “But the thing I would say that’s different about Treasury is it is a job that requires you to transcend politics … I understand that.”

The Forward is free to read, but it isn’t free to produce

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward.

Now more than ever, American Jews need independent news they can trust, with reporting driven by truth, not ideology. We serve you, not any ideological agenda.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

This is a great time to support independent Jewish journalism you rely on. Make a gift today!

— Rachel Fishman Feddersen, Publisher and CEO

Support our mission to tell the Jewish story fully and fairly.

Most Popular

- 1

Fast Forward Ye debuts ‘Heil Hitler’ music video that includes a sample of a Hitler speech

- 2

Opinion It looks like Israel totally underestimated Trump

- 3

Culture Cardinals are Catholic, not Jewish — so why do they all wear yarmulkes?

- 4

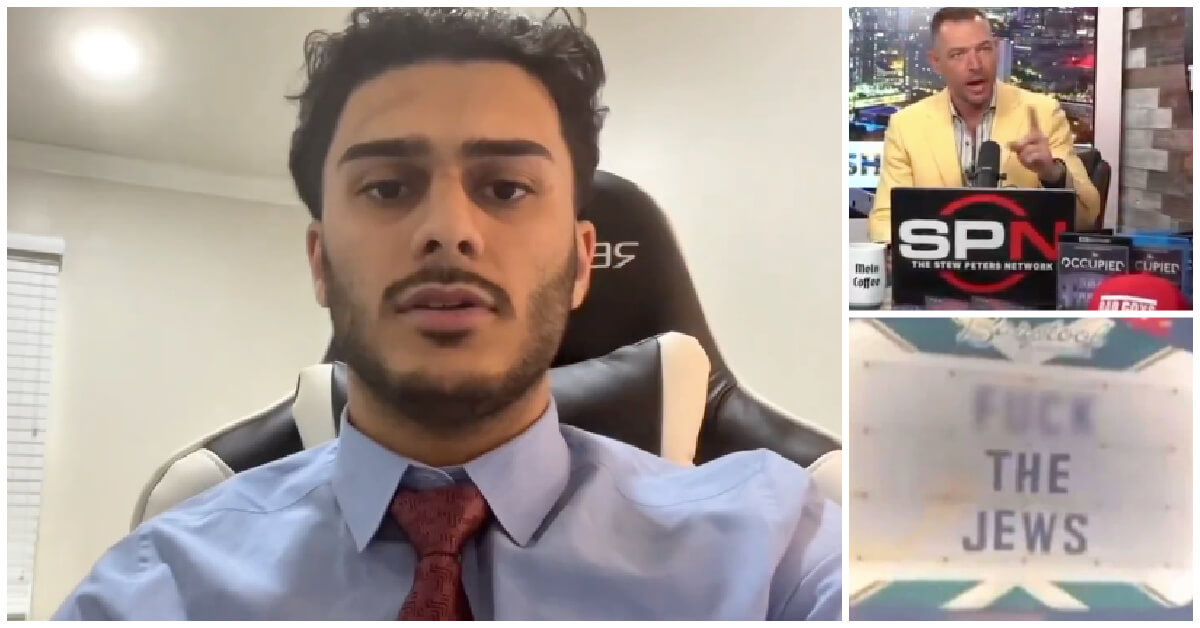

Fast Forward Student suspended for ‘F— the Jews’ video defends himself on antisemitic podcast

In Case You Missed It

-

Fast Forward In first Sunday address, Pope Leo XIV calls for ceasefire in Gaza, release of hostages

-

Fast Forward Huckabee denies rift between Netanyahu and Trump as US actions in Middle East appear to leave out Israel

-

Fast Forward Federal security grants to synagogues are resuming after two-month Trump freeze

-

Fast Forward NY state budget weakens yeshiva oversight in blow to secular education advocates

-

Shop the Forward Store

100% of profits support our journalism

Republish This Story

Please read before republishing

We’re happy to make this story available to republish for free, unless it originated with JTA, Haaretz or another publication (as indicated on the article) and as long as you follow our guidelines.

You must comply with the following:

- Credit the Forward

- Retain our pixel

- Preserve our canonical link in Google search

- Add a noindex tag in Google search

See our full guidelines for more information, and this guide for detail about canonical URLs.

To republish, copy the HTML by clicking on the yellow button to the right; it includes our tracking pixel, all paragraph styles and hyperlinks, the author byline and credit to the Forward. It does not include images; to avoid copyright violations, you must add them manually, following our guidelines. Please email us at [email protected], subject line “republish,” with any questions or to let us know what stories you’re picking up.