See the Charts: Where the Taxes Come From, Where They Go

My latest column on taxes, deficits and debt, “Taking From the Poor and Giving to the Rich,” has stirred up quite a bit of discussion, which is fine. Much of it revolves around the credibility of my numbers, which is unfortunate. Herewith, a guide to the websites where the numbers are available, so you all can check for yourselves. Included are websites showing—year by year: What percentage of the population took home what share of total national income; What proportions of all federal revenue came from personal income tax, corporate tax and Social Security-Medicare payroll tax; How much the federal government took in, how much it spent and what the surplus or deficit came to; How much of the federal budget was spent on Social Security, Medicare and Medicaid; and lots more. I also give you biblical sources to clear up just how much of one’s income the Bible says it’s fair to give over in taxes to support the poor and the government bureaucracy. Here we go:

One of the most important guides to this whole discussion is this historical overview of the federal budget compiled by the Office of Management and Budget. It shows how much has been taken in and how much has been spent, both in hard numbers and as percentages, year by year. Totals of revenue, spending and surplus or deficit are shown, year by year — in dollars pp. 21-23, and as percentage of GDP pp. 24-25. This lets you see exactly when the budget was balanced and when it was in deficit.

Then you get to see receipts and spending broken down into categories. On pages 30-31 you can see the dollar amounts coming in from personal income tax, corporate tax and payroll tax (“social insurance and retirement”) as well as excise tax and “other,” year by year. The same categories are given on pp. 32-33 as percentages of the total budget, which lets you see how the regressive payroll tax has crept steadily upward as a percentage of total federal revenue, reducing the progressive impact of the income tax. In 2009 the payroll tax provided almost as much of the budget as the personal income tax (42.3% vs. 43.5%). Then, on pp. 34-35, you get federal receipts by source category as a percentage of GDP. How much of our total economy does the federal government actually eat up? It’s right there.

Pages 47-55 break down federal spending into major categories or “superfunctions” — defense, human resources (education, Social Security, Medicare, veterans), physical resources (transportation, housing, energy) and so on. Categories as percentages — of the budget and of GDP — are given separately, but they don’t break out Social Security or Medicare as percentages, so you have to do some math.

Those major categories are broken down further (air vs. ground transportation, veterans’ education vs. hospitals) from pages 56-76.

There’s much, much more in there if you’ve got the time, but those are the historical budget categories that I relied on.

Second, the very useful website of the Tax Foundation has charts that show very graphically what share of total national income was earned by which proportions of the population, broken down by annual income. What percentage did the bottom half of the population receive in 1994? What share did the top 10% get? The top 5%? It also shows how many people were in each category in each year, and what the income cut-off was between one percentile and another.

The Tax Foundation also has a chart that I’ve used in the past, but I came to understand this time around that it’s deceptive: what percentage of federal taxes are paid by each segment of the population. If you’re not paying attention, as I’ve failed to do in the past and some of our readers failed this time, you don’t notice that this only covers personal income tax. To see how much of federal revenue those income taxes represented in a given year, you have to go back to the federal budget history, pp. 32-33.

You’ll then want to go to the Tax Policy Center to see how much each segment of the population paid of total federal revenues. Comparing a population segment’s share of income tax revenue with its share of total federal revenue, then going back to the Tax Foundation to see its rising or falling share of the nation’s total income, shows very clearly how much more regressive the tax system has become over the past generation.

The Tax Policy Center also has a very useful chart of payroll tax rates year by year—showing not only what percentage of an individual’s income was taken off for Social Security, but also the income ceiling above which no tax was levied (that is, if the ceiling was $55,000 in 1992, only the first $55,000 of your income was charged payroll tax—every dollar you earned after that was untouched by payroll tax). When using it, note that OASDI and HI refer to Social Security and Medicare taxes (Old Age, Survivor and Disability Income versus Medical Insurance). They need to be added together to get the actual payroll tax taken from a paycheck in a given year—if you only look at the first column, the tax hikes look deceptively mild. Remember, too, that employees pay half of their payroll tax and their employer pays the other half, while self-employed people pay both halves.

The Social Security Administration itself has a chart showing the year-by-year worker to retiree ratio, or how many people are working in the economy to support each beneficiary in any given year. Note how the increase has sharply leveled off since 1980.

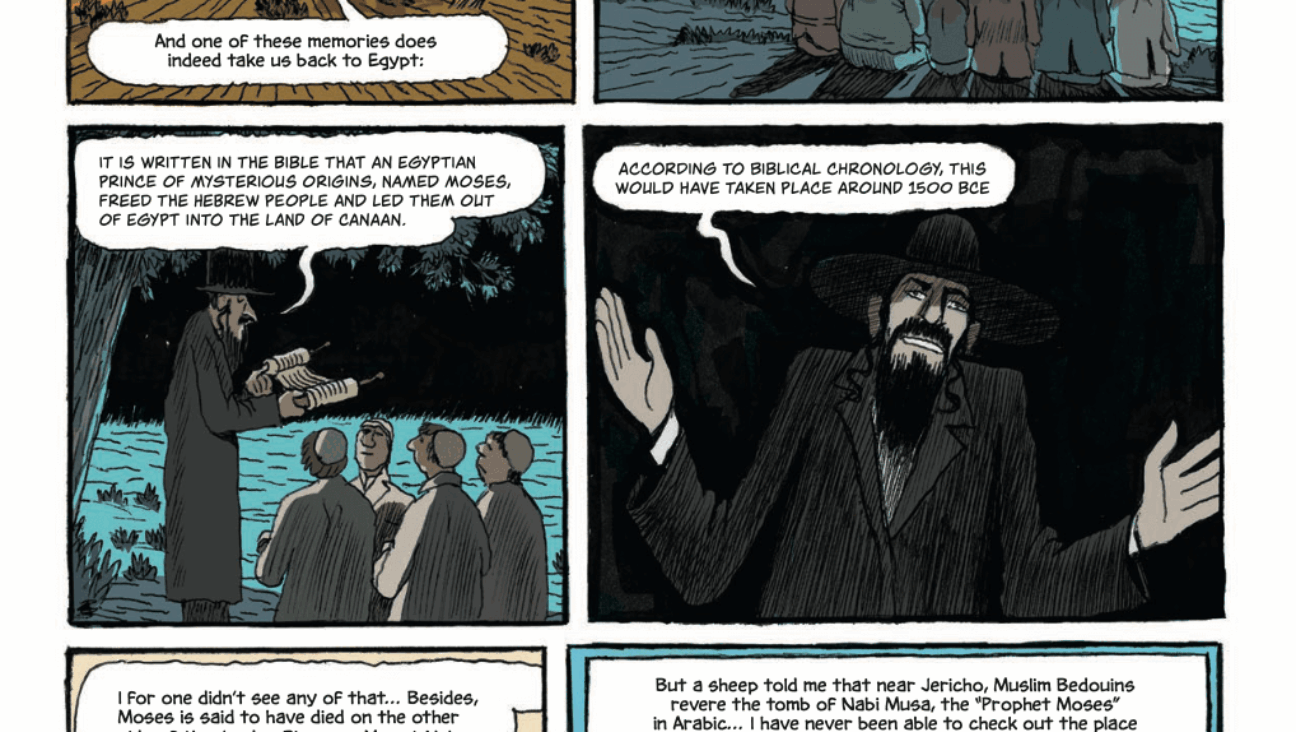

Numbers 18:8-19 the sacrifices and redemption taxes that went to support the Kohanim or priests, and the tithe of the Israelites that went to support the Levites. It’s often claimed that the ancient Israelites only had to pay 10% of their income (the tithe) in taxes, while we pay much more. The mistake is that the tithe was just the share that went to support the Levites—the salaries of the government bureaucracy, if you will. We pay much less for that purpose.

Two other taxes rarely get mentioned in discussions of biblical economic morality. First of all, gleaning: Farmers (which was just about everyone) were forbidden to harvest the corners of their field or pick up any wheat that fell to the ground during harvest. All of that belonged to the poor. Note that this was not intended as a recommended form of charity. It was law, as enforceable in its day as the IRS code is today. See Leviticus 19:9-10; Leviticus 23:22, and Deuteronomy 24:19-20. Note, too, how this law gets restated three separate times in the scripture. Moses wasn’t fooling around.

Another major form of taxation, or economic redistribution, was the Jubilee year. Every 50th year (some say 49th) all land sales were nullified and the land returned to the family that owned it originally. This placed severe limitations on the accumulation of wealth and eliminated the possibility of a permanent underclass. The idea that when somebody acquired property it was his, period, had sharp limitations on it. The main rules are spelled out in Leviticus 25:23-34.