Lehman, From Cotton to Crash

The global financial system was shaken by news that Lehman Brothers is filing for bankruptcy. Given its longstanding prominence as a pillar of high finance, it may be difficult to imagine a Wall Street without Lehman. And yet, it is worth recalling, Lehman Brothers, like so many of the firms that loom large on our economic landscape, had a modest start.

The origins of Lehman Brothers are not unlike those of other prominent companies launched by the handful of German Jewish families that came to refer to one another as “Our Crowd.” Like the Seligmans, Kuhns, Loebs, Goldmans, Sachses, Lewisohns and other such families, the Lehmans got their start in America as single young men who came to these shores in the years preceding the Civil War.

The Lehmans and many of their cohorts came from families that were involved in the cattle trade in small towns and villages in southern Germany. Buying and selling was, for them, like mother’s milk. They grew up on it. When they came to America, they started out as peddlers along the waterways, highways and byways of a rapidly expanding nation. In a single generation, these German Jewish immigrant families advanced from peddling pots and pans to running family-owned and -operated merchant and investment banking houses on Wall Street.

So it was for Emanuel Lehman, the son of a cattle dealer, who in the 1840s traveled from Bavaria to Alabama. He went there because “cotton was king” — as the saying went — and Emanuel felt he could cash in. In Mobile, Emanuel obtained peddler’s supplies on credit from a Jewish wholesaler who knew his family back home. Emanuel boarded a boat headed up the Alabama River, selling his merchandise to plantation folk who waited at the river bank for the sound of a cowbell, announcing his impending arrival.

In Montgomery, Emanuel joined an older brother, Henry. A year later, they opened a general merchandise store in the heart of town, directly opposite Montgomery’s slave auctioning block. Initially specializing in cotton goods, the store carried everything from sheets, shirts and yarn to cotton rope and ball thread. In 1850, after the arrival of a third brother, Mayer, the name of the store was changed from Lehman & Bro. to Lehman Brothers.

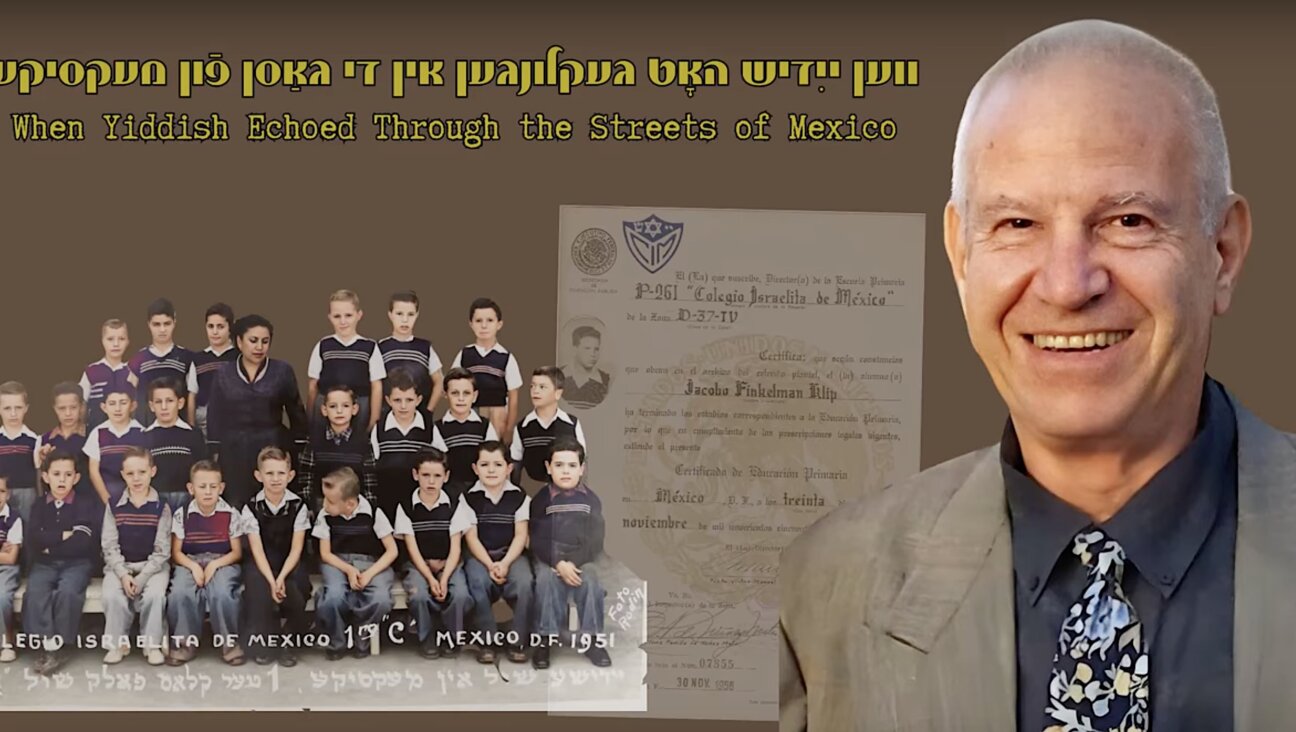

“It was largely a barter arrangement,” recalled Mayer’s son Herbert, who, with the help of familial wealth and connections, became governor of New York and a United States senator. “The farmers would come in with their cotton and trade it for shirts and shoes and fertilizer, such little as was used in those days, and seed, and all the necessities. That’s how they got started in the cotton business.”

By 1852, the brothers were also buying and selling real estate and extending long-range credit to planters, settling accounts in bales more often than in dollars. Every year, Emanuel went to New York to replenish supplies and negotiate with cotton manufacturers and exporters, while Mayer, in addition to managing the store in Montgomery, dealt with planters and farmers in the surrounding area. In 1858, Emanuel moved to New York and, starting out as a cotton broker, opened a branch of Lehman Brothers at 119 Liberty Street, just a few blocks from where the Kuhns, Loebs, Goldmans, Sachses and Seligmans would later make names for themselves as Wall Street entrepreneurs.

For some 40 years Emanuel and Mayer were the firm. Emanuel was considered conservative, Mayer adventurous. According to family tradition, Mayer made the money; Emanuel made sure they didn’t lose it. With Mayer’s death in 1897 and Emanuel’s 10 years later, the firm passed into the hands of a second generation of Lehmans.

Until 1924, nearly 75 years after the firm was founded, all the partners were named Lehman. No one who was not a Lehman was allowed to join the firm. John L. Loeb Jr. has recalled that his father, who was married to Mayer’s granddaughter Frances, “couldn’t get a job at Lehman Brothers when he wanted to work on Wall Street. They wouldn’t hire any in-laws, and in fact for years I don’t think there was even a descendant who had a name other than Lehman who got the job.”

During much of its rise to prominence, Lehman Brothers had been trading in basic commodities, mostly on the New York cotton exchange but also on the coffee and petroleum exchanges. It wasn’t until the second generation took over that the character of Lehman Brothers was altered from “merchant” to “investment” banking.

A major step in that direction resulted from a fateful turn-of-the-century meeting over the backyard fence between Emanuel’s son Philip and his counterpart at Goldman Sachs who asked Philip to raise money with him for a new and emerging retail company known as Sears, Roebuck. This led to the financing by Lehman Brothers of other Jewish-owned and Jewish-run businesses, in particular department stores, textile and clothing manufacturers, five-and-dime operations, and cigarette manufacturers.

The results were extremely profitable. Riding the crest of technological innovation and economic expansion, the Lehmans were destined to take the high road that led the firm inexorably into the ranks of America’s foremost banking institutions. Following the passing in 1969 of Emanuel’s grandson Robert — for whom the Robert Lehman Wing of the Metropolitan Museum of Art is named — Lehman Brothers, after three generations, passed largely out of the hands of the family.

And so this family-owned firm that was built up through trading in cotton and other worldly goods came to be a massive multinational corporation that dealt in complicated securities based on otherworldly mortgages. Emanuel Lehman, it is safe to say, would not have been pleased.

Kenneth Libo is the editor of “Lots of Lehmans: The Family of Mayer Lehman of Lehman Brothers.” He teaches American Jewish history at Hunter College of the City University of New York.