Barney Frank and the Financial Crisis

Image by getty images

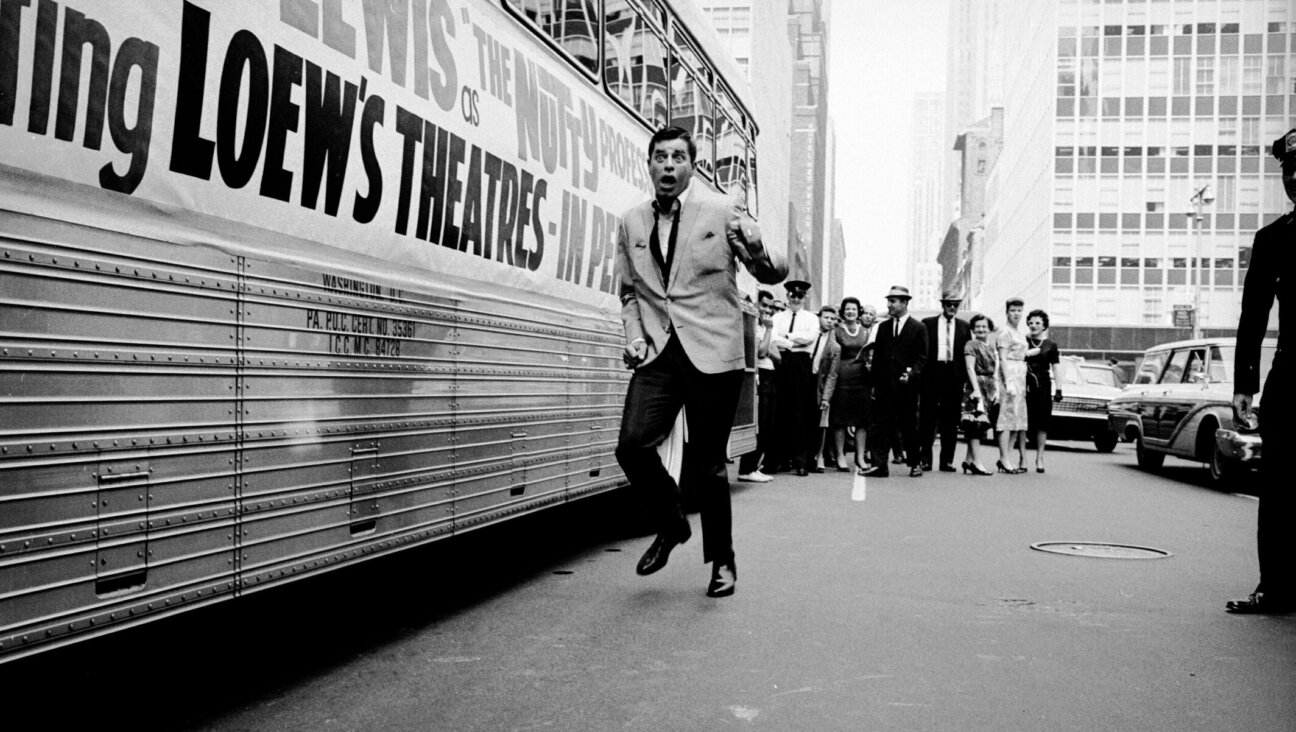

Long Slog: Barney Frank didn?t shy away from tough battles. But it must?ve gotten tiring dealing with Republicans who treated him like a human punching bag. Image by getty images

Democrats have never recovered from the trauma of 1994, when they lost the House of Representatives to Newt Gingrich’s Republicans and found themselves in the minority for the first time in 40 years. One Democrat emerged relatively unruffled, however: Barney Frank of Massachusetts.

“I’m used to being in the minority,” he famously wisecracked in a 1996 interview. “I’m a left-handed, gay Jew. I’ve never felt automatically a member of any majority.”

There are several layers of meaning there. Obviously, he’s always been an outsider. With Frank, though, there’s an edge. Though passionately outspoken on both gay and Jewish concerns, from Iranian nukes to gays in the military, he’s never let labels define his work. He’s treated identity issues not as personal missions but as the proper concerns of all fair-minded Americans. He’s been a legislator for the majority first, minorities second. It’s an old-fashioned liberalism. As he wrote in a 1992 book, it’s what Democrats have forgotten.

The bills he’s sponsored over 30 years in Congress address broad, national concerns: the environment, railroad security, help for families of fallen police officers and, most single-mindedly, the financial system. His popular image is a flame-throwing liberal with a lacerating wit. (On Ronald Reagan’s napping during meetings: “It’s not the dozing off of Ronald Reagan that causes us problems. It’s what he does on those moments when he’s awake.”) His record, though, reflects pragmatic, bipartisan lawmaking.

Search the Web for “Barney Frank” and “mortgage crisis” and you’ll find a string of conservative attacks branding Frank the main culprit. The charges: He publicly defended the federally sponsored mortgage giants Fannie Mae and Freddie Mac in 2003 and 2004, even as their insolvency was surfacing. He took over the House Financial Services Committee in 2007, when the Democrats recaptured the House, putting him in charge of the banks when they collapsed. He co-authored the 2010 Dodd-Frank Wall Street Reform Act, partly reversing the bank deregulation that liberals say caused the crisis. Conservatives say the law worsened things.<> The accusations are half-baked, but passionate. A 2008 interview with Bill O’Reilly on Fox News turned into a six-minute screaming match, now a sensation on YouTube. Gingrich called for Frank’s imprisonment this past October.

Democrats’ analysis of the crisis isn’t much better. The usual suspect is the banking deregulation enacted by the Republican Congress in 1999, capping two decades of economic deregulation begun under Reagan. The bank deregulation largely repealed the Depression-era Glass-Steagall Act separating commercial banks, which serve individual depositors, from investment banking, with its high-risk market maneuvers. Free to play, banks began speculating wildly with clients’ mortgages.

Conservatives counter that commercial banks actually weathered the storm better than investment banks. Bear Stearns, Lehman and Merrill Lynch folded, not Chase or Citi. What dragged the system down, they say, was the crusade by Fannie and Freddie, New Deal holdovers beloved by Democrats, to peddle risky mortgages to people who couldn’t afford them.

Both stories are partly true and partly false. Deregulation began under Democrat Jimmy Carter, not Reagan. The critical 1999 bank deregulation, known as Gramm-Leach-Bliley after its three Republican sponsors, passed in both houses of Congress by strong bipartisan majorities and was signed into law by Bill Clinton. Only a handful of Democrats voted no, including Barney Frank.

Bank deregulation wasn’t the only blow. Arguably worse was a rule quietly adopted in late 2000, barring the little-known Commodity Futures Trading Commission from regulating the new, exotic, barely understood financial instruments known as derivatives.

One key derivative was the Mortgage-Backed Security. It’s a bundle of individual mortgages bought from the original lenders that are thrown into a pot, chopped up into shares and sold off to investors, who now owned tiny pieces of hundreds of mortgages and receive a share of all those homeowners’ mortgage payments. As long as folks kept buying homes and making their monthly payments, everyone was happy.

But many families were suddenly having trouble, and therein lies our tale. Millions had bought homes with something called an adjustable-rate mortgage. This offered the borrower a very low starting interest rate, which then rose or (rarely) fell in sync with industry rates. Usually, the rate was tied to the so-called London Inter-Bank Offer Rate, or LIBOR.

Popular in Europe, adjustable mortgages were first approved by Congress in 1982 as a vehicle for sophisticated investors. By the 1990s, however, they were being sold to lower-income borrowers eager to get in the door. The practice exploded following deregulation. By 2004, about one-fifth of all American mortgages were adjustable. The vast majority — 90%, according to government figures — were characterized as sub-prime loans, meaning the borrowers didn’t qualify for credit by normal standards.

The assault on Barney Frank is largely over his role as opposition leader on the financial services committee in the early 2000s. He says he was pushing for better regulation of lenders but faced a hostile Republican majority. The Bush administration’s priority was a new body to oversee Fannie Mae and Freddie Mac, which together underwrote about half of all mortgages in the country and were seriously undercapitalized. Democrats feared that was a ploy to undercut the organizations’ role in affordable housing.

In the midst of this came a disastrous decision by the SEC: a change in the biggest investment banks’ leverage requirements. Leverage is the cash kept on hand to cover current debts and future bets. The banks were required to have $1 in cash for every $12 they owed. In April 2004, the commissioners voted to increase the ratio to 1-to-30. The five banks could now double their indebtedness. Some observers call that the worst decision of all.

But the most fateful decision was taken in Europe. Beginning in 2004, the continent’s central banks began raising their base interest rates in a bid to head off inflation. Consequently, the LIBOR soared from 1.21% in January 2004 to 5.64% in June 2006. This caused a sudden spike in mortgage bills for millions of American sub-prime homeowners. You know the rest.

In November 2006, a wave of voter anger swept the Democrats back into control of Congress. Frank, now chairing the banking committee, quickly took the lead in a multipart rescue operation — trying to halt evictions, restore regulation, then save the banks as they began to tumble, so the whole economy didn’t collapse. It was a daunting, terrifying sprint when he had a cowed Republican minority and a broken president to work with. When Barack Obama became president and Republicans declared war, it became an agonizing slog. Since the Republicans regained the House last January, he’s become a piñata. At a certain point, you had to wonder how much longer he could take it. Now we know.

Contact J.J. Goldberg at [email protected]