The Jewish History of Futures (and Options)

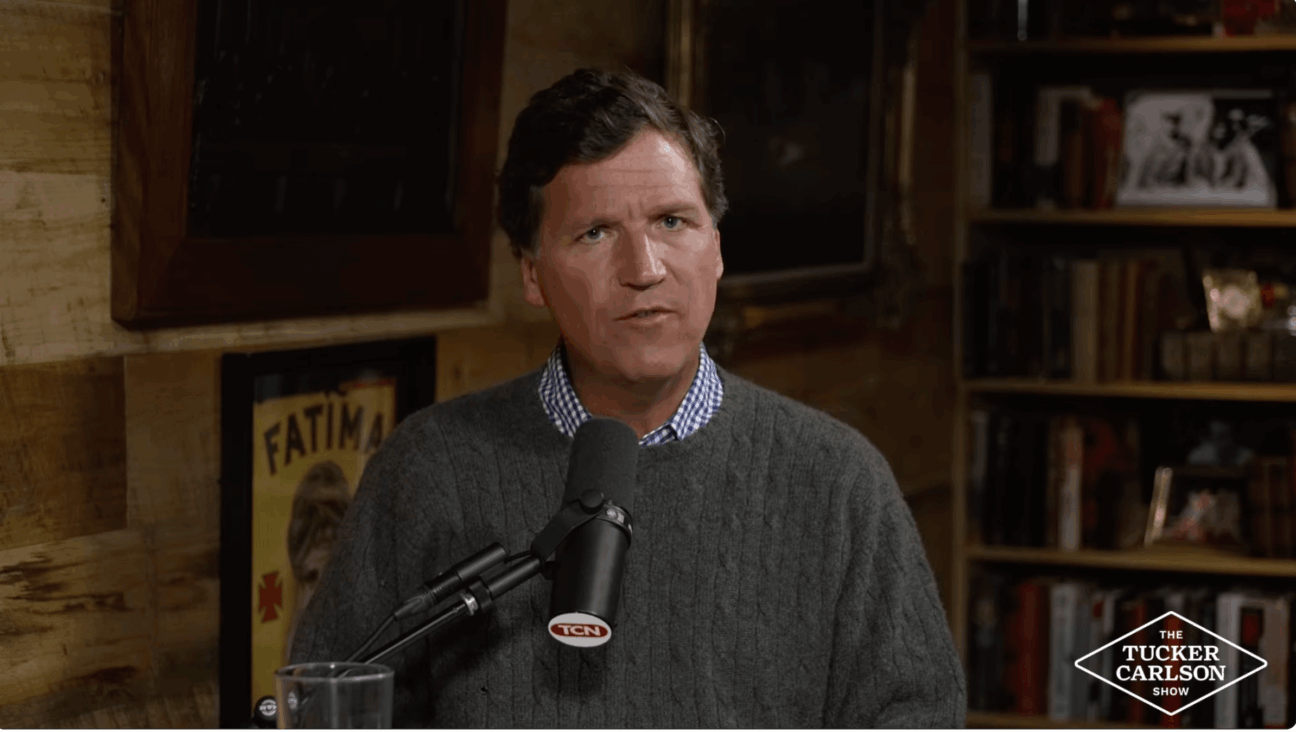

OMG, CME: Leo Melamed (second left) rings the bell to start trading on the CME, by some measures the largest futures exchange in the world. Image by getty images

Everyone’s heard of derivatives, options and futures, but the details of how they might save or destroy civilization are so daunting that the simple facts get lost.

Let’s get down to business: A derivative is a financial security (tradable itself) whose value is based on that of an underlying asset. In other words, instead of purchasing, say, 100 shares of Procter & Gamble, you can buy a “call option,” which gives you the right to buy the shares at a certain date and price, or to sell that right. You are in essence betting that the share price of P&G will rise, in which case the value of your option rises — but if it doesn’t, you’re only out the fee for the transaction, or “option premium.”

At this point (if you’re still reading), you might be thinking that the above is a simplification, and you would be right. You might also ask what this has to do with the Jews. The answer to this question is that there is nothing particularly “Jewish” about derivatives. However, given the strong historical associations between Jews and finance, it’s only natural that we would find Jews involved in such transactions.

The story begins with Torah, believe it or not. One financial historian argues that the first recorded instance of an option is in Genesis 29, when Jacob exchanges seven years of labor for the hand of Laban’s shapely daughter Rachel. It was also an early example of a bait and switch scheme — instead of the hot one, Jacob first got the mieskeyt, Leah.

Derivatives were common in the ancient world. The dry air of Mesopotamia has preserved thousands of futures contracts — agreements to deliver commodities like wood or spices sometime in the future at a fixed price — recorded on cuneiform tablets or papyri. In his “Politics,” Aristotle (not a Jew) writes of Thales the Milesian (also not a Jew), who made a fortune by buying options on olive presses and then renting them out at higher prices.

But it seems safe to say that Jews brought derivative trading from Mesopotamia to the Roman Empire and, after the disastrous expulsions from Iberia, to the generally more secure and business-friendly cities of Northern Europe. In the 16th and 17th centuries, derivative trading flourished in places like Bruges, Antwerp and Amsterdam, with Jewish merchants and stockbrokers frequently in the mix.

One such broker was Joseph Penso de la Vega (1650-1692). De la Vega’s father was a converso who, after running afoul of the Inquisition, fled from Spain to Antwerp in order to openly practice Judaism. The family ended up in Amsterdam, where Joseph established himself as one of those enviable polymaths, a successful speculator and respected author of prose, poetry and plays in Spanish and Hebrew.

In 1688, de la Vega published his masterwork, “Confusión de Confusiones.” Written in Spanish, the book explains the inner workings of the Amsterdam Stock Exchange, including a number of forms of derivatives. De la Vega seems to have preferred options, considering them less risky than other forms of trading.

But “Confusión de Confusiones” is more than just a kind of early how-to manual. De la Vega had a novelist’s eye for the telling detail, describing the “unpleasant smells of perspiration” in the Exchange, the wheeling and dealing in Amsterdam coffee houses, wherein “one person takes chocolate, the others coffee, milk, and tea; and nearly everybody smokes while conversing.”

De la Vega seems to have been an honest sort, or at least the book gives that impression. He was clear-eyed about the dubious ethics of many traders. “The best and most agreeable aspect of the new business is that one can become rich without risk,” writes de le Vega, with no small irony. “Just as the Hebrews, when they are seriously ill, change their names in order to obtain relief, so a changing of name is sufficient for the speculator who finds himself in difficulties.”

Derivatives must have played a part in the rise of the great Jewish financier families of the 19th century, such as the Rothschilds and the Lazards. But in their cases it is harder to find historical data. Their clients, whether they were the Bank of England or the Prussian royal family, preferred secrecy. In addition, family networks could be less formal in their agreements with each other — Nathan Rothschild in London wouldn’t need a written contract when doing business with his brother James in Paris. Discretion was also preferable due to various attempts by European governments to regulate derivative trading — which, then as now, tended to be ineffective.

In the U.S., the futures market was institutionalized with the founding of the Chicago Board of Trade in 1848. Its original purpose was to mitigate volatility in grain prices with “to-arrive” contracts. Such agreements allowed farmers to negotiate a set price and delivery date for the grain, as opposed to shlepping it to Chicago and hoping for the best. The Chicago Board of Trade would eventually grow into the Chicago Mercantile Exchange, the largest futures and options exchange in the world.

Henry Horner, a Jewish wholesale grocer and flower merchant, was “instrumental” in founding the Chicago Board of Trade, according to historian Irving Cutler, but that may be Jewish boosterism. An 1885 history of the institution refers to Horner as an “influential member of the Board of Trade for many years.” But his name appears nowhere in a 1917 “History of the Board of Trade of the City of Chicago.” This latter book, in fact, only mentions one Jew in its 1,200 pages: Bernhard Pfaelzer, a “dealer in grain, hay and millstuff [who] is identified with the Masonic fraternity and the Jewish church [sic].”

Horner’s grandson and namesake, however, did become the first Jewish governor of Illinois. A fact which would certainly have brought a lot of nakhes to his Prussian-born grandfather.

Derivatives were involved in a more shameful episode in the history of American Jewry. Judah P. Benjamin (1811-1884) was a New Orleans-based lawyer, politician and slaveholder. In an era when very few Jews were prominent in public life, Benjamin was held in high esteem: He was a senator of Louisiana and was twice nominated for a Supreme Court post, which he declined both times.

When the Civil War broke out, Benjamin sided with the Confederacy, serving as its first attorney general and later as secretary of war. In 1863, as secretary of state, Benjamin arranged the Erlanger loan. The South was desperate for credit and its only fungible asset was cotton. Smelling an opportunity, a French banker, Frédéric Emile Baron d’Erlanger (whose father, Raphael, had converted from Judaism to Catholicism), offered to arrange a loan. Through intermediaries, Benjamin and Baron d’Erlanger negotiated the terms of a bond that would be redeemable in cotton at six British pence per pound. With Southern cotton selling for 21 pence in London, the bondholder stood to make a substantial profit. This, of course, made the bonds attractive to European investors, especially with unscrupulous dealers claiming that the North would honor the bonds in the event of a Confederate defeat.

It’s unclear how much cash the South raised through the Erlanger loan — estimates range between $5 million and $8 million. But it is clear that the loan extended the Civil War by giving the South the credit it needed to keep fighting — as well as making millions in commissions for Baron d’Erlanger’s investment company. (There is anecdotal evidence that the Rothschilds would have nothing to do with the loan.)

A less shameful but certainly unethical episode came about in the 1950s, when Vincent Kosuga, a farmer from upstate New York, and Sam Siegel, a Chicago produce wholesaler and son of an Orthodox rabbi, cornered the onion futures market. This was less piffling than it sounds: In the mid-1950s, onion futures contracts accounted for 20% of the trades on the Chicago Mercantile Exchange. In 1955, Kosuga and Siegel bought virtually all of the onions in Chicago, and then bought short positions of onion futures — essentially betting that the price of onions would go down. Which it did — when Kosuga and Siegel flooded the market with onions.

The partners made millions, and put plenty of onion farmers out of business in the process. A rising young congressman named Gerald Ford sponsored a bill that banned the trading of onion futures; the Onion Futures Act was passed in 1958. The loss of trading volume nearly killed the CME, until the trading of futures on a diverse range of commodities such as pork bellies and frozen orange juice concentrate made up the volume. To this day, it is illegal to trade onion futures.

The 1970s saw two revolutionary changes in the derivatives market, which led to shifts in the very nature of finance and today’s gargantuan and complex virtual global economy. And Jews were in the thick of it. The first was in 1972, when Leo Melamed (a member of the Forward Association), whose family had fled the Holocaust via Japan, created the Internal Monetary Market. The IMM traded futures based on currencies and the interest rate of Treasury bills and Eurodollars (or dollars in foreign banks) — meaning, for the first time in the history of finance, the underlying asset of a derivative was not a physical commodity.

The second was in 1973, when two economists, Fischer Black and Myron Scholes, published a formula for pricing options that came to be known as the Black-Scholes model. Robert C. Merton, another economist, expanded on their work. I’m not even going to pretend that I understand the formula. But I can tell you that its importance was compared to the discovery of DNA, and that it led to explosive growth in derivative markets. In 1997, Scholes and Merton, both Jews, were awarded the Nobel Prize in Economics, and their mothers were awarded lifetime bragging rights. (Black died in 1995; unfortunately the Nobel Committee does not award posthumous prizes.)

Derivatives help investors “hedge,” or reduce risk. But in the 21st century, their astonishing complexity can make them dangerous investments. In 2002, Warren Buffett famously described them as “time bombs” and “financial weapons of mass destruction.”

Buffet was right. The 2008 crash was in no small part caused by an unregulated derivative called a “credit default swap.” In this case, the underlying assets turned out to be crappy subprime mortgages. When thousands of Americans became unable to make their mortgage payments, the swaps imploded in value, and severely damaged the American economy.

Thus it’s probably best to follow our forebears’ advice. In 1688, de la Vega wrote: “Whoever wishes to win in this game must have patience and money.” Or we could go even further back to Rabbi Yitzchak, the Talmudic sage who urged us to divide our money into three parts: “one third in land, one third in commerce and one third at hand.” Rabbi Yitzchak, in other words, advises us to diversify.

Gordon Haber is a frequent contributor to the Forward. His new novella “Adjunctivitis” was published as a Kindle single on October 30.